In dunnhumby's second annual Retailer Preference Index (RPI) study, a comprehensive nationwide study, we re-examine the evolving US grocery landscape to help retailers navigate an increasingly fragmented market where shoppers are, on average, shopping at four grocery stores per month and regularly buying groceries from at least three other channels. The study focuses on the following questions:

- What drives preference?

- Who is winning and losing?

- Why are they winning or losing?

- What can grocery retailers do to improve preference and performance?

Existing retailer rankings by Consumer Reports or Market Force only use survey data to capture how shoppers feel about the various banners without linking the emotion to financial performance. Others, like Supermarket News, rank banners based on financial metrics but fail to capture how people feel.

Our study is different because it quantifies the preference driver importance based on a combination of a banner's emotional connection and financial performance. The emotional connection was captured through a 15-minute online survey across 7,000 US households about how customers think and feel about 56 US grocery retailers.

The list of banners evaluated, in alphabetical order, include:

|

Acme

Albertsons Aldi Amazon Big Y Foods Bi-Lo BJs Wholesale Brookshires Costco Food City Food Lion Food4Less/Foods Co. Fred Meyer Frys Food Stores Giant Eagle Giant Foods Hannaford Harris Teeter H-E-B Hy-Vee |

Ingles Markets

Jewel-Osco King Soopers Kroger Lidl Lowes Foods Market Basket Meijer Peapod Price Chopper Publix Raley's Ralphs Safeway Sam's Club Save Mart Schnucks Shaws/Star Market ShopRite Smart & Final |

Smiths

Sprouts Farmers Market Stater Bros Stop & Shop Supervalu Target The Fresh Market Tops Trader Joes Vons Walmart Walmart Neighborhood Wegmans Weis Markets WinCo Winn-Dixie |

|---|

To learn more, download a free copy of the report. If your banner is in our report and you'd like your custom brief, contact us.

FOR RETAILERS

Smarter operations and sustainable growth, powered by Customer Data Science.

FOR BRANDS

Better understand and activate your Shoppers to grow sales.

Retail success takes many forms in today's dynamic marketplace. From large legacy retailers to disruptive start-ups and all manner of competitors in between, the paths to retail success involves common principals around which there is a wide variation of understanding and execution.

To bring clarity to the issue of what makes a winner, dunnhumby, the global customer data science firm, conducted a massive survey of more than 7,000 U.S. shoppers for the second annual Retailer Preference Index (RPI), the first study of its kind in the industry. In what's quickly become known as retailing's equivalent of research firm Gartner's often-cited Magic Quadrant, dunnhumby's RPI is a ranking of more than 50 large food and consumable retailers based on a combination of shopper sentiment and financial performance.

Join Retail Leader and dunnhumby's Grant Steadman, SVP of Client Services, and Erich Kahner, Associate Director of Strategy, for a deep dive into the RPI, the levers for success, and an unvarnished look at why some retailers win and others don't.

Topics discussed include:

- The 7 drivers of consumer preference and what's changed.

- Understanding the RPI methodology.

- How retail winners make emotional connections.

- The new rules of value perception, key drivers and amplifiers.

- The three things RPI laggards must do to improve their appeal to shoppers.

For a look at the retailer rankings and to understand how your business can benefit from implementing the RPI success framework, watch our webinar which took place on Thursday, September 5, 2019.

The traditional, regional U.S. grocery store—it's the institution that has fed communities for decades and families for generations. It offers that connection to a simpler time, a time when the guy behind the meat counter would know Customers by name, a time when a dad pushed his child around in a shopping cart while they "helped" him shop and a time before mobile phones invaded our lives and sped up the pace of life…

That place—the traditional grocery store—has history. Customers and the people who work there are part of a family. That kind of emotional connection is priceless.

If this is true, then why does Aldi—which borrows a quarter per shopping cart and operates with a small crew that arranges shelves while taking care of customers—have a stronger emotional connection with shoppers than 90% of its competitors?

Yes, that's right. Aldi, known for its cost cutting and low prices, has– an emotional connection that is stronger than nine out of 10 traditional grocery stores.

Traditional grocers may take for granted that they have an advantage over non-traditional channels in the strength of their emotional connection with shoppers, but that doesn't appear to be the case at all. So just how bad is it for traditional grocers?

The inconvenient truth is that the average traditional grocery store has a lower emotional connection with its shopper than the average store in any other major channel where groceries are sold. While traditional grocers have been focused on selling groceries to the same towns for decades, non-traditional grocers have been able to move into those towns and secure a stronger emotional connection in far less time.

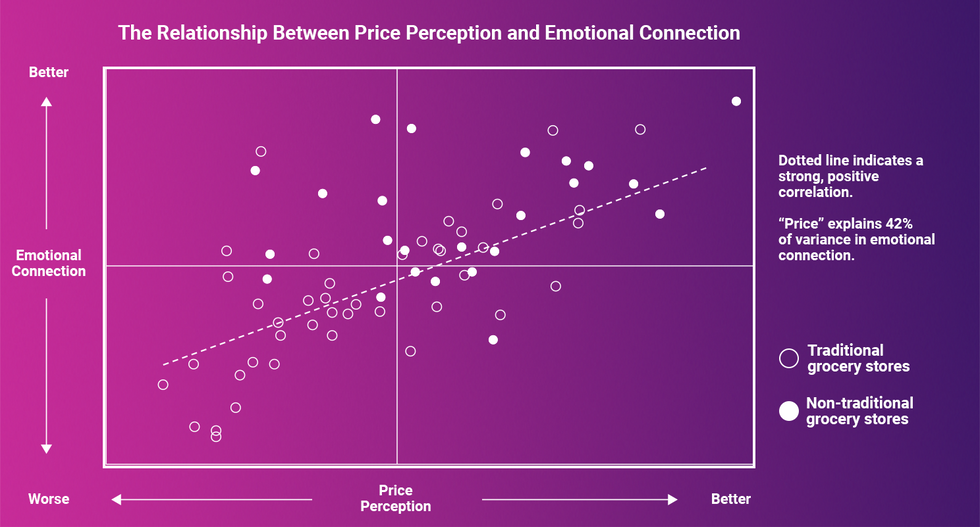

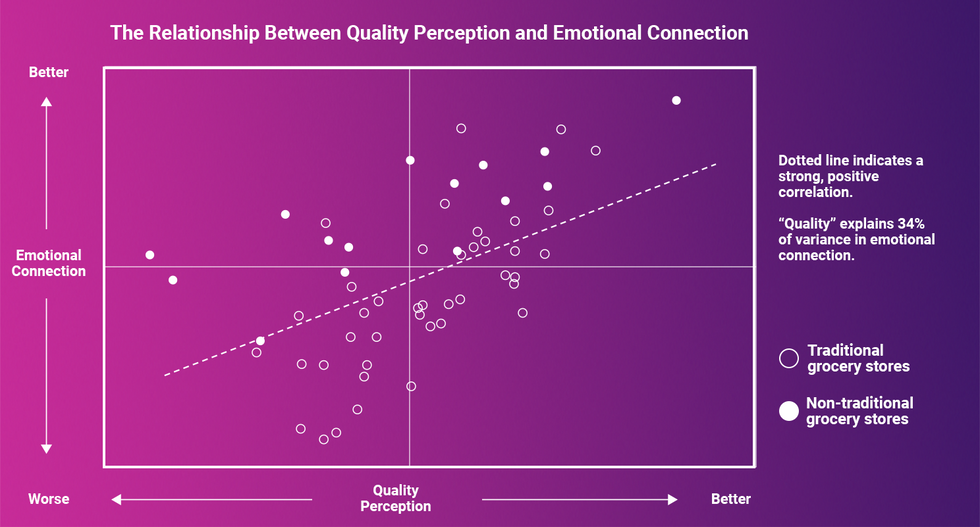

How? Well, it appears that emotional connection does have a price, after all. In fact, price perception is slightly more associated with emotional connection than perception of the quality of products and store experience:

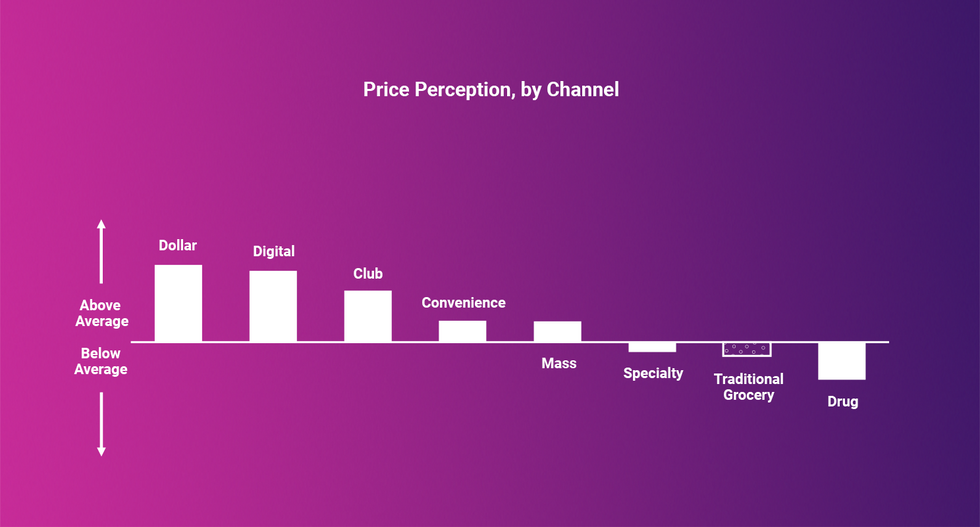

And, whereas traditional grocers have managed to hold their own on quality perceptions, they lose on price perception.

So, where does the traditional grocer start if they want to win back the hearts of their local constituents? After all, there are many levers they can pull within pricing, assortment, and store experience to move perceptions. A close look at data from our 2019 Retailer Preference Index: Grocery Channel Edition offers some hints. Stores who have the strongest emotional connection separate themselves from the pack with the following:

- Private brands that customers love

- Leading prices on natural and organic items

- Fast checkout

- Staff who show they value shoppers

Translated into language customers might use, that means:

- Have products I can't get anywhere else, at competitive prices

- Make healthy food affordable

- Don't waste my time

- Treat me like a person

Of the 56 retailers ranked by emotional connection, 24 of the bottom 25 are traditional retailers. And while Aldi, ranked 17th for emotional connection, has been used as a stark example to illustrate traditional grocers' emotional connection issue, many other non-traditional stores have a stronger emotional connection with their shoppers than Aldi does with theirs.

However, 3 traditional grocery stores buck the trend and join non-traditional retailers in the top 10: Market Basket (4th), H-E-B (5th) and Publix (6th). They each check more than one of the boxes on the core ingredients of emotional connection.

These retailers, more than any other traditional, regional grocer, have established with their emotional connection an insurance policy for an uncertain grocery industry future. And the prevalence of non-traditional grocers with superior emotional connection proves the point that this insurance policy is more a product of "what have you done for me lately" than a product of consumer nostalgia. Non-traditional grocers are buying emotional connection with better prices while delivering on some combination of a superior private label, offering the best natural and organic prices and having staff who show they value customers.

A new format in grocery retail is emerging: the 50,000 square foot convenience store. Its value proposition to customers is simple: higher quality perishables and ready-to-eat items than your typical grocery store. Thousands of the same center-store products you can also find at Walmart, Target, Amazon, Costco and Sam's Club. Everything at higher prices. Added bonus: since the store is 10x to 20x bigger than your typical c-store, you can get your steps in and burn calories at the same time.

Wait, what?

The reality is that this is not a new format—rather the customer-led repurposing of a familiar one: the traditional, regional grocery store. This finding comes from a follow-up analysis of data collected for the recent 2019 Grocery Retailer Preference Index report, a report which identified winners and losers among the 56 largest retailers in the U.S. Grocery Retail Industry. In this follow-up analysis, we examined the types of trips people took (e.g. bigger vs. smaller) to each retailer, as well as the categories they bought (e.g. produce, ready-to-eat or paper products). The findings cast further light on the problems faced by traditional grocers in an evolving grocery landscape that has seen national mass, club, drug, dollar, convenience and digital players invest more in the grocery game the past few decades.

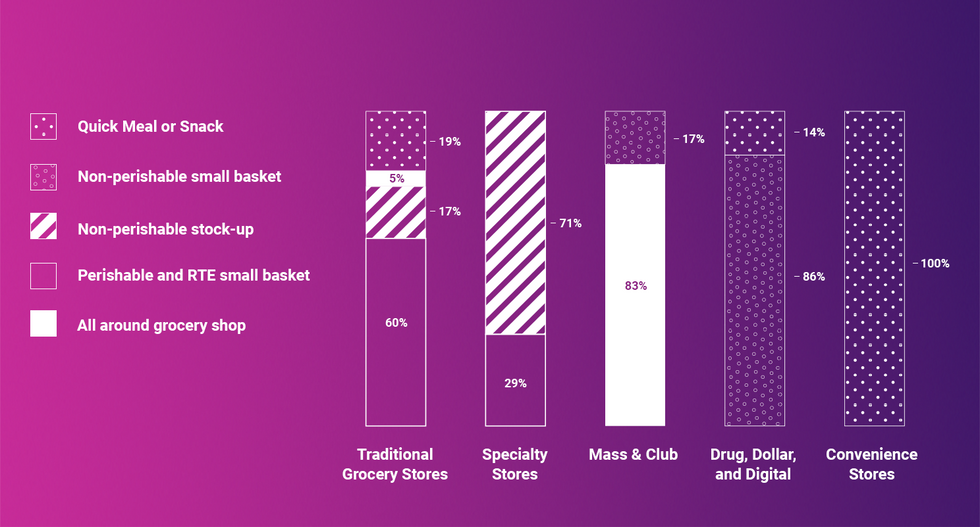

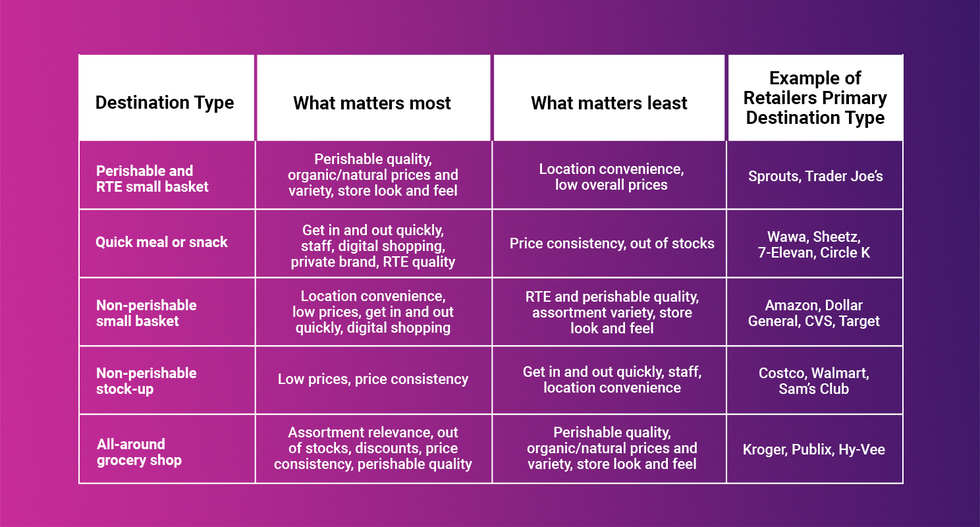

When considering trip types and categories sought by customers, five general types of retail destinations emerge:

- All-around grocery shop

- Perishable and ready-to-eat small basket

- Quick and convenient meal

- Non-perishable stock-up

- Non-perishable small basket

Certain channels lend themselves to certain destination types. Specialty grocers like Trader Joe's or Sprouts, with fewer SKUs and smaller formats than the traditional grocer, tend to fall in the "Perishable and ready-to-eat small basket" destination type. Club and mass are non-perishable stock-up destination. Drug, dollar and digital in non-perishable small basket. C-stores in quick and convenient meals. However, many traditional grocers have an identity crisis. Only 6 in ten are seen primarily as "all around grocery shop" destinations, despite all of them carrying the full complement of SKUs.

In other words, almost half of traditional grocery stores are shopped more like a convenience and specialty store than like a store with 10-20x more products than that. At best, categories beyond perishable and RTE food are typically an afterthought and only shopped in a pinch. At worst, those categories are bypassed completely by shoppers, who instead buy the same products for cheaper at widely available mass, club, digital, dollar or drug channels.

The result of being treated as a perishable c-store is a lower share of customer wallet. Traditional grocers who are all-around grocery destinations win 33% of their customer's share of wallet, versus only 20% for traditional grocers shopped like a perishable c-store.

So, what can traditional grocers who are not being viewed as an all-around grocery shop do about it?

According to an analysis of customer needs gathered from a survey sent to 7,000 shoppers in the U.S., if traditional grocers want to ensure they'll be an all-around grocery shop, they need to ensure some key ingredients are in place:

- Highly relevant assortment, which is rarely out of stock

- Prices that are consistent on inelastic and competitive on key-value items, while offering discounts on the products that are important to customers and responsive to promotions

- Decent perishable quality

For now, traditional retailers aiming to be all-around grocery shops can trade-off on having the best digital offering and the best ability to get customers in and out quickly. These things are less important to customers when picking an all-around grocery destination.

While some traditional grocers are struggling to win the title of all-around grocery shop, one non-traditional store isn't: Aldi. Aldi's consistently industry-leading prices and their ability to manage out of stocks and store cleanliness just as well as your average traditional grocery store, has made them a stock-up destination for perimeter categories, like produce and dairy, as well as center store packaged food items. As a result, despite having stores which carry less than 2,000 SKUs, Aldi's share of customer wallet is in line with that of the average traditional grocery store, which often carry more than 40,000 SKUs.

Of course, the reality is that no single non-traditional competitor is eating away at traditional grocers' hold on the all-around grocery shop. Rather, a host of non-traditional competition, each with unique value propositions, are all taking small bites, which add up. The data suggests that this is because traditional grocers took their eye off the retail basics, perhaps because they grew complacent after decades of dominance and relatively little industry disruption from non-traditional substitutes.

So, the call to action is clear: before overinvesting on any shiny new toys, like eCommerce or technology to speed up checkout, get back to your roots and make sure you're offering the right prices on the right products.

In our third annual Retailer Preference Index (RPI) for the U.S. grocery channel, we look at the $700 billion grocery industry which finds itself potentially less than a year away from an economic downturn, according to many economists. Which grocers are best prepared to weather the storm, and what can other retailers do to compete? The RPI seeks to answer these and other questions, including:

- What drives customer preference for grocery retailers?

- Which retailers are winning and losing? And why?

- What can grocery retailers do to improve performance and win more trips?

Existing ranking methods focus primarily on retail growth based on store counts and revenue size, without linking growth to emotional or financial performance. We have a different perspective, one that focuses on the consumer and their emotional connection to the various retailers within the grocery channel. Our study surveyed 7,500 US consumers to uncover how they think and feel about grocery stores, and how they shop them. All with a goal to understand how Customers perceive stores through seven different drivers, and how these perceptions affect both the emotional connection and financial performance.

Our goal: to help retailers better understand their customers to deliver a value proposition that aligns with their needs, to earn more trips and drive sustainable growth.

To learn more, download a free copy of the report. If your company is in our report and you'd like your custom retailer profile, contact us.