Memories of panic buying may be fading here in the UK but have resurfaced elsewhere1. The near constant threat of another wave of Covid-19 may yet prompt another round of hyper demand. Whilst there is little hard evidence to determine the underlying drivers of panic buying2, there are numerous theories that the retail industry may benefit from exploring.

Feroud Seeparsand, dunnhumby's Senior Consumer Psychologist, outlines some likely theories to explain the 'why' behind the 'panic buy' and some implications for retailers to prevent it reoccurring in future.

1.Loss Aversion

Nobel Prize-winning economist Daniel Kahneman stated that 'loss aversion' was his and Amos Tversky's single greatest contribution to decision-making theory3.

We feel the pain of loss more than an equivalent gain. In other words, losing £100 hurts more than the joy of winning £100. When applied to panic buying, we fear for the loss of a product we could otherwise have had. Perhaps more to the point, we would normally have had access to a variety of products. Relative to this normal point of reference, the relative loss of not possessing a product helped lead to panic. As customers would normally possess a certain product, the relative loss of it created pain.

A curious detail is that small numbers can make big differences, a concept called 'diminishing sensitivity'; winning £200 does not double the joy relative to winning £100. In other words, even small numbers of a valued product can have a significant effect on one's decision making. It is because of this diminishing sensitivity customers may lean towards zero risk aversion, in other words not to risk missing out on a product; if you see it, buy it!

Implication for retailers: Use the new reference point that past panic buying did not stop most customers obtaining products.

2.Social Norms

Another Nobel Prize-winning economist, Richard Thaler, and his colleague Cass Sunstein highlighted numerous heuristics to nudge behaviour4; one of these is social norms or copycat behaviour. We are perhaps all guilty of assuming restaurants with longer queues have superior dishes or assuming that the more popular films, plays or books are worth consuming. When applied to retail, if a customer sees another purchasing a particular item, the odds are that they will follow. This can easily be exaggerated through social media and news reports.

It does not matter if this perception is factually inaccurate; perception will still hold sway. If customers do cause products to sell out as a result, this is likely to lead to a scarcity effect, where those products are valued even more than before. This can be further exacerbated if such products are perceived to be potential life savers, like hand sanitisers or medicine.

Implication for retailers: Highlight how most people are not panic buying. Foodstuffs North Island and South Island, in New Zealand, got out ahead by introducing their 'Shop Normal' campaign, which encouraged customers to 'shop normally and be kind in supermarkets'. Tesco in the UK also ran a 'Together we can do this' campaign in national media to encourage people to 'shop normally together'.

3.Uncertainty Breeds a Desire for Control

Sometimes the actions that can save lives, such as hand washing and social distancing, are simply not enough to regain a sense of control5, as they are too dependent upon the goodwill of others. Therefore, there remains a need to reduce anxiety. Stockpiling or buying more, as a form of retail therapy, is a manner for regaining control.

Scientists have found uncertainty leads to the consumption of utilitarian products (such as cleaning agents and cooking ingredients), i.e. products that give you something to do6. Shoppers are less likely to be interested in the latest fashion trends. When one adds to the mix a virus that demands hygiene, the hyper-demand for particular products can be better understood. The same scientists explore the concept of 'displaced coping', where shoppers purchased items that are of no direct relevance to their uncertainty. This may go one step to explain the recent insatiable worldwide desire for toilet paper.

Implication for retailers: Provide customers with products that may provide a sense of control, such as gardening, DIY, crafts, puzzles.

4.Game Theory

Whilst behavioural economics and nudge theory assume irrationality, game theory (which also can claim a Nobel Prize by John Nash, as featured in the film A Beautiful Mind), assumes rationality.

In the same way panic buying exists, customers may panic and create a bank run, where customers take money out en masse which then collapses a bank. In one study, it was found that asking participants to recount a time when they felt fear was found to increase the likelihood of a bank run in the form of a game format7. There was some evidence that inducing sadness was less likely to create a bank run. Given the emotion of fear led to bank runs, it is of little wonder that the fear of a pandemic may have led to panic buying.

Implication for retailers: Influence emotion to avoid fear (e.g. through in-store media and music).

5.Personality Theory

A recent global survey addressed toilet paper hoarding through personality traits8. It was found that customers who felt more threatened by the pandemic, possessed greater emotionality and greater conscientiousness (i.e. planned more) led to more toilet paper hoarding. This study may suggest that appealing to higher values2,9 (ie encouraging responsible behaviour) may not help to avoid panic buying.

Implication: Encourage long term planning and purchase of long shelf life products, to ease supplies if a second or third wave returns.

6.Concluding remarks

This is not an exhaustive causal list, but instead focuses on theories that could have at least some practical application to limit panic buying. The theories covered include areas that assume irrationality, such as behavioural economics and nudge theory, or rationality such as game theory. Other theories may sit more on the fence.

Whatever the drivers for panic buying this is a topic that retailers need to address. Even if panic buying does not reoccur within the Covid-19 pandemic, it is likely to return in some future event whether it be a natural disaster, climate change, strikes or supply shortages.

References

1. https://www.bbc.co.uk/news/world-australia-53196525

2. Lunn, P. et al (2020). Using Behavioural Science to Help Fight the Coronavirus: A Rapid, Narrative Review. Journal of Behavioral Public Administration Vol 3(1): doi: 10.30636/jbpa.31.147

3. Kahneman, D. (2011). Thinking Fast and Slow. Penguin

4. Thaler and Sunstein (2008). Nudge. Improving Decisions About Health, Wealth, and Happiness. Penguin

5. Taylor, S (2019). The Psychology of Pandemics. Cambridge

6. Chen, C.Y. and Pham, M.T. (2018). Affect regulation and consumer behaviour. Consumer Psychology Review 2(1): 114-144

7. Dijk, O. (2017). Bank Run psychology. Journal of Economic Behavior & Organization 144: 87-96.

8. Garbe L., et al (2020) Influence of perceived threat of Covid-19 and HEXACO personality traits on toilet paper stockpiling. PLoS ONE 15(6): e0234232.

FOR RETAILERS

Smarter operations and sustainable growth, powered by Customer Data Science.

FOR BRANDS

Better understand and activate your Shoppers to grow sales.

In a series of posts published earlier this year, we covered the results of the dunnhumby Customer Pulse – a global study designed to explore changing consumer mindsets during the COVID-19 pandemic. Over three waves, conducted between March and the end of May, we polled thousands of people from more than 20 countries on subjects including supermarkets' responses to the outbreak, the economic outlook, and how their shopping behaviour had changed due to COVID.

At the beginning of September – three months on from the previous wave and with supply chains stable and the changing nature of lockdowns – we wanted to revisit the Customer Pulse to see what, if anything, had changed. Below are some of the standout findings from this fourth tranche of research.

Worries fade, but some still feel unsafe while shopping

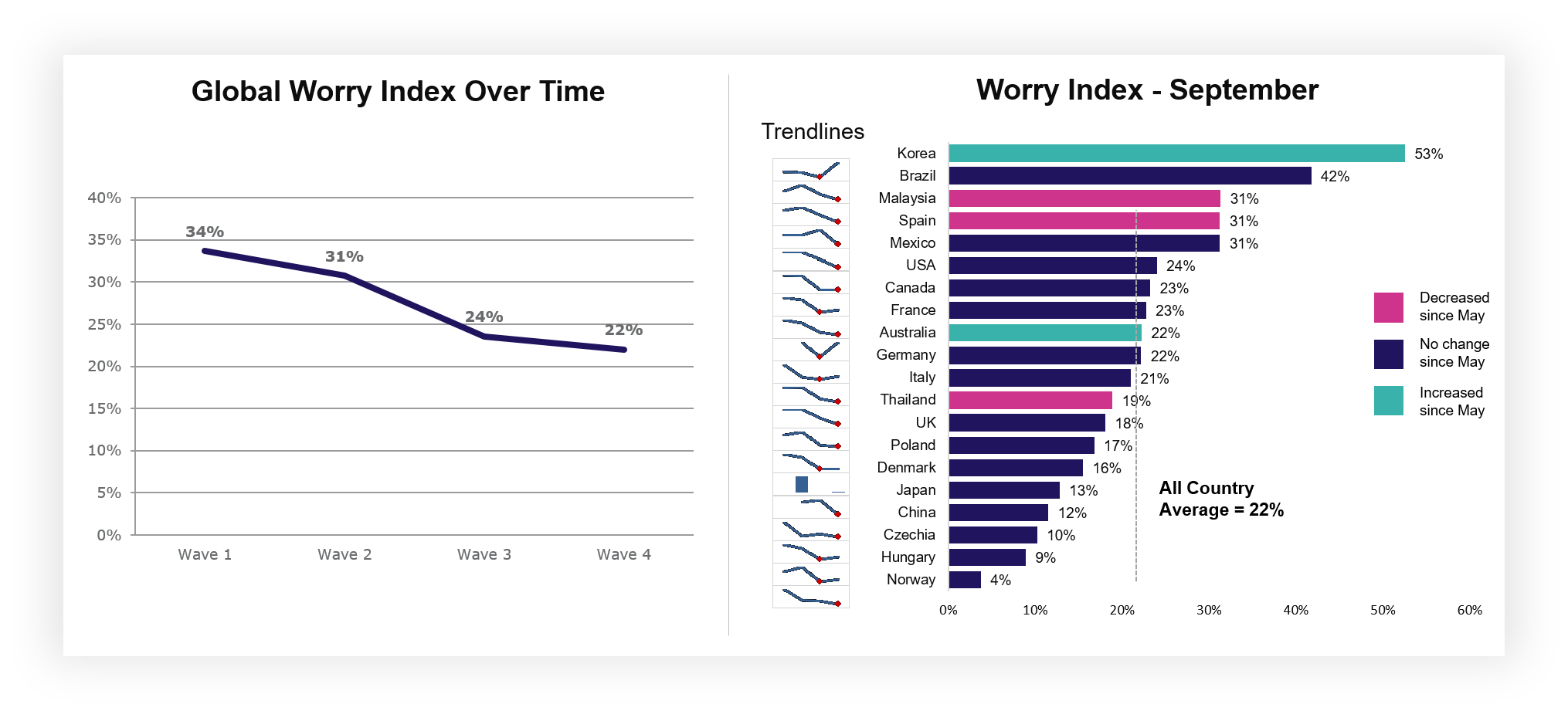

One of the key things tracked by the Customer Pulse is something that we refer to as the "Worry Index" – a representation of how concerned consumers around the world are about COVID-19. Globally, the Index has now fallen to its lowest point, down from 34% in March to just 22% in September. Australia and Korea are the only countries to show a rise since the previous study, with the latter of those demonstrating the sole meaningful increase.

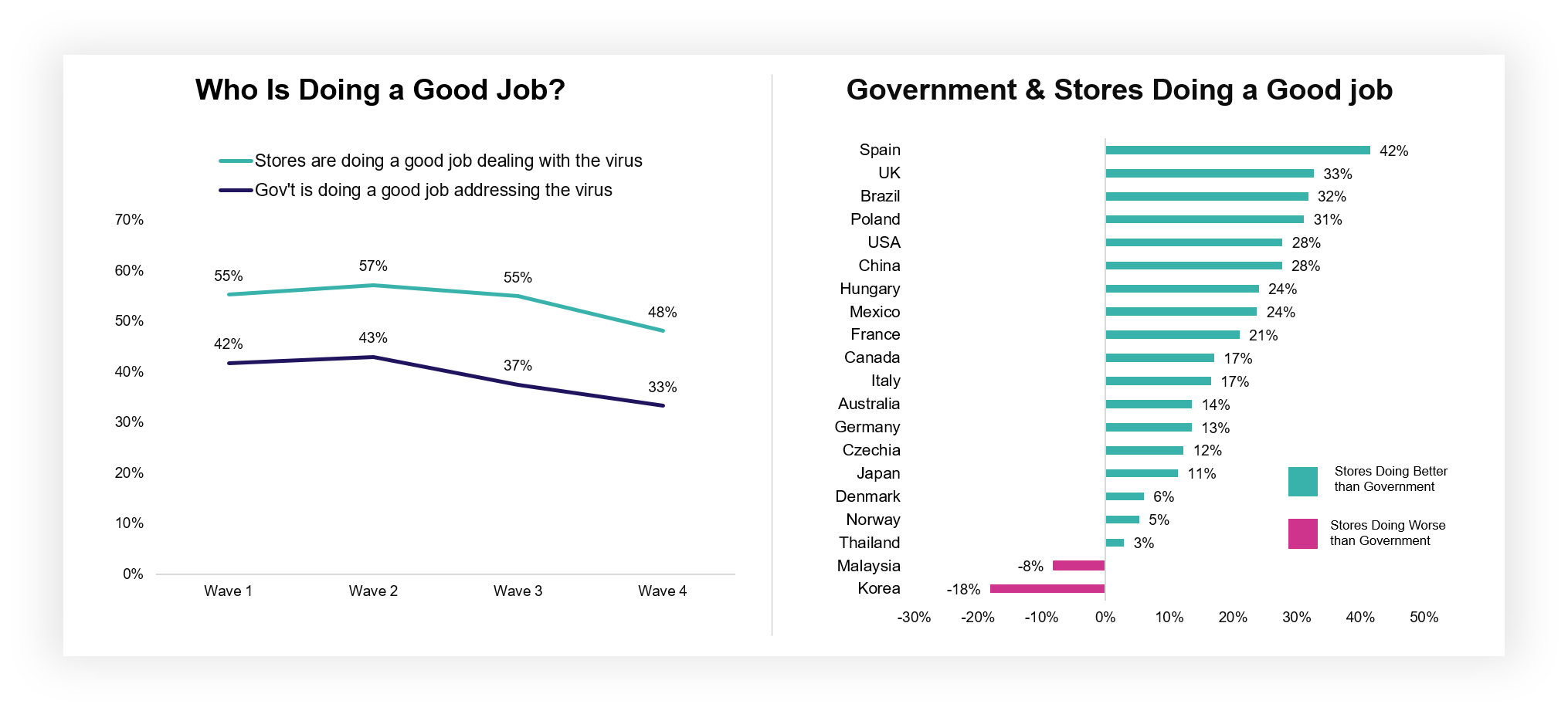

While worries may be dwindling generally, this can change rapidly based on local circumstances, and in-person shopping is still a point of concern for many: one third (33%) of those surveyed said they still don't feel safe from infection while shopping. Although this figure has fallen considerably since waves one (42%) and two (43%) of the Customer Pulse, this does mean it's of critical importance to retailers to keep communicating the efforts and importance of supporting colleagues and customers by focussing on positive drivers of a safe shopping experience and activities supporting vulnerable customers.

Those persistent worries should not detract from the phenomenal work the Grocery Retail industry has done to reassure Customers over the past six months. Stores (48%) continue to outpace the government (33%) in terms of who shoppers believe are doing a good job of dealing with the virus, a trend that has remained consistent across the duration of our study. Retailers in Canada, Australia and the UK are seen to be doing particularly well.

Early changes to shopping habits remain in place

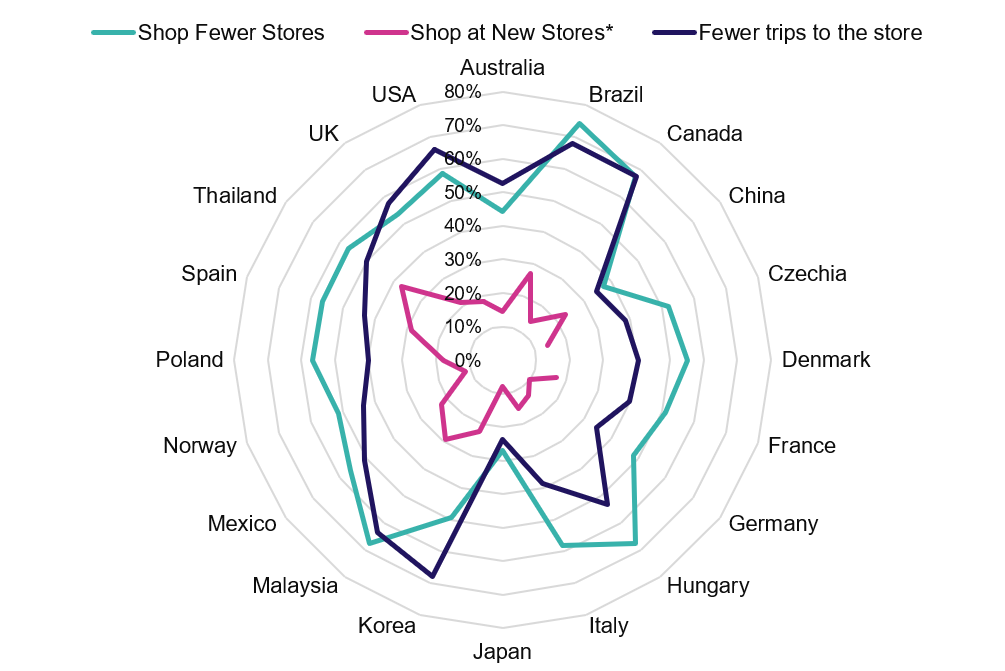

The early months of the pandemic saw major changes to Customer shopping behaviours. Trips decreased, as did the number of stores being visited, while basket sizes and ecommerce usage both skyrocketed.

Six months on from our initial survey, those behaviours remain largely unaffected. While the number of trips that Customers make has slightly risen, it has not done so with any degree of significance. Broadly, shoppers have continued to stay local, and visit stores only when they need to. Only a minority are shopping new stores.

Consequently, many shoppers continue to spend more when they do shop; around a quarter (23%) say they are still spending more each trip. Basket sizes can fluctuate though and some markets saw spikes particularly sharply towards the end of September*, likely a consequence of infection rates beginning to rise once again and many shoppers wishing to stock up in the event that tighter restrictions could follow.

One the most profound changes in behaviour during the outbreak – the upsurge in online grocery – continues apace. Ecommerce now accounts for 28% of weekly shops, the same as it did in May, and relatively stable since the start of the pandemic when it stood at 30%. Many respondents plan to continue to adopt online alongside store shopping with 59% saying they plan to continue using online channel. The tipping point for online is well and truly here.

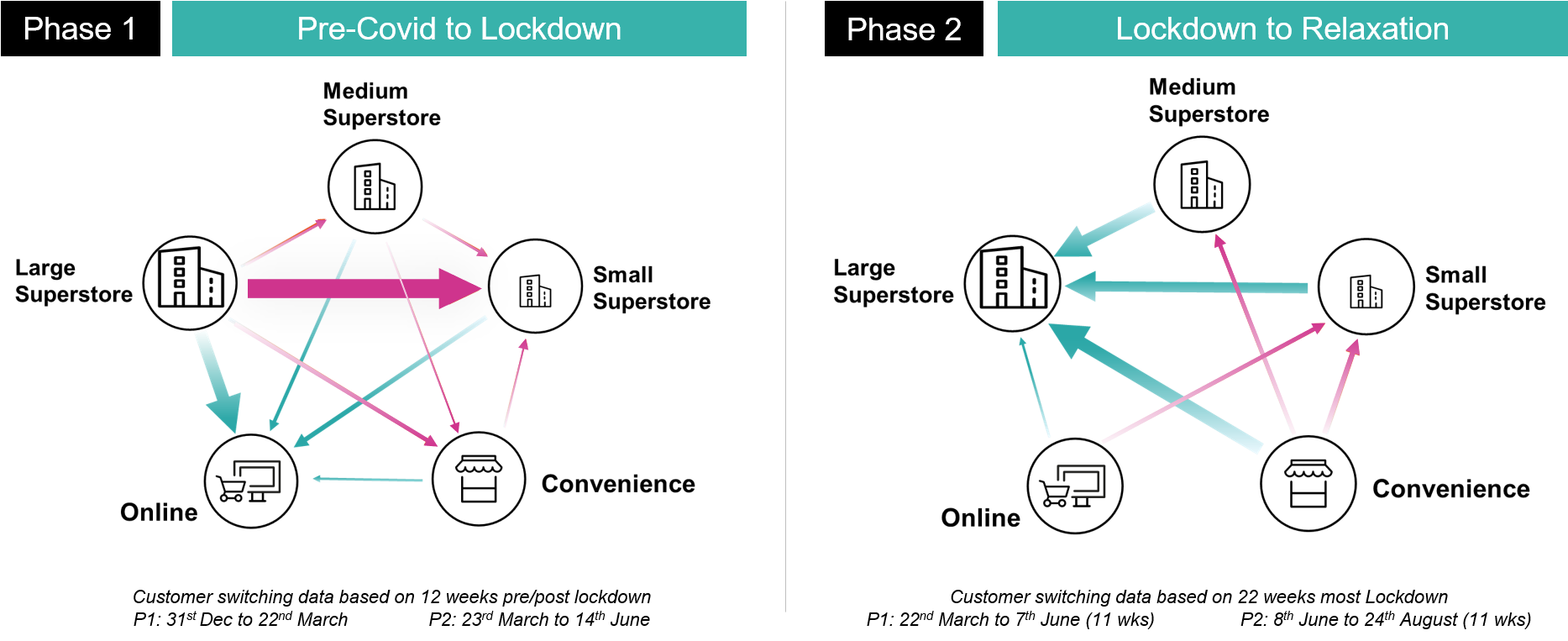

Although many of the pandemic-based trends have remained consistent during the past half year, some shifting dynamics are worth bearing in mind. In the UK specifically, while the initial outbreak saw large superstores lose much of their trade to both smaller shops and digital channels, much of that custom is now being pulled back in from small and medium stores, as well as convenience locations.

Financial worries have remained constant, and frugal behaviours are rising as a result

In regard to both their personal finances and the economic outlook for their country as a whole, many shoppers are now a little more optimistic than they were when the Customer Pulse began. That said, concern is still rife; around half (47%) of consumers have worries about their own financial situation, and more than two-thirds (67%) say the same about their national economy.

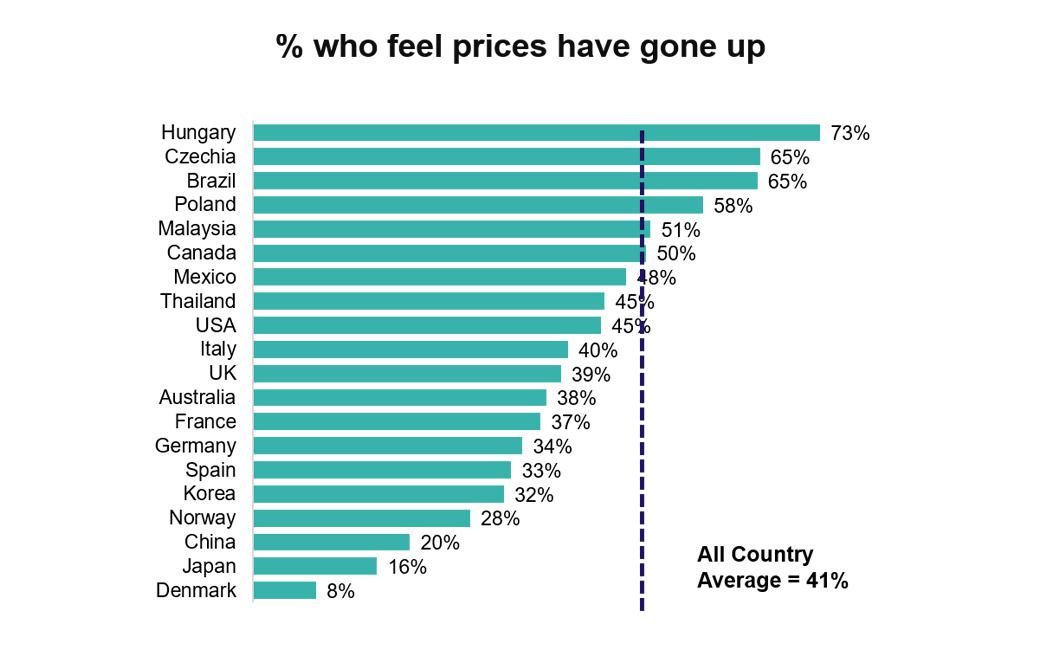

Accurately or not, this prolonged concern has translated into widespread belief that grocery shopping is becoming more expensive. Some 41% of global respondents believe that prices have risen, with many countries showing a significant increase since May. France is the only country in which this figure has declined.

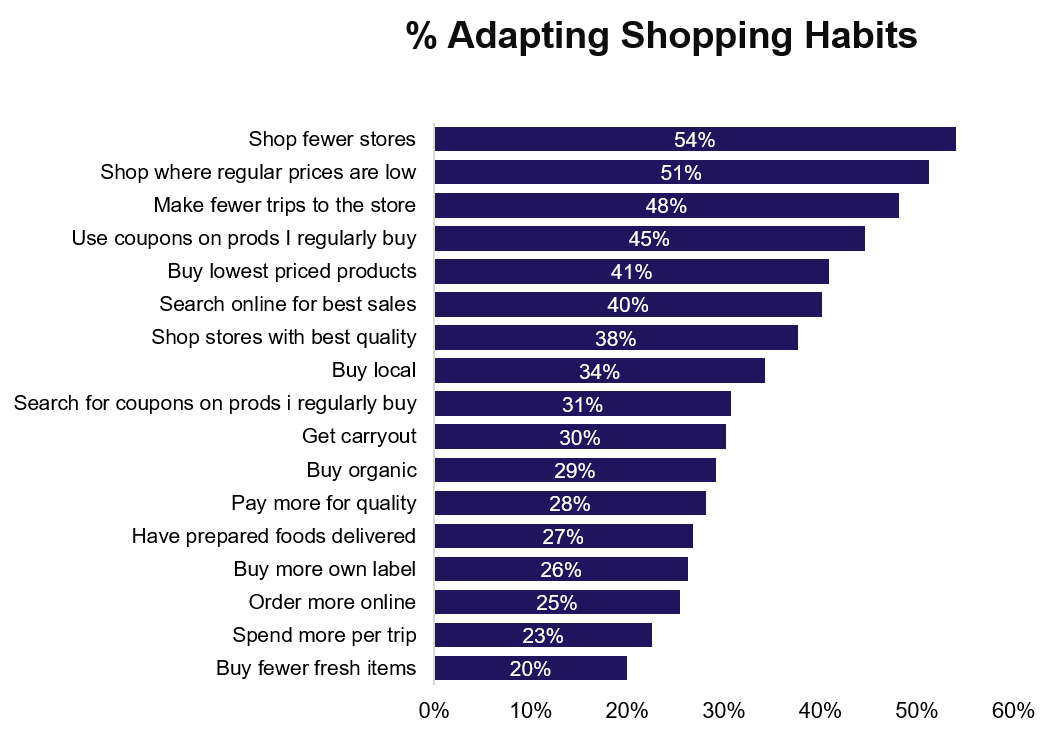

The upshot of this persistent financial worry is that many Customers are now beginning to act more frugally. More than half (51%) are looking to lower-priced stores, with similar numbers increasing coupon usage (45%), opting for the lowest-priced goods (41%), and looking online for the best available sales. As we reported in June, a new age of value perception is here.

Eight important shifts will define the future for Grocery Retail

As Customer behaviours continue to flex around the impact of COVID-19, we believe that Retailers need to continue to focus on eight key shifts and business enablers as they continue to respond and future proof their business for the future. Consumer behaviours

- Value: as discussed above, demonstrating value to Customers will become increasingly important over the coming months with continued pressure on household budgets.

- Local: with shoppers preferring to stay local, range and assortment will need to be tailored as a result across formats.

- Food at home: despite recent increases in the number of people dining out, many shoppers continue to favour recreating meal experiences at home, both in cooking from scratch and food to go solutions from grocers.

- Personal wellbeing: a growing trend towards health, wellness, and better eating habits will need to be catered for.

Retailer adaptation

- Online: while the sharp rise in ecommerce adoption has now begun to plateau, utilisation remains significantly higher than it was pre-pandemic.

- Digital acceleration: with more Customers heading online, a greater opportunity to engage and inspire using digital channels comes into play.

- New revenue streams: with margins growing tighter as the cost of managing the Pandemic and online fulfilment rises, Retailers will need to find new sources of revenue to offset this expenditure. New retail services, and monetising data and media are key opportunity areas.

- Efficiency and SKU consolidation: related to the above, the need for Retailers to optimise and solidify their operations will become greater too with heightened focus on optimising and simplifying assortment.

For more information about COVID-19's impact on Grocery Retail, please visit our dedicated resource hub.

* Data from this edition of the Consumer Pulse has been supplemented with recent insights from HuYu, dunnhumby's receipt scanning and rewards platform.

Find out how COVID-19 has accelerated the shift to grocery ecommerce, and explore the successful strategies to follow.

2020 has seen an acceleration of grocery e-commerce with globally 29% of shoppers saying they are using pick up or delivery weekly for their grocery of eat at home consumption.

Whilst there was an initial surge in demand at the height of the Covid-19 crisis that was hard to meet, there has been a significant increase in capacity across retailers in recent months. Consumers have also started to adopt the channel more with 59% saying they will continue to stick with online pick up and delivery, alongside going to store.

In this session we explore successful strategies for meeting these new consumer needs. This will look at ways to capture this new growth channel, and grow customer adoption as well as ensuring a seamless omni-channel experience and a scalable, more profitable operation.

The 45-minute session will be by a live Q&A with the presenters.

When: Wednesday 4 November 2020, 16:00 GMT

Presenters:

- David Clements, Global Head of Retail, dunnhumby

- Tom Langley, Head of Media Propositions, dunnhumby

- Jemma Haley, Global Media Consulting Manager, dunnhumby

The "new normal" isn't really normal at all. Life amid COVID-19 has forced U.S. consumers to adopt new behaviors, dramatically impacting how they shop, work and go about their daily lives. Trips to the grocery store are now once weekly trips to buy essentials and stock the pantry for home cooking. And, vulnerable consumers now rely on online ordering and delivery services they were once reluctant to try.

On average, it takes 66 days for new behaviors to become automatic. The majority of U.S. consumers will cross that milestone under pandemic restrictions very soon. Retailers should prepare now to successfully serve their customers after the "COVID curve."

Join dunnhumby's Emily Turner, Head of Customer Engagement for North America, and John O'Reilly, Head of Customer Development for North America, as they discuss:

- The future of loyalty and reward programs and what retailers should do now to better align with the emotional and functional needs of customers after the curve

- Communications strategies and tactics that are improving the digital customer experience

- The best practices likely to continue to drive and grow customer engagement post COVID-19

Person shopping in grocery store with empty shelves

In our latest look at the Coronavirus' lasting impact on global Grocery Retail, we examine eight emerging trends that are set to redefine the industry's future.

1.Value becomes a decision maker

As global economies tighten, financial strain will prompt certain behaviours from shoppers; not only will they become more frugal in their spending, they will also make greater use of existing food stores and become less wasteful in their quest to reduce outgoings. As a result, value will become an increasingly vital factor in store and product choice.

This has major implications for Retailers and CPG brands:

- Private labels and discount brands will experience strong growth amongst value-centric shoppers.

- Non-grocery spend will fall as budgets tighten and non-essential purchases fall away.

- Discount stores that can deliver a "one-stop shop" experience could make significant gains.

2.Localized shopping means new challenges ahead

Even as lockdown measures ease in some countries, many shoppers are likely to try and stay as close to home as possible. Hypermarket-sized stores may have provided shoppers with bulk-buying opportunities during the initial outbreak, but sales volumes in those formats have now tapered off significantly. Instead, smaller and convenience format stores are now the de facto choice for consumers who would prefer (or are still mandated) to stay local.

As a result:

- Spending patterns are changing, with Customers choosing to carry out full shops closer to home.

- Cross-shopping has fallen by the wayside as shoppers limit the number of stores they frequent.

- Strong action will be required to retain new shoppers and regain lost custom as the situation evolves.

3.Food adventures will continue to happen at home for the foreseeable future

One in five British shoppers are now cooking every meal from scratch, up from just one in eight before the pandemic began. While restaurants, cafés, and bars will slowly begin to open up as social distancing restrictions ease, many Customers – particularly higher-risk individuals – are likely to continue their food adventures in the comfort of their own home rather than risk potential exposure.

For Retailers, this means:

- Meeting greater demand for fresh and frozen products in favour of pre-prepared lines.

- Educating and inspiring shoppers to try new recipes via online platforms.

4.Health, wellbeing, and humane behaviour become new benchmarks

Not only has the virus prompted Customers to raise their spending on personal and home hygiene products, we've seen it drive a similar rise in healthy eating as shoppers seek to build their natural immunity as best they can. Concerns aren't just limited to their own wellbeing, either; recent weeks have seen debates ranging from the safety and protection of Retail staff, to the need for a wholesale re-evaluation of global meat consumption.

Addressing this heightened awareness around health means:

- Supporting Customers with their renewed focus on health, nutrition, and mental wellbeing.

- Focusing hard on hygiene and humanitarianism – not only with regard to employee and Customer wellbeing, but in terms of animal welfare in the supply chain, too.

5.Online Retail reaches the tipping point

Soaring demand for home delivery and click and collect services prompted many Retailers to ramp up their online operations, and early indications suggest that this change will be anything but short-lived. Online sales now sit somewhere between two and four times those seen pre-outbreak, limited more by Retailer capacity than by Customer demand. The digital tipping point is here, Customers convinced by recent experience that online represents a viable way to shop going forwards.

Retailers looking to optimise their online operations now should consider:

- Expanding capacity via 'last mile' innovations, from offering click and collect in smaller stores to partnering with fulfilment companies in order to expand delivery networks.

- Ensuring that new shoppers become repeat Customers, making first shops easy, reliable and value-laden.

6.Expectations for digital grow in tandem with the online boom

As frugality and wellbeing come to dominate the Customer mindset, their expectations around technology won't be limited to online channels alone. Digital innovations that make shopping easier, faster, safer and lower-contact will all be sought after, with shoppers looking to Retailers to deliver useful and helpful new applications.

Areas of focus should include:

- Pre-trip planning applications that enable crowd avoidance based on levels of in-store custom.

- Touch-free replacements for vouchers, receipts, lists and payment.

- Additional investment in technologies that reduce one-on-one contact such as self-scan and self-service checkouts.

7.Public goodwill must not be misspent

In 2020, stores have become something more. Customers have come to see supermarkets, stores, and employees not merely as a means to an end, but as pillars of their local community – essential services and key workers helping them navigate a period of unprecedented disruption. This social capital will prove to be hugely valuable, but only for Retailers who demonstrate an unwavering willingness to operate for the public good.

Harnessing the power of this deeper connection with Customers will mean:

- Increasing or maintaining activities that benefit local communities such as food banks and charity initiatives.

- Supporting local and national food producers and minimising their overall supply chain.

8.Market consolidation will define the years ahead

As the economy contracts, competition will only get fiercer. As weaker operators begin to struggle, larger Retailers are likely to benefit from their scale, forming global alliances and buying groups that enable them to operate more efficiently and purchase key lines in larger volumes. A period of consolidation is likely to follow, these larger chains scaling up as smaller competitors fall away.

To prepare for this period, Retailers should:

- Focus on resetting and simplifying their assortments, as discussed in our previous post.

- Lay the groundwork for new partnerships that can enable more efficient and productive operations.

For more information on retail strategies beyond the virus, please watch our webinar on demand | Future Outlook: Consumer and Retail shifts for Grocery & Pharmacy post-Coronavirus