The traditional, regional U.S. grocery store—it's the institution that has fed communities for decades and families for generations. It offers that connection to a simpler time, a time when the guy behind the meat counter would know Customers by name, a time when a dad pushed his child around in a shopping cart while they "helped" him shop and a time before mobile phones invaded our lives and sped up the pace of life…

That place—the traditional grocery store—has history. Customers and the people who work there are part of a family. That kind of emotional connection is priceless.

If this is true, then why does Aldi—which borrows a quarter per shopping cart and operates with a small crew that arranges shelves while taking care of customers—have a stronger emotional connection with shoppers than 90% of its competitors?

Yes, that's right. Aldi, known for its cost cutting and low prices, has– an emotional connection that is stronger than nine out of 10 traditional grocery stores.

Traditional grocers may take for granted that they have an advantage over non-traditional channels in the strength of their emotional connection with shoppers, but that doesn't appear to be the case at all. So just how bad is it for traditional grocers?

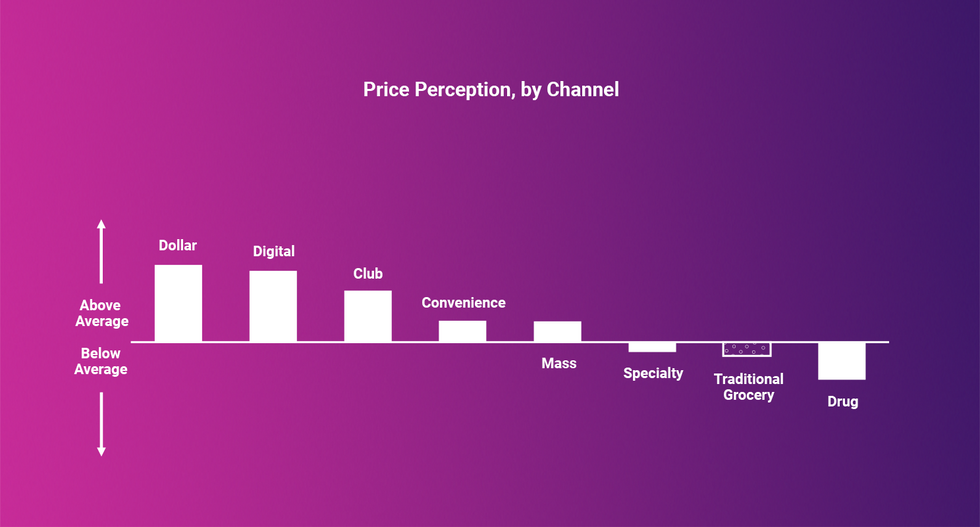

The inconvenient truth is that the average traditional grocery store has a lower emotional connection with its shopper than the average store in any other major channel where groceries are sold. While traditional grocers have been focused on selling groceries to the same towns for decades, non-traditional grocers have been able to move into those towns and secure a stronger emotional connection in far less time.

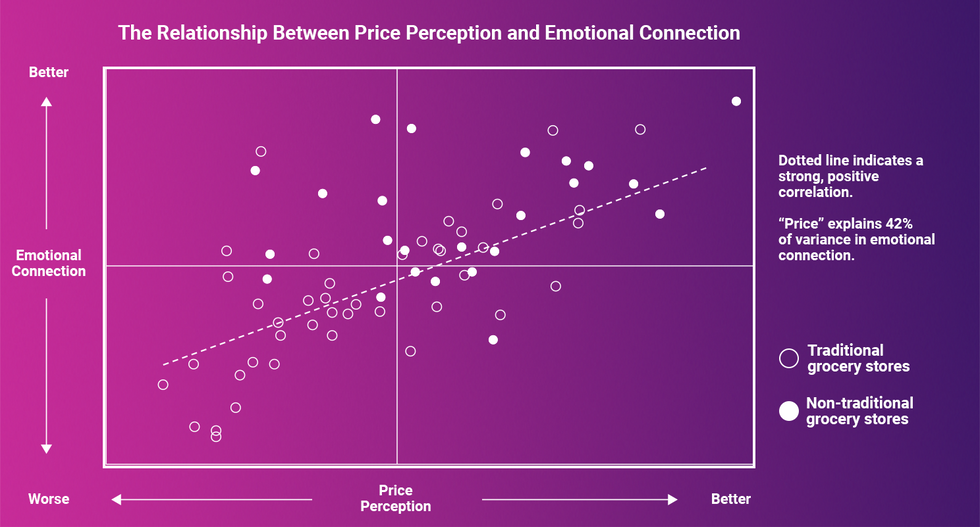

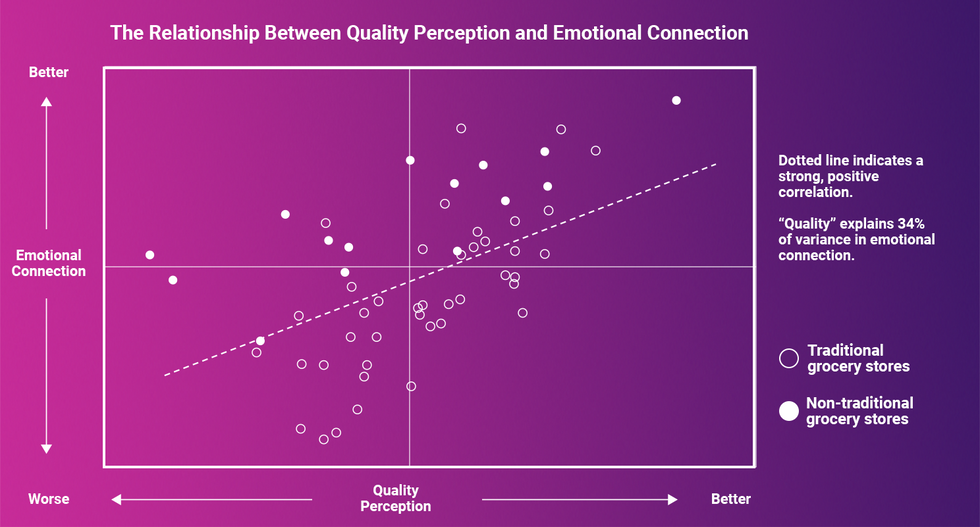

How? Well, it appears that emotional connection does have a price, after all. In fact, price perception is slightly more associated with emotional connection than perception of the quality of products and store experience:

And, whereas traditional grocers have managed to hold their own on quality perceptions, they lose on price perception.

So, where does the traditional grocer start if they want to win back the hearts of their local constituents? After all, there are many levers they can pull within pricing, assortment, and store experience to move perceptions. A close look at data from our 2019 Retailer Preference Index: Grocery Channel Edition offers some hints. Stores who have the strongest emotional connection separate themselves from the pack with the following:

- Private brands that customers love

- Leading prices on natural and organic items

- Fast checkout

- Staff who show they value shoppers

Translated into language customers might use, that means:

- Have products I can't get anywhere else, at competitive prices

- Make healthy food affordable

- Don't waste my time

- Treat me like a person

Of the 56 retailers ranked by emotional connection, 24 of the bottom 25 are traditional retailers. And while Aldi, ranked 17th for emotional connection, has been used as a stark example to illustrate traditional grocers' emotional connection issue, many other non-traditional stores have a stronger emotional connection with their shoppers than Aldi does with theirs.

However, 3 traditional grocery stores buck the trend and join non-traditional retailers in the top 10: Market Basket (4th), H-E-B (5th) and Publix (6th). They each check more than one of the boxes on the core ingredients of emotional connection.

These retailers, more than any other traditional, regional grocer, have established with their emotional connection an insurance policy for an uncertain grocery industry future. And the prevalence of non-traditional grocers with superior emotional connection proves the point that this insurance policy is more a product of "what have you done for me lately" than a product of consumer nostalgia. Non-traditional grocers are buying emotional connection with better prices while delivering on some combination of a superior private label, offering the best natural and organic prices and having staff who show they value customers.

FOR RETAILERS

Smarter operations and sustainable growth, powered by Customer Data Science.

FOR BRANDS

Better understand and activate your Shoppers to grow sales.

A new format in grocery retail is emerging: the 50,000 square foot convenience store. Its value proposition to customers is simple: higher quality perishables and ready-to-eat items than your typical grocery store. Thousands of the same center-store products you can also find at Walmart, Target, Amazon, Costco and Sam's Club. Everything at higher prices. Added bonus: since the store is 10x to 20x bigger than your typical c-store, you can get your steps in and burn calories at the same time.

Wait, what?

The reality is that this is not a new format—rather the customer-led repurposing of a familiar one: the traditional, regional grocery store. This finding comes from a follow-up analysis of data collected for the recent 2019 Grocery Retailer Preference Index report, a report which identified winners and losers among the 56 largest retailers in the U.S. Grocery Retail Industry. In this follow-up analysis, we examined the types of trips people took (e.g. bigger vs. smaller) to each retailer, as well as the categories they bought (e.g. produce, ready-to-eat or paper products). The findings cast further light on the problems faced by traditional grocers in an evolving grocery landscape that has seen national mass, club, drug, dollar, convenience and digital players invest more in the grocery game the past few decades.

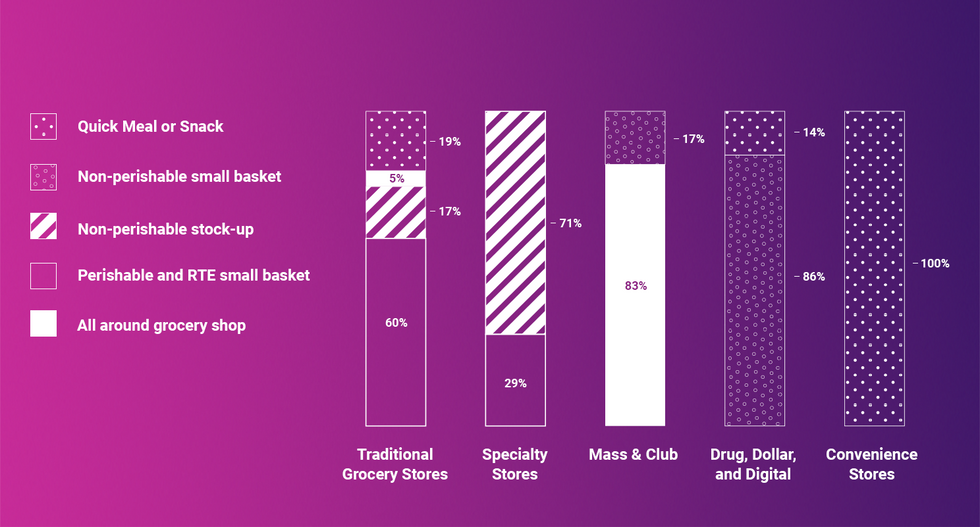

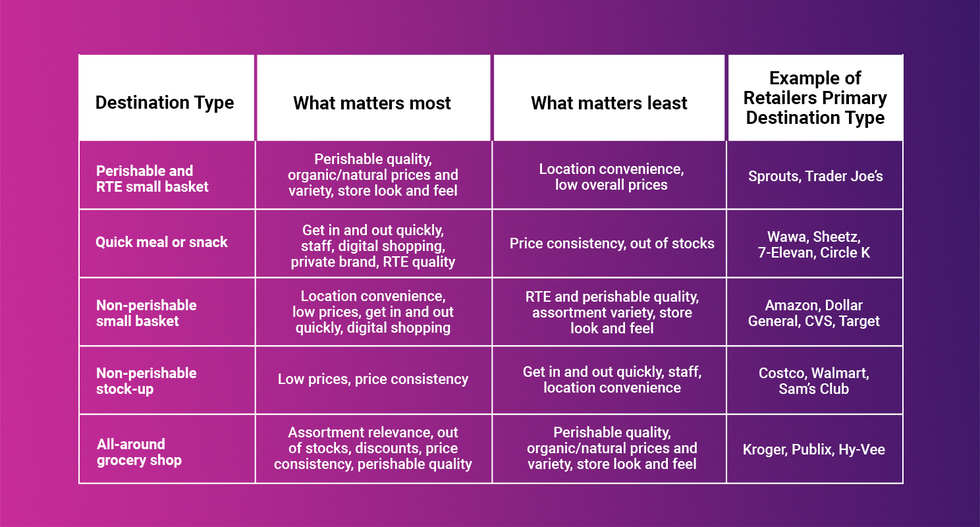

When considering trip types and categories sought by customers, five general types of retail destinations emerge:

- All-around grocery shop

- Perishable and ready-to-eat small basket

- Quick and convenient meal

- Non-perishable stock-up

- Non-perishable small basket

Certain channels lend themselves to certain destination types. Specialty grocers like Trader Joe's or Sprouts, with fewer SKUs and smaller formats than the traditional grocer, tend to fall in the "Perishable and ready-to-eat small basket" destination type. Club and mass are non-perishable stock-up destination. Drug, dollar and digital in non-perishable small basket. C-stores in quick and convenient meals. However, many traditional grocers have an identity crisis. Only 6 in ten are seen primarily as "all around grocery shop" destinations, despite all of them carrying the full complement of SKUs.

In other words, almost half of traditional grocery stores are shopped more like a convenience and specialty store than like a store with 10-20x more products than that. At best, categories beyond perishable and RTE food are typically an afterthought and only shopped in a pinch. At worst, those categories are bypassed completely by shoppers, who instead buy the same products for cheaper at widely available mass, club, digital, dollar or drug channels.

The result of being treated as a perishable c-store is a lower share of customer wallet. Traditional grocers who are all-around grocery destinations win 33% of their customer's share of wallet, versus only 20% for traditional grocers shopped like a perishable c-store.

So, what can traditional grocers who are not being viewed as an all-around grocery shop do about it?

According to an analysis of customer needs gathered from a survey sent to 7,000 shoppers in the U.S., if traditional grocers want to ensure they'll be an all-around grocery shop, they need to ensure some key ingredients are in place:

- Highly relevant assortment, which is rarely out of stock

- Prices that are consistent on inelastic and competitive on key-value items, while offering discounts on the products that are important to customers and responsive to promotions

- Decent perishable quality

For now, traditional retailers aiming to be all-around grocery shops can trade-off on having the best digital offering and the best ability to get customers in and out quickly. These things are less important to customers when picking an all-around grocery destination.

While some traditional grocers are struggling to win the title of all-around grocery shop, one non-traditional store isn't: Aldi. Aldi's consistently industry-leading prices and their ability to manage out of stocks and store cleanliness just as well as your average traditional grocery store, has made them a stock-up destination for perimeter categories, like produce and dairy, as well as center store packaged food items. As a result, despite having stores which carry less than 2,000 SKUs, Aldi's share of customer wallet is in line with that of the average traditional grocery store, which often carry more than 40,000 SKUs.

Of course, the reality is that no single non-traditional competitor is eating away at traditional grocers' hold on the all-around grocery shop. Rather, a host of non-traditional competition, each with unique value propositions, are all taking small bites, which add up. The data suggests that this is because traditional grocers took their eye off the retail basics, perhaps because they grew complacent after decades of dominance and relatively little industry disruption from non-traditional substitutes.

So, the call to action is clear: before overinvesting on any shiny new toys, like eCommerce or technology to speed up checkout, get back to your roots and make sure you're offering the right prices on the right products.

In our two previous blogs looking at the Coronavirus pandemic's impact on grocery retail, we explored themes including the dual challenge of protecting and serving Customers and pricing, promotions and the pressing need to protect employees.

As Retailers around the world work tirelessly to keep shelves stocked and their employees safe, in this latest post we're putting the Customer back in the spotlight once again. With Customer needs changing rapidly as Coronavirus continues to spread, we're turning our focus to the vital issues of loyalty building and communications during these unprecedented times.

Listening to the voice of the Customer

Helping Retailers make sense of Customer behaviour is one of our key areas of focus here at dunnhumby. While we normally do this by using granular purchasing data to deduce what Customers might do next, we're also keen to provide Retailers with a view of some of the bigger issues affecting the shopper mindset right now.

It's with that thought in mind that we created the dunnhumby Customer Pulse, a survey of shoppers from 19 countries across Asia, Europe, Latin America, and North America. Around 400 consumers were surveyed in each market, with online interviews conducted between March 29th and April 1st 2020.

The first survey provided us with a great deal of insight and three key observations.

- We believe that a new value wave is here Customers may be making fewer visits and shopping at fewer stores, but they are buying more when they do, and spending more on groceries as a result. Above all else, though, fears about personal finances mean that Customers are looking for greater value from Retailers.

- Satisfaction with online shopping is outpacing shopping in-store The majority of Customers believe that physical stores have done a good job of responding to the outbreak (54%), but satisfaction with both online delivery and online pickup services both outweigh that of brick-and-mortar stores.

- 'Worried' shoppers provide great insight into differing need states One of the key questions we asked survey respondents was the degree to which they found themselves worrying about the pandemic. 34% of respondents identified as 'worried', and answers to subsequent questions from this specific group allows us to gain insight into their evolving needs, something we plan to explore further in future surveys.

We plan to conduct two subsequent surveys over the coming months, so please stay tuned for the launch of future editions later this year.

Building loyalty in a time of crisis

Amidst all of the challenges facing Retailers and their Customers at present, it can be hard to focus on anything other than the vital tasks of keeping stores open, clean, well-stocked, and as safe as possible. Nonetheless, opportunities to improve Customer loyalty do continue to exist, and those Retailers that can build a greater connection with their shoppers during this time have much to gain.

We believe that the pandemic will be defined by three key stages: Insecurity, Transition and Recovery. At present, we find ourselves somewhere between Insecurity and Transition – uncertainty remains rife, but the world has started to adapt to the consequences of the outbreak.

In speaking to our colleagues, partners, and Customers around the globe, we feel Retailers need to focus on three primary areas when looking to improve Customer loyalty during this phase.

- Reinstate (or maintain) personalised promotions One immediate response to stock shortages by many Retailers was to remove digital and in-store promotions. While this was an entirely sensible reaction during the early days of the outbreak, there is clear evidence that now is the time to reintroduce promotions.With supply chains continuing to normalise, Customers are now acutely aware of the absence of promotions. A third of Customers (35%) in our Customer Pulse survey say that they have noticed price rises, and while a huge number (80%) acknowledge the necessity of basket restrictions, fewer than a fifth (18%) believe the same is true of promotion removal.As the economy contracts, Customers will look to Retailers for continued value in their shop. The reintroduction of promotions is a simple way to make this happen.

- Make reward schemes flexible, clear and easy-to-use Loyalty schemes might not be top-of-mind for many Customers at the moment, but Retailers can help make those programmes work harder with just a few tactical changes. Reminding Customers of the benefits they're entitled to presents a low-level way to demonstrate your commitment to them.Tactics to consider include the waiving of voucher expiration dates, offering additional redemption values for limited periods, and generally helping Customers get greater value from their incoming and existing rewards, particularly as shopping budgets tighten.Finally, consider allowing Customers to divert their rewards towards local communities and charities, or giving them the option to convert points into 'pay it forward' gift cards for local businesses.

- Prepare for tomorrow with lifecycle marketing plans Getting an accurate forecast of Customer behaviour has become much harder, with trends changing dramatically week-by-week. At the same time, keeping track of attitudes as they change is an essential task for anyone who wants to be ready to respond as new patterns emerge.Broadly speaking, this means focusing on a deep understanding of how and why Customer needs are changing. Retailers must strive to understand key indicators like how and why the dynamics of Customer value are changing, whether specific demographic attributes contribute to behavioural shifts, how shopping behaviour has changed, the new need states driving that transformation, and how different messaging can influence Customers on a segment-by-segment basis.A nuanced appreciation of these factors, combined with a consistent commitment to keep listening, will help Retailers develop effective loyalty-building strategies as we move gradually towards recovery.

Recommendations for Retail Media advertisers

For anyone involved in advertising to Customers via Retail Media, the past few weeks have been characterised principally by widespread uncertainty.

Trade uncertainty has seen products disappear from shelves, promotions halted, and a shift in focus from Retailers towards effective operation. Channel uncertainty has been defined by the cancellation of major events, the removal of 'touch-based' media like coupons and sampling, and the removal of out-of-home advertising as social distancing takes effect. At a brand level, advertisers have been faced with the unenviable task of staying relevant while striving not to be seen as uncaring, insensitive or – worse – profiting from a crisis.

To navigate these waters, advertisers need to show that their business is committed to doing right by their Customers. And the only way to do that is to demonstrate a clear understanding of what 'right' means. To us, this requires a focus on three areas.

- Truly understanding Customers These are unprecedented times, and what worked yesterday may no longer work tomorrow. Only granular behavioural insights can tell us what Customers are truly thinking and how brands can help them overcome their fears, worries and needs.

- Tailoring, targeting, and personalising communications to them Huge swings in Customer behaviour are now commonplace, particularly with the pandemic unfolding at different speeds across the world. Communications must be tailored using aggregated insights, deliver the right messages to the right segments, and personalised to provide Customers with the support they need at that moment in time.

- Implementing sensible targets and KPIs With new approaches and new techniques of reaching out to Customers comes the need to implement new targets and KPIs. Advertisers must be mindful not to let the pursuit of their objectives outweigh their focus on helping Customers.

Data warehouse

As disruption in the retail industry accelerates, more companies are turning to technology to keep up with new market entrants and changing consumer trends. But taking the focus off of Customer needs as the core driver of CRM strategy, retailers are missing opportunities for meaningful Customer interactions and profitable growth.

In this report, we'll take a closer look at the five big myths behind the trend of putting technology at the center of CRM strategies, revealing why a Customer First approach will help improve engagement with your Customers, which may just be the answer for ineffective tech solutions.