The dunnhumby Consumer Pulse Survey is a multi-phased, worldwide study of the impact of COVID-19 on customer attitudes and behavior. We surveyed more than 27,000 respondents online in 22 countries, with interviews conducted for Wave one from March 29 – April 1, for Wave two from April 11 – 14, and for Wave three from May 27 – 31. Due to the rapidly unfolding crisis in North America, dunnhumby conducted Wave four from July 9 – 12 in the U.S., Canada and Mexico only. Here are highlights from the study:

FOR RETAILERS

Smarter operations and sustainable growth, powered by Customer Data Science.

FOR BRANDS

Better understand and activate your Shoppers to grow sales.

Why North America’s health and wellbeing could be the next big retail pharmacy battleground

The retail sector has experienced both of these extremes, with some seeing strong sales while others have been forced into bankruptcy and liquidation.

What we have seen is an acceleration of trends that were in motion prior to the pandemic but are now even more essential for success. One such trend is, understandably, the enhanced focus in retail on health and wellness. This is not a new phenomenon especially within Retail Pharmacy as "buy and build" expansion pushed the market towards saturation. More savvy competition, both within the sector, as well as grocery, mass merchant, and ecommerce began to expand into Health & Beauty (H&B) and prescriptions.

Prescription benefit managers (PBMs) grew increasingly powerful and began demanding lower reimbursement terms and restricted access to customers. Some even set up their own mail order prescription businesses and became direct competitors. This direct attack on the pharmacy business model, combined with the erosion of the convenience advantage forced chains to find other ways to extend their reach. For many, the answer lay in diversification and, specifically, the integration of products and services that had previously sat with dedicated medical providers.

Faced with limited development prospects, retail pharmacies once again needed to re-examine their offering and carve out a distinctive customer proposition.

Clinical decisions

In the US, prescription medicines account for around two-thirds of retail pharmacy revenues¹. As a result, repeat business is vital. Clinical services – a longer-term, more consultative offering than pure dispensary – can help to encourage ongoing business by building a stronger relationship between pharmacist and patient.

With that in mind, it's little wonder that for many retail pharmacies in the mid-2000s, the decision to expand into clinical services seemed like a natural evolution.

CVS, Walgreens and others went through a flurry of acquisitions, purchasing small health service companies up and down the US. In-store facilities were rolled out to capture new clinical business and commence the shift into a wider "health services" offering.

Certain activities, such as immunizations, had successful starts. But the growth of these clinics and their services rapidly dropped off and it soon became apparent that success would not be as readily won as those retailers may have hoped.

One major problem lay deep in the complex inner workings of US healthcare. Limited by their insurance plan benefit structures, customers would often find themselves unable to access the full range of services offered in-store. Clinical service costs, while usually lower than those available at a hospital or doctor's office, would likely be higher than the insured co-pay price paid by the consumer at the latter.

Retailers quickly learned that in order to integrate into the healthcare industry, they would need to learn how to influence and control it as well.

Playing a long game

CVS, which made the strongest initial investment into in-store clinics, has spent more than a decade in pursuit of that goal. Major product decisions, such as the removal of tobacco from stores (itself a $1bn annual business) were executed in the name of a slow repositioning towards healthcare.

Strategic acquisitions have only helped to further that ambition. With its first major vertical healthcare purchase – that of PBM Caremark in 2006 – CVS gained control of the levers of customer access and prescription reimbursement for millions of lives. 13 years later, with the acquisition of Aetna, the company added the ability to provide health, dental, vision and other insurance plans to customers.

Taken to its logical conclusion, this trajectory could lead to the eventual formation of an integrated healthcare system supported by some 10,000 points of service.

There is growing evidence that an empire of that kind is firmly in the retailer's plans. CVS has already announced its intention to evolve clinics into more expansive "Health Hubs", bringing enhanced services to 1,500 locations by 2021. Health Hubs include more space devoted to clinical services and a broader focus on proactive wellness and nutrition alongside extensive health services.

That wider remit is immediately evident in an enhanced product assortment, one that includes numerous specialized items and categories for maintaining health and preventative wellness products –. And, perhaps influenced by insights delivered by Aetna, CVS has also chosen to put significant emphasis on chronic condition management, an area that can provide a pharmacy with some of its most valuable customers.

While CVS is playing a highly strategic game, though, it is by no means the only player to watch.

Save money, live better

As the world's largest retailer, just about anything Walmart does is reason for the competition to pay attention. It may have taken more than a quarter of a century for Walmart to start selling groceries after all, but the retail behemoth now holds top position in that segment in North America by an overwhelming margin.

With that precedent in mind, and in light of Walmart now holding the position as the nation's third largest retail pharmacy provider, it seems likely that another fierce battle for the future of retail pharma is about to begin.

Launched in fall 2019, the Walmart Health Care Clinic serves as a good indicator as to the strength of the company's ambitions.

Staffed to deliver an expansive set of services that range from primary care and disease management through to dental, hearing, nutrition and fitness, these sleek, modern facilities offer the same one-stop-shop approach as Walmart's core store.

Moreover, Health Care Clinics also employ the company's "everyday low pricing" model, something that makes for a compelling proposition regardless of insurance coverage. Medicare and Medicaid are both accepted too, encompassing what is likely a significant number of customers.

The battle within

Similar at their core yet, subtly different, these offerings from CVS and Walmart represent a dramatic shift in healthcare delivery in the US.

While the scale of each remains too small at this point to draw many conclusions, those small differences could carve out room enough for both to flourish. CVS' focus on providing specialist-level health and chronic condition care is different enough from Walmart's "low price, one-stop shop" approach to appeal to a distinct group of customers.

Rather than between each other, the biggest challenges ahead for CVS and Walmart may actually be found within. As both companies make fundamental changes in order to facilitate a future in which healthcare is a significant part of their offering, they will need to focus on evolving their relationships with their long-term customers too.

CVS, for instance, will need to ask customers to reconcile the idea that a company that continues to dominate in snacks and candy is now an active participant in their healthcare. And Walmart, famed for its leadership in building highly efficient operations, will need to scale and sustain a healthcare business rooted in flat, affordable pricing, as well as build the credibility as a viable provider of quality healthcare.

Neither challenge is easy. But if history has taught us anything, it's that when companies of this size decide to redefine an industry from the ground-up, they tend to succeed.

The arrival of Covid-19 also introduces a new reality unthinkable less than a year ago. Health and wellness permeates all aspects of our lives and vigilance is essential to protect ourselves and our loved ones.

- PPE has become a category in its own right with massive and sustained demand across such items as masks and sanitizers.

- Hospital capacity is being tested repeatedly with infection surges and unable to address lower level and elective procedures

- Vaccination is now a global necessity requiring a distribution network capable of rapidly reaching billions of people

In a series of posts published earlier this year, we covered the results of the dunnhumby Customer Pulse – a global study designed to explore changing consumer mindsets during the COVID-19 pandemic. Over three waves, conducted between March and the end of May, we polled thousands of people from more than 20 countries on subjects including supermarkets' responses to the outbreak, the economic outlook, and how their shopping behaviour had changed due to COVID.

At the beginning of September – three months on from the previous wave and with supply chains stable and the changing nature of lockdowns – we wanted to revisit the Customer Pulse to see what, if anything, had changed. Below are some of the standout findings from this fourth tranche of research.

Worries fade, but some still feel unsafe while shopping

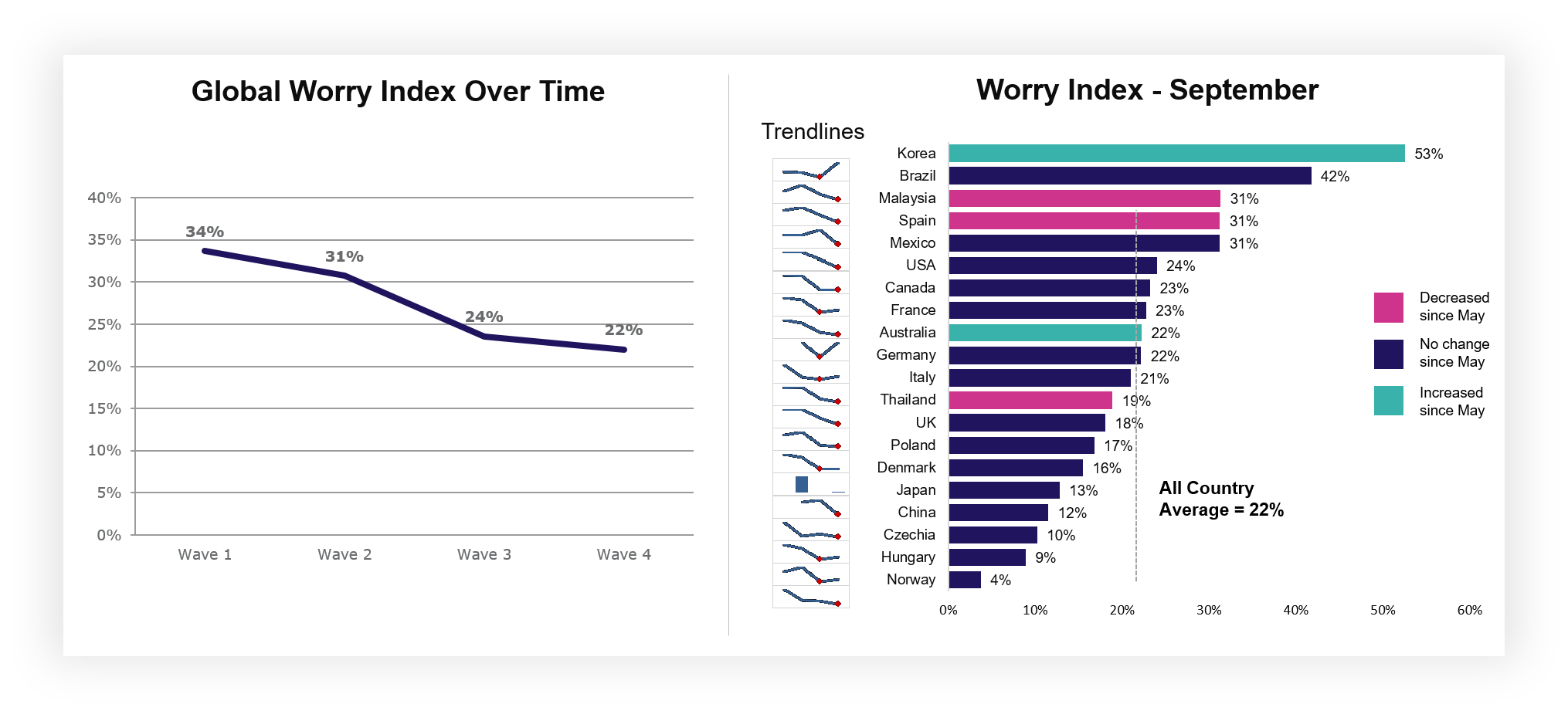

One of the key things tracked by the Customer Pulse is something that we refer to as the "Worry Index" – a representation of how concerned consumers around the world are about COVID-19. Globally, the Index has now fallen to its lowest point, down from 34% in March to just 22% in September. Australia and Korea are the only countries to show a rise since the previous study, with the latter of those demonstrating the sole meaningful increase.

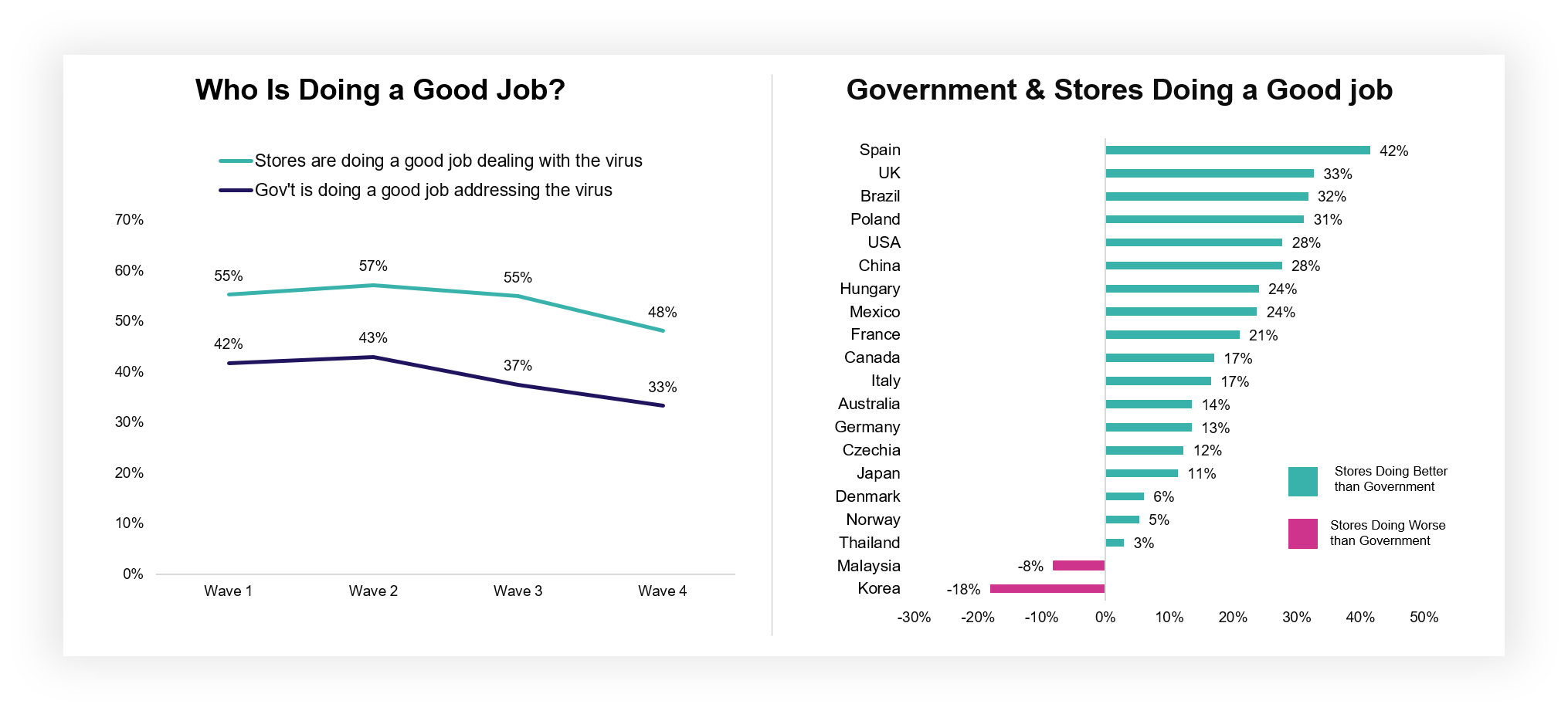

While worries may be dwindling generally, this can change rapidly based on local circumstances, and in-person shopping is still a point of concern for many: one third (33%) of those surveyed said they still don't feel safe from infection while shopping. Although this figure has fallen considerably since waves one (42%) and two (43%) of the Customer Pulse, this does mean it's of critical importance to retailers to keep communicating the efforts and importance of supporting colleagues and customers by focussing on positive drivers of a safe shopping experience and activities supporting vulnerable customers.

Those persistent worries should not detract from the phenomenal work the Grocery Retail industry has done to reassure Customers over the past six months. Stores (48%) continue to outpace the government (33%) in terms of who shoppers believe are doing a good job of dealing with the virus, a trend that has remained consistent across the duration of our study. Retailers in Canada, Australia and the UK are seen to be doing particularly well.

Early changes to shopping habits remain in place

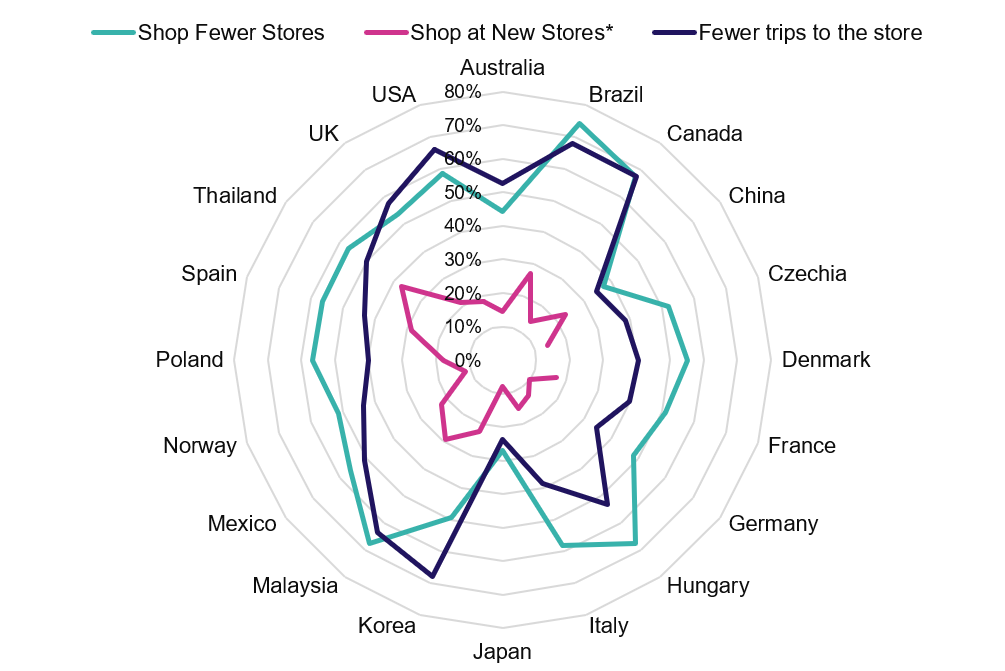

The early months of the pandemic saw major changes to Customer shopping behaviours. Trips decreased, as did the number of stores being visited, while basket sizes and ecommerce usage both skyrocketed.

Six months on from our initial survey, those behaviours remain largely unaffected. While the number of trips that Customers make has slightly risen, it has not done so with any degree of significance. Broadly, shoppers have continued to stay local, and visit stores only when they need to. Only a minority are shopping new stores.

Consequently, many shoppers continue to spend more when they do shop; around a quarter (23%) say they are still spending more each trip. Basket sizes can fluctuate though and some markets saw spikes particularly sharply towards the end of September*, likely a consequence of infection rates beginning to rise once again and many shoppers wishing to stock up in the event that tighter restrictions could follow.

One the most profound changes in behaviour during the outbreak – the upsurge in online grocery – continues apace. Ecommerce now accounts for 28% of weekly shops, the same as it did in May, and relatively stable since the start of the pandemic when it stood at 30%. Many respondents plan to continue to adopt online alongside store shopping with 59% saying they plan to continue using online channel. The tipping point for online is well and truly here.

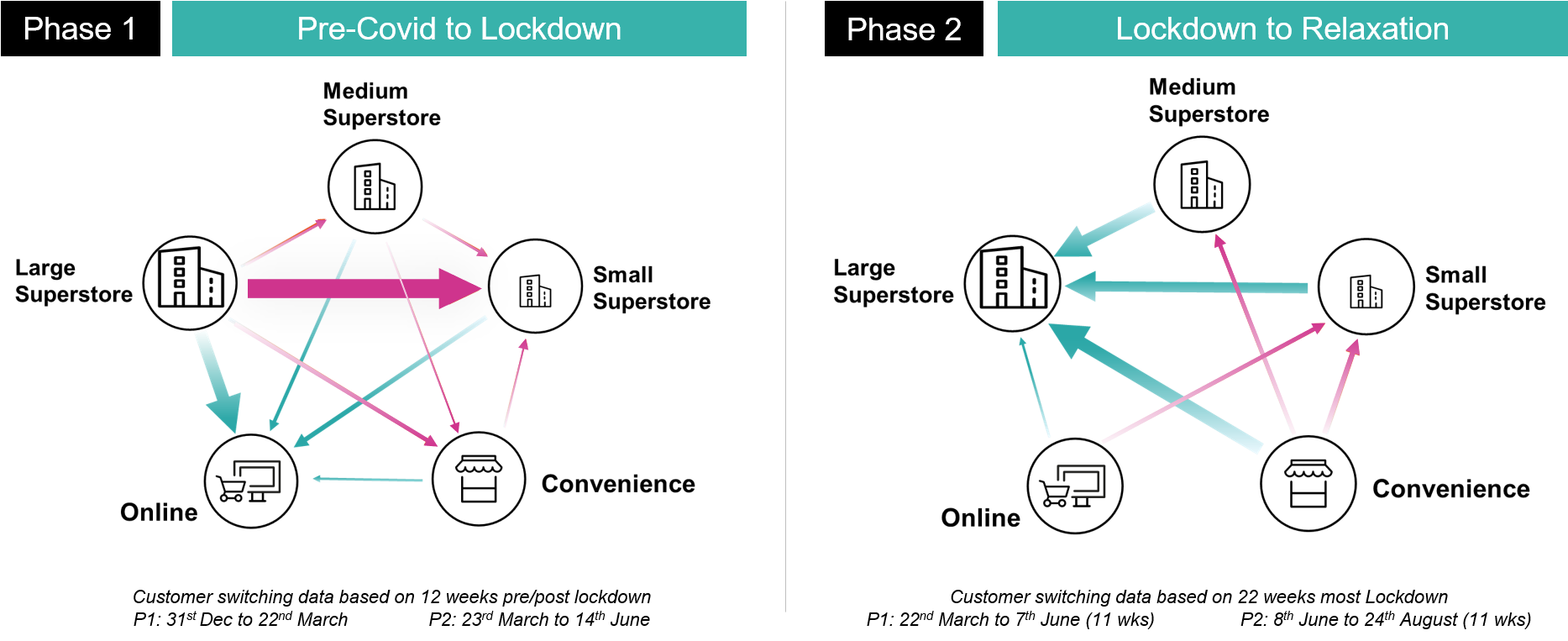

Although many of the pandemic-based trends have remained consistent during the past half year, some shifting dynamics are worth bearing in mind. In the UK specifically, while the initial outbreak saw large superstores lose much of their trade to both smaller shops and digital channels, much of that custom is now being pulled back in from small and medium stores, as well as convenience locations.

Financial worries have remained constant, and frugal behaviours are rising as a result

In regard to both their personal finances and the economic outlook for their country as a whole, many shoppers are now a little more optimistic than they were when the Customer Pulse began. That said, concern is still rife; around half (47%) of consumers have worries about their own financial situation, and more than two-thirds (67%) say the same about their national economy.

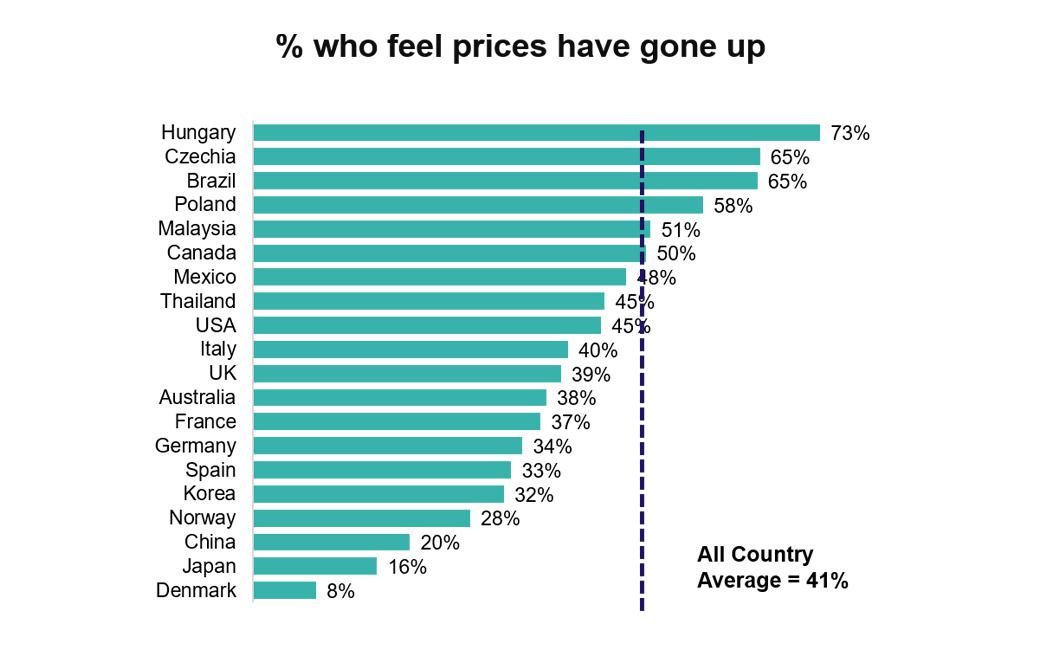

Accurately or not, this prolonged concern has translated into widespread belief that grocery shopping is becoming more expensive. Some 41% of global respondents believe that prices have risen, with many countries showing a significant increase since May. France is the only country in which this figure has declined.

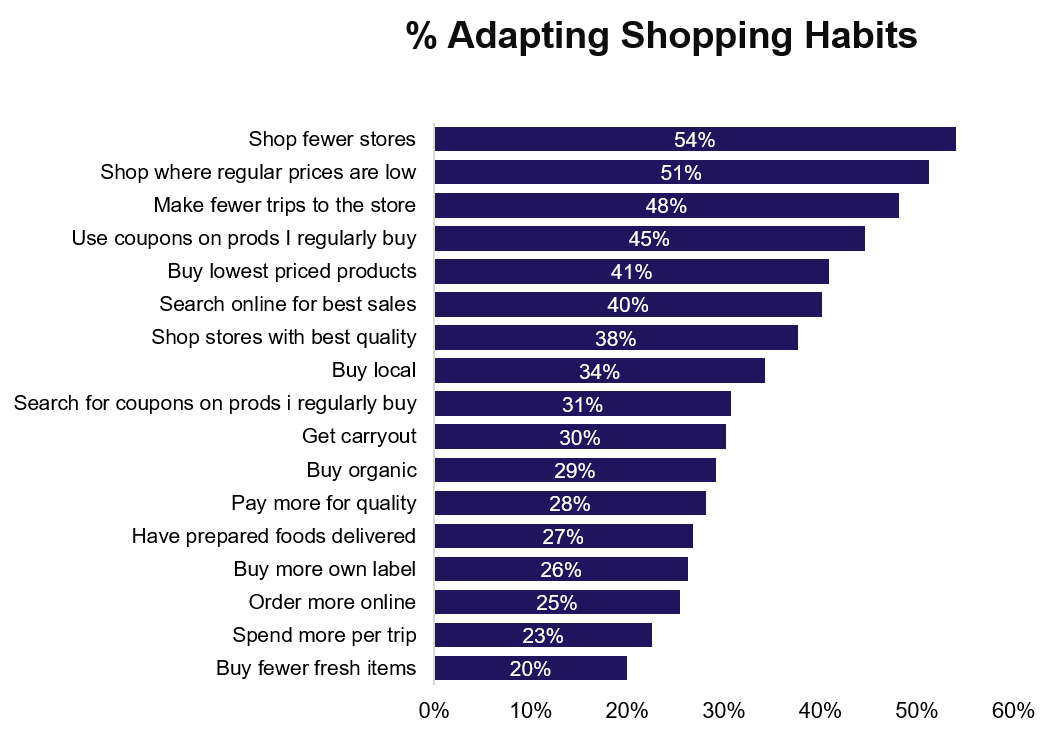

The upshot of this persistent financial worry is that many Customers are now beginning to act more frugally. More than half (51%) are looking to lower-priced stores, with similar numbers increasing coupon usage (45%), opting for the lowest-priced goods (41%), and looking online for the best available sales. As we reported in June, a new age of value perception is here.

Eight important shifts will define the future for Grocery Retail

As Customer behaviours continue to flex around the impact of COVID-19, we believe that Retailers need to continue to focus on eight key shifts and business enablers as they continue to respond and future proof their business for the future. Consumer behaviours

- Value: as discussed above, demonstrating value to Customers will become increasingly important over the coming months with continued pressure on household budgets.

- Local: with shoppers preferring to stay local, range and assortment will need to be tailored as a result across formats.

- Food at home: despite recent increases in the number of people dining out, many shoppers continue to favour recreating meal experiences at home, both in cooking from scratch and food to go solutions from grocers.

- Personal wellbeing: a growing trend towards health, wellness, and better eating habits will need to be catered for.

Retailer adaptation

- Online: while the sharp rise in ecommerce adoption has now begun to plateau, utilisation remains significantly higher than it was pre-pandemic.

- Digital acceleration: with more Customers heading online, a greater opportunity to engage and inspire using digital channels comes into play.

- New revenue streams: with margins growing tighter as the cost of managing the Pandemic and online fulfilment rises, Retailers will need to find new sources of revenue to offset this expenditure. New retail services, and monetising data and media are key opportunity areas.

- Efficiency and SKU consolidation: related to the above, the need for Retailers to optimise and solidify their operations will become greater too with heightened focus on optimising and simplifying assortment.

For more information about COVID-19's impact on Grocery Retail, please visit our dedicated resource hub.

* Data from this edition of the Consumer Pulse has been supplemented with recent insights from HuYu, dunnhumby's receipt scanning and rewards platform.

Find out how COVID-19 has accelerated the shift to grocery ecommerce, and explore the successful strategies to follow.

2020 has seen an acceleration of grocery e-commerce with globally 29% of shoppers saying they are using pick up or delivery weekly for their grocery of eat at home consumption.

Whilst there was an initial surge in demand at the height of the Covid-19 crisis that was hard to meet, there has been a significant increase in capacity across retailers in recent months. Consumers have also started to adopt the channel more with 59% saying they will continue to stick with online pick up and delivery, alongside going to store.

In this session we explore successful strategies for meeting these new consumer needs. This will look at ways to capture this new growth channel, and grow customer adoption as well as ensuring a seamless omni-channel experience and a scalable, more profitable operation.

The 45-minute session will be by a live Q&A with the presenters.

When: Wednesday 4 November 2020, 16:00 GMT

Presenters:

- David Clements, Global Head of Retail, dunnhumby

- Tom Langley, Head of Media Propositions, dunnhumby

- Jemma Haley, Global Media Consulting Manager, dunnhumby