Customer First Radio Episode 5 | Ted Eichten, Head of Price & Promotions, North America for dunnhumby

April 21 2021

BlogThank you! Your copy of the report opened in a new tab. If you have trouble viewing it,click here.

Thank you! Your copy of Webinar is opened in new tab, If you have trouble viewing it,click here.

Last March, when we realized the potential impact that COVID-19 might have on all aspects of our lives, dunnhumby launched a survey to understand how the virus would affect consumers food shopping habits. It was designed to help our clients better meet the needs of their Customers by seeing the impact of the virus through their customers eyes.

Little did we know at the time that one year later we would still be dealing with the impact Covid-19. This study presents the results of the sixth global wave of the study and the seventh wave for the United States. Other waves were conducted in March, April, May, July, September and November of 2020. This wave was conducted in February 2021.

This report focuses on just how things have changed over that year and what remains the same.

Retail leaders must objectively understand how their business currently considers Customers before trying to set a more Customer-centric direction and focus. There are some formal assessment methodologies, like dunnhumby's Retail Preference Index (RPI) and Customer Centricity Assessment (CCA), which offer detailed evaluations of a business' capabilities, strengths and weaknesses based on Customer perceptions (RPI) or global best practices (CCA).

The approach outlined below is not intended to replace these formal tools; rather, these observations are intended as a kind of 'toe in the water' to help retail leaders form early hypotheses and points of views. These are rules of thumb, heuristics culled from global experience. Later, leaders might use these observations to informally check progress from time to time as a way of assessing whether the "program in the stores matches the program in our heads".

Hence, the context and laboratory for these suggestions is the retail store, where the rubber meets the road, so to speak.

Walking around a store (or better, walking around several), can give many clues toward understanding a retailer's attitude about its Customers, as well as revealing some of the challenges ahead for installing Customer First. As Customers ourselves, we are qualified to assess an organization's 'readiness' for Customer First, simply starting by walking around.

How a Customer experiences the store shapes their perception of the brand, and there are dozens (even hundreds) of 'moments of truth' for Customers in each shopping trip – opportunities for the retailer to win more loyalty, or indeed to lose it. And it only takes one 'bad' experience to erase all the good.

Leaders can form an opinion about the Customers' true shopping experience by observing 'Who really runs the store?' – a way to put on a Customer lens to assess if the Customer, the retailer, the supplier, or no one is driving shopping experience decisions, like range and presentation. For example:

Of course, analysing any available loyalty data will later tell us how Customers shop the category and that might well be by brand (or flavour or size, etc., and will certainly vary by section). But this first assessment helps us begin to form our perspective on how tuned-in the business is around its Customers, and about where within the business leaders might need to begin to install insights and the Customer language.

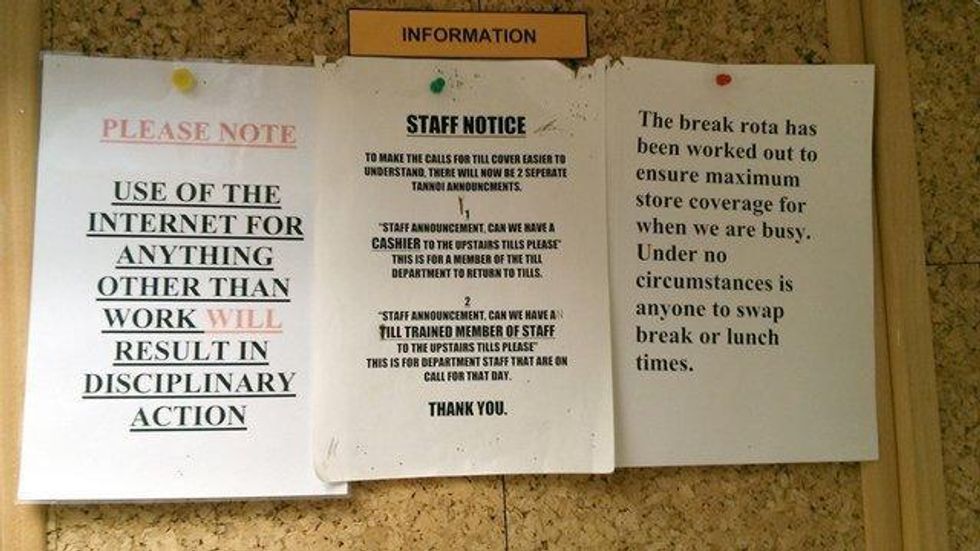

Store signage not only delivers a written message, but also a type of 'body language' that Customers tune in to, albeit not always consciously. Look around the store to see both the written and hidden messages, and hear the tone being communicated: ask, do messages speak respectfully to Customers? For example:

While walking the store, traveling through stock rooms and the employee break room, note the signage and messaging aimed at staff. What seems to be valued more – numbers or people?

What policies and rules guide employee behaviour?

How are they expected to interact with Customers?

Are the messages respectful of staff? Of Customers?

What do signs say about the culture around Customers?

dunnhumby's Loyalty Drivers analysis suggests that Customers exhibit four 'mindsets' in their shopping journey – Discover, Shop, Buy, and Reflect. One element of the 'Reflect' mind-set includes the decision to return, exchange, or to request a refund when the product or service does not quite suit.

On your store walk, observe who has the power to satisfy Customers making a return or wanting a refund: is the front-line employee empowered to satisfy the Customer, or must the Manager be called? Is there one 'service' desk where Customers must queue to get their money back, or can the helpful cashier make it good on the spot?

Examine the return policy to assess its sensibility and ease from a Customer viewpoint. For example, must a Customer act within 7 or 30 days, and is a receipt required and signature under penalty of perjury? Is the taking of an oath necessary, or perhaps a drop of blood? The store's practice says volumes about who deserves trust in the eyes of the business. Requiring levels of approvals and higher management involvement (or some other form of hoop-jumping) is neither trusting of employees nor Customers.

The return / refund policies and practices are strong indicators of a company's readiness for, or progress along the Customer-centric journey. Customer First organizations give front-line employees broader authority to resolve Customer needs, and extend the power to satisfy Customers to most members of staff, in some form. For best practices in this area, please see the policies from Nordstrom in the U.S. and Ritz-Carlton globally.

Senior leaders set the tone for how Customers are regarded and treated in the business both by their words and their actions, of course. And the C.E.O.S – Customers, Employees, Owners, and Suppliers – all take notice. It's widely documented that leaders who walk the walk are more effective than those who only talk the talk.

One simple yet powerful way to assess readiness and progress is seeing how leadership's walk and talk align. A word cloud, like the one illustrated below, makes the point very clear. In this example, recent shareholder statements (same quarter) were compared for two companies on a Customer-centric journey. We can see different progress in a form of 'walking the walk' at Retailer X and Retailer Y. The C.E.O.S are hearing what really matters to the leaders, and are forming the Customer culture accordingly, all the way down to store level.

The store shapes Customers' perception of the brand; there are hundreds of opportunities for the retailer to win or lose loyalty in each shopping trip. Customers take clues, consciously and unconsciously, throughout their entire shopping experience, and draw conclusions about retailer warmth and attitude toward shoppers. And it only takes one disappointing experience to erase all the good.

Retail leaders must take an objective assessment of the shopping experience using a Customer lens to understand their current state and readiness for customer centricity. Pay close attention to the body language and tone of your policies. Store signage, employee empowerment and communications, and practices around assortment and presentation are clear indicators of the organization's attitude about the Customer.

This is the first in a series of LinkedIn articles from David Ciancio, advocating the voice of the customer in the highly competitive food-retail industry.

In order to reflect on how the grocery world changed in 2020, we have changed how we calculate our overall Grocery RPI score. Given the historically unique metrics we've witnessed in the economy, the restaurant industry and the grocery industry, along with the rare influence a global pandemic has brought to consumer behavior, we're viewing grocery success in 2020 through a different lens than we viewed grocery success in prior years.

In the first episode of Customer First Radio, Dave Clements, Global Head of Retail for dunnhumbyand David Ciancio, Global Head of Grocery for dunnhumby kick off the series by discussing what it means to be a truly Customer First business, share which retailers and brands today embody a Customer First mindset, and examine how Customer First materialized during the pandemic with retailers.

The 2021 Retailer Preference Index: Who's winning and why. David Ciancio, Global Head of Grocery discusses the 2021 U.S Retailer Preference Index (RPI): Grocery Edition with the lead author of the RPI, Erich Kahner. They unveil key insights and discuss who is winning and who is best positioned for the future.

The Prophets of Aisle Six is the first online reality series focusing on innovation in the food retail industry. In this episode, Jose Gomes, dunnhumby's North America Managing Director, travels to the downtown Cleveland store of Heinen's Fine Foods. Jose meets with Tom and Jeff Heinen, co-owners and brothers, and learns how they are evolving their grandfather's mission of delivering excellent customer service. With 23 stores in Northeast Ohio and the greater Chicago area, and a 90-year legacy, Heinen's is proving that being a small retailer can be an advantage when it comes to data.

In this series, dunnhumby tours the globe and speaks with some of the world's greatest brands, exploring their biggest challenges and how they are using customer data science to meet those challenges.