Customer First Radio Episode 5 | Ted Eichten, Head of Price & Promotions, North America for dunnhumby

FOR RETAILERS

Smarter operations and sustainable growth, powered by Customer Data Science.

FOR BRANDS

Better understand and activate your Shoppers to grow sales.

The traditional, regional U.S. grocery store—it's the institution that has fed communities for decades and families for generations. It offers that connection to a simpler time, a time when the guy behind the meat counter would know Customers by name, a time when a dad pushed his child around in a shopping cart while they "helped" him shop and a time before mobile phones invaded our lives and sped up the pace of life…

That place—the traditional grocery store—has history. Customers and the people who work there are part of a family. That kind of emotional connection is priceless.

If this is true, then why does Aldi—which borrows a quarter per shopping cart and operates with a small crew that arranges shelves while taking care of customers—have a stronger emotional connection with shoppers than 90% of its competitors?

Yes, that's right. Aldi, known for its cost cutting and low prices, has– an emotional connection that is stronger than nine out of 10 traditional grocery stores.

Traditional grocers may take for granted that they have an advantage over non-traditional channels in the strength of their emotional connection with shoppers, but that doesn't appear to be the case at all. So just how bad is it for traditional grocers?

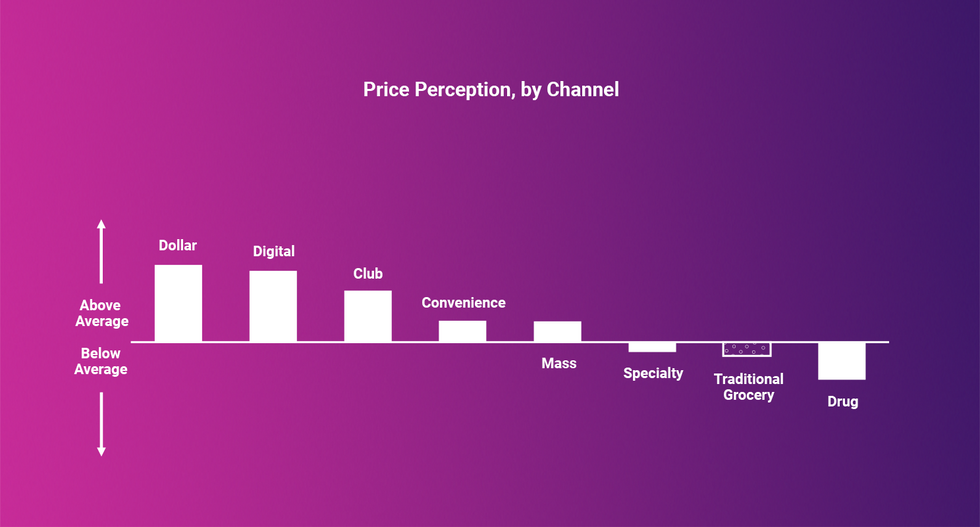

The inconvenient truth is that the average traditional grocery store has a lower emotional connection with its shopper than the average store in any other major channel where groceries are sold. While traditional grocers have been focused on selling groceries to the same towns for decades, non-traditional grocers have been able to move into those towns and secure a stronger emotional connection in far less time.

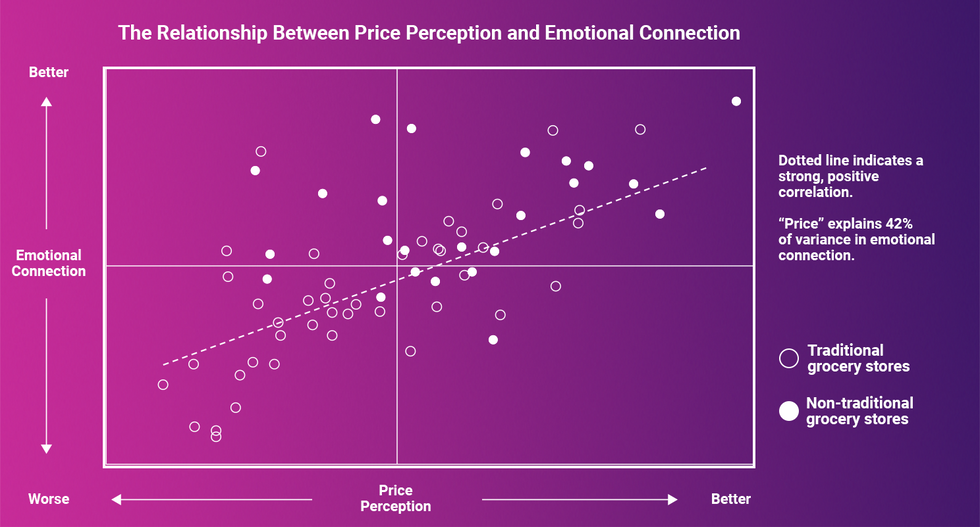

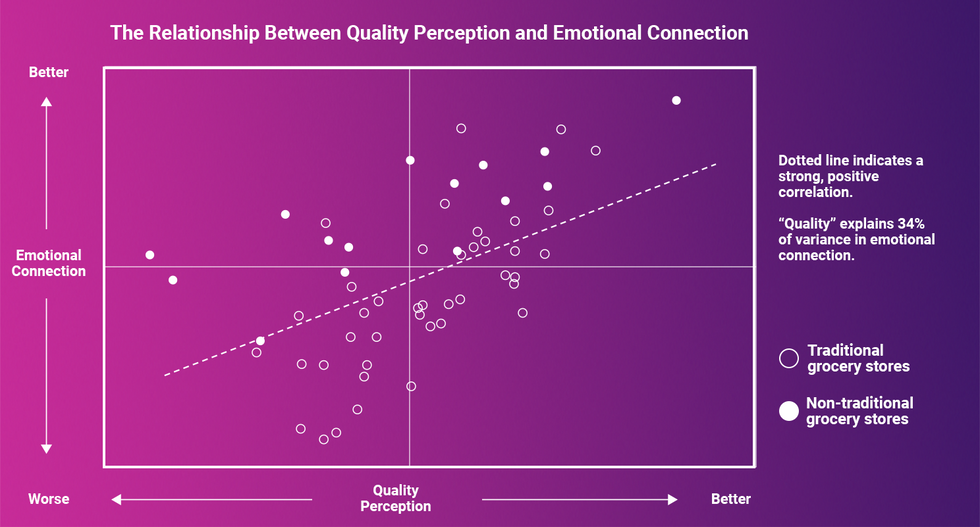

How? Well, it appears that emotional connection does have a price, after all. In fact, price perception is slightly more associated with emotional connection than perception of the quality of products and store experience:

And, whereas traditional grocers have managed to hold their own on quality perceptions, they lose on price perception.

So, where does the traditional grocer start if they want to win back the hearts of their local constituents? After all, there are many levers they can pull within pricing, assortment, and store experience to move perceptions. A close look at data from our 2019 Retailer Preference Index: Grocery Channel Edition offers some hints. Stores who have the strongest emotional connection separate themselves from the pack with the following:

- Private brands that customers love

- Leading prices on natural and organic items

- Fast checkout

- Staff who show they value shoppers

Translated into language customers might use, that means:

- Have products I can't get anywhere else, at competitive prices

- Make healthy food affordable

- Don't waste my time

- Treat me like a person

Of the 56 retailers ranked by emotional connection, 24 of the bottom 25 are traditional retailers. And while Aldi, ranked 17th for emotional connection, has been used as a stark example to illustrate traditional grocers' emotional connection issue, many other non-traditional stores have a stronger emotional connection with their shoppers than Aldi does with theirs.

However, 3 traditional grocery stores buck the trend and join non-traditional retailers in the top 10: Market Basket (4th), H-E-B (5th) and Publix (6th). They each check more than one of the boxes on the core ingredients of emotional connection.

These retailers, more than any other traditional, regional grocer, have established with their emotional connection an insurance policy for an uncertain grocery industry future. And the prevalence of non-traditional grocers with superior emotional connection proves the point that this insurance policy is more a product of "what have you done for me lately" than a product of consumer nostalgia. Non-traditional grocers are buying emotional connection with better prices while delivering on some combination of a superior private label, offering the best natural and organic prices and having staff who show they value customers.

Webinar On-demand | Customer First Price & Promotions and COVID-19: Life After the Curve

The "new normal" isn't really normal at all. Life amid COVID-19 has forced U.S. consumers to adopt new behaviors, dramatically impacting how they shop, work and go about their daily lives. Trips to the grocery store are now once weekly trips to buy essentials and stock the pantry for home cooking. And, vulnerable consumers now rely on online ordering and delivery services they were once reluctant to try.

On average, it takes 66 days for new behaviors to become automatic. The majority of U.S. consumers will cross that milestone under pandemic restrictions very soon. Retailers should prepare now to successfully serve their customers after the "COVID curve."

Join dunnhumby's Ted Eichten, Head of Price & Promotion for North America, and John O'Reilly, Head of Customer Development for North America, as they discuss:

- Pricing strategies you can implement now to prepare for possible grocery price volatility and increased customer price sensitivity

- Best practices to ensure promotions and trade funds deliver optimal results, based on customer preferences

- The importance of capturing margin with the least impact to Customers as spending begins to normalize

The "new normal" isn't really normal at all. Life amid COVID-19 has forced U.S. consumers to adopt new behaviors, dramatically impacting how they shop, work and go about their daily lives. Trips to the grocery store are now once weekly trips to buy essentials and stock the pantry for home cooking. And, vulnerable consumers now rely on online ordering and delivery services they were once reluctant to try.

On average, it takes 66 days for new behaviors to become automatic. The majority of U.S. consumers will cross that milestone under pandemic restrictions very soon. Retailers should prepare now to successfully serve their customers after the "COVID curve."

Join dunnhumby's Jose Gomes, President for North America, and Eric Karlson, Head of Strategy for North America, as they discuss:

- dunnhumby's model of the three phases of the COVID-19 pandemic

- Insights and learnings from retailers around the globe

- How retailers should prepare to adapt their customer strategy for the "new normal" of customer behaviors and expectations

This webinar originally took place on Tuesday, May 5, 2020 as part of an exclusive four-part webinar series with Retail Leader and Progressive Grocer about how to adapt your Customer Strategy now for life after the curve, and possible implications for Customer Engagement, Category Management, and Price & Promotions.