In order to reflect on how the grocery world changed in 2020, we have changed how we calculate our overall Grocery RPI score. Given the historically unique metrics we've witnessed in the economy, the restaurant industry and the grocery industry, along with the rare influence a global pandemic has brought to consumer behavior, we're viewing grocery success in 2020 through a different lens than we viewed grocery success in prior years.

View Full Report

Customer First Radio Episode 2 | Erich Kahner, Associate Director of Customer Strategy at dunnhumby

January 11 2021

black and silver headphones on black and silver microphone

Photo by Will Francis on Unsplash

The 2021 Retailer Preference Index: Who's winning and why. David Ciancio, Global Head of Grocery discusses the 2021 U.S Retailer Preference Index (RPI): Grocery Edition with the lead author of the RPI, Erich Kahner. They unveil key insights and discuss who is winning and who is best positioned for the future.

Photo by Jonathan Velasquez on Unsplash

In the first episode of Customer First Radio, Dave Clements, Global Head of Retail for dunnhumby and David Ciancio, Global Head of Grocery for dunnhumby kick off the series by discussing what it means to be a truly Customer First business, share which retailers and brands today embody a Customer First mindset, and examine how Customer First materialized during the pandemic with retailers.

dunnhumby's Prophets of Aisle Six, Episode 1: Raley's Supermarkets

The Prophets of Aisle Six is the first online reality series focusing on innovation in the food retail industry. Join Jose Gomes, dunnhumby's North America Managing Director, in this season premiere as he travels to Sacramento to visit with executives from Raley's Supermarkets, a prominent grocery chain with more than 120 locations in California and Nevada, and learns more about the company's unique mission to help customers make more healthy eating decisions. Jose is joined by Raley's CEO Michael Teel, COO Keith Knopf, and Wellness Evangelist, Emmie Satrazemis, as they discuss how they're leveraging customer data science to make the company's mission come alive in a way that's both effective and sustainable.

In this series, dunnhumby tours North America and speaks with some of the world's greatest brands, exploring their biggest challenges and how they are using customer data science to meet those challenges. Check back next time as we head to Cleveland to see what the Heinen's team is up to.

To learn how to use customer data to grow your business, download a free copy of our report: Retailing in the Age of Me-Commerce: Using Customer Data Science for Competitive Advantage.

Keep Reading...

Show less

Prophets of Aisle Six, Episode 2: Heinen’s Fine Foods

January 03 2021

dunnhumby’s Prophets of Aisle Six, Episode 2: Heinen's Fine Foods

The Prophets of Aisle Six is the first online reality series focusing on innovation in the food retail industry. In this episode, Jose Gomes, dunnhumby's North America Managing Director, travels to the downtown Cleveland store of Heinen's Fine Foods. Jose meets with Tom and Jeff Heinen, co-owners and brothers, and learns how they are evolving their grandfather's mission of delivering excellent customer service. With 23 stores in Northeast Ohio and the greater Chicago area, and a 90-year legacy, Heinen's is proving that being a small retailer can be an advantage when it comes to data.

In this series, dunnhumby tours the globe and speaks with some of the world's greatest brands, exploring their biggest challenges and how they are using customer data science to meet those challenges.

Customer First Radio Episode 4 | Daryl Wehmeyer, Head of Category Management, North America for dunnhumby

February 17 2021

FOR RETAILERS

Smarter operations and sustainable growth, powered by Customer Data Science.

FOR BRANDS

Better understand and activate your Shoppers to grow sales.

Upcoming Webinar | Insights from the 2021 dunnhumby Retailer Preference Index for U.S. Grocery

January 14 2021

The Great Recession programmed lasting value-consciousness into the minds of consumers. How might COVID-19 rewire us again?

The fourth annual dunnhumby Retailer Preference Index for U.S. Grocery (RPI) sheds light on what makes a retail winner, and how the pandemic has impacted consumer shopping behaviors. Known as retail's equivalent of the Gartner Magic Quadrant, the RPI surveyed about 10,000 consumers to understand what's driving customer preference and rank the top 57 grocery retailers in the United States.

Join dunnhumby CEO Guillaume Bacuvier as he dives into the latest study, revealing the levers for success, and which retailers are winning the hearts, and wallets, of shoppers today.

Register now

Build Customer Loyalty with Personalization

In a series of posts published earlier this year, we covered the results of the dunnhumby Customer Pulse – a global study designed to explore changing consumer mindsets during the COVID-19 pandemic. Over three waves, conducted between March and the end of May, we polled thousands of people from more than 20 countries on subjects including supermarkets' responses to the outbreak, the economic outlook, and how their shopping behaviour had changed due to COVID.

At the beginning of September – three months on from the previous wave and with supply chains stable and the changing nature of lockdowns – we wanted to revisit the Customer Pulse to see what, if anything, had changed. Below are some of the standout findings from this fourth tranche of research.

Worries fade, but some still feel unsafe while shopping

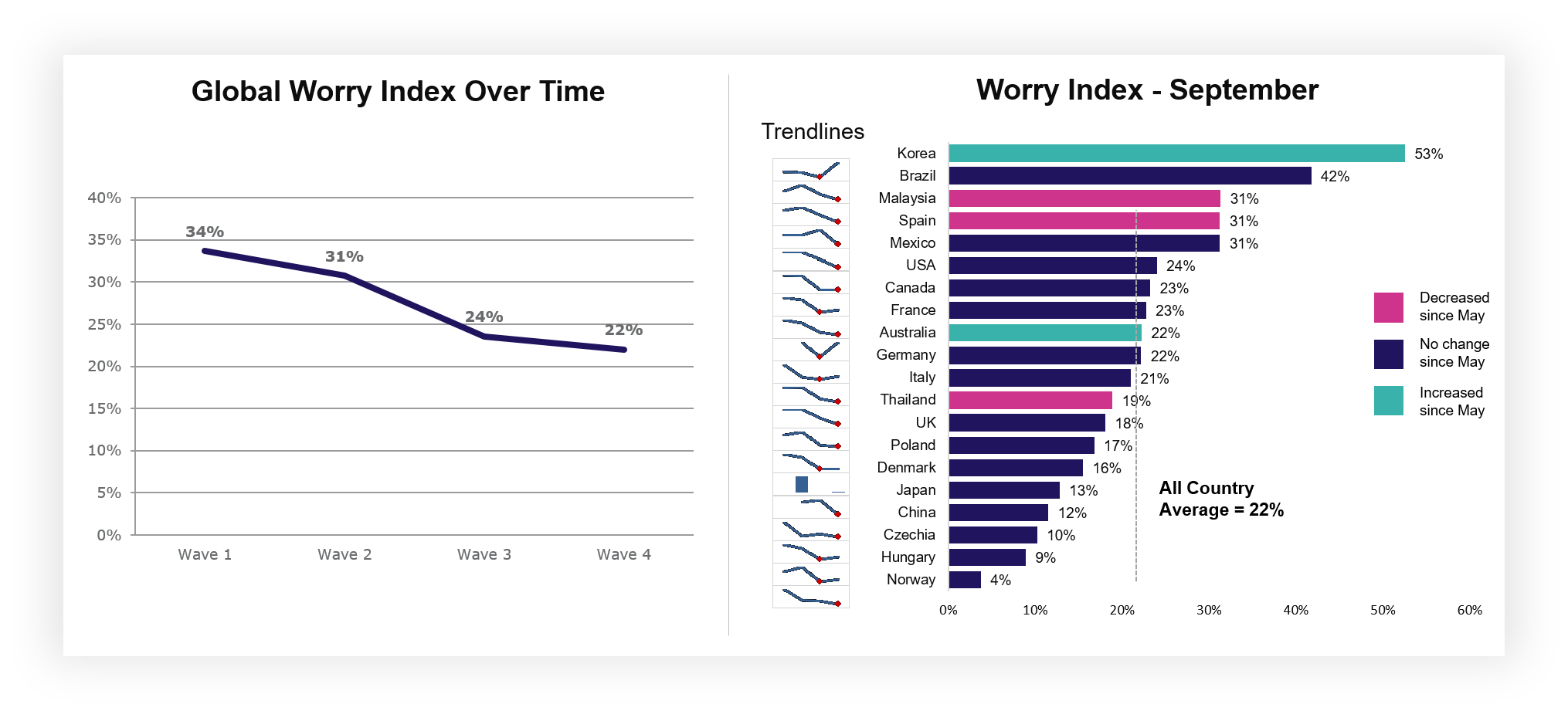

One of the key things tracked by the Customer Pulse is something that we refer to as the "Worry Index" – a representation of how concerned consumers around the world are about COVID-19. Globally, the Index has now fallen to its lowest point, down from 34% in March to just 22% in September. Australia and Korea are the only countries to show a rise since the previous study, with the latter of those demonstrating the sole meaningful increase.

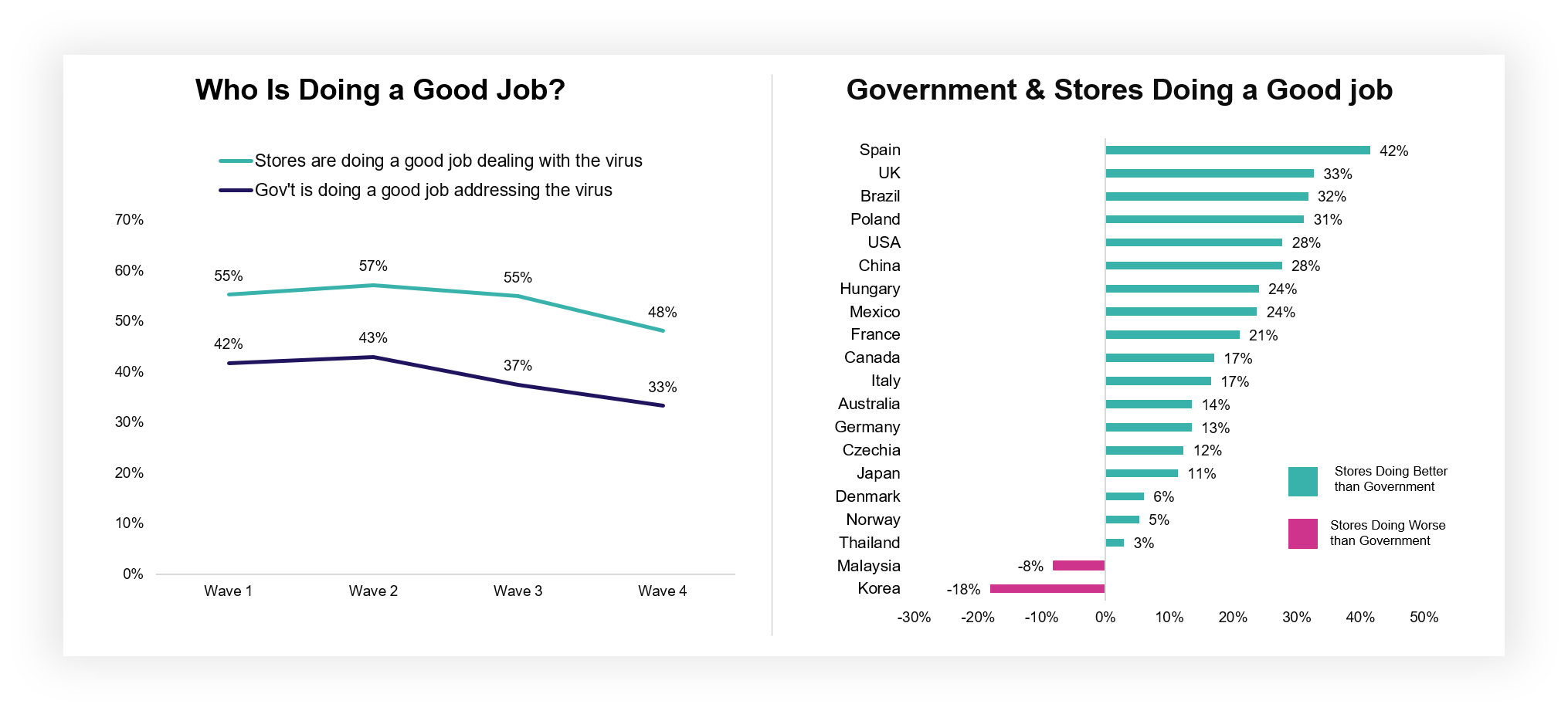

While worries may be dwindling generally, this can change rapidly based on local circumstances, and in-person shopping is still a point of concern for many: one third (33%) of those surveyed said they still don't feel safe from infection while shopping. Although this figure has fallen considerably since waves one (42%) and two (43%) of the Customer Pulse, this does mean it's of critical importance to retailers to keep communicating the efforts and importance of supporting colleagues and customers by focussing on positive drivers of a safe shopping experience and activities supporting vulnerable customers.

Those persistent worries should not detract from the phenomenal work the Grocery Retail industry has done to reassure Customers over the past six months. Stores (48%) continue to outpace the government (33%) in terms of who shoppers believe are doing a good job of dealing with the virus, a trend that has remained consistent across the duration of our study. Retailers in Canada, Australia and the UK are seen to be doing particularly well.

Early changes to shopping habits remain in place

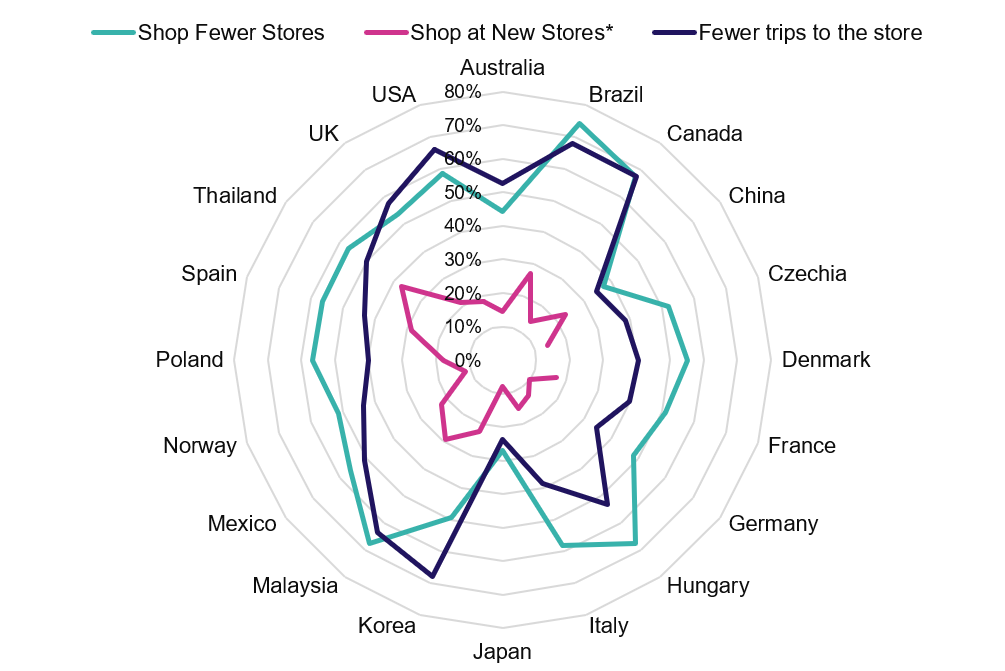

The early months of the pandemic saw major changes to Customer shopping behaviours. Trips decreased, as did the number of stores being visited, while basket sizes and ecommerce usage both skyrocketed.

Six months on from our initial survey, those behaviours remain largely unaffected. While the number of trips that Customers make has slightly risen, it has not done so with any degree of significance. Broadly, shoppers have continued to stay local, and visit stores only when they need to. Only a minority are shopping new stores.

Consequently, many shoppers continue to spend more when they do shop; around a quarter (23%) say they are still spending more each trip. Basket sizes can fluctuate though and some markets saw spikes particularly sharply towards the end of September*, likely a consequence of infection rates beginning to rise once again and many shoppers wishing to stock up in the event that tighter restrictions could follow.

One the most profound changes in behaviour during the outbreak – the upsurge in online grocery – continues apace. Ecommerce now accounts for 28% of weekly shops, the same as it did in May, and relatively stable since the start of the pandemic when it stood at 30%. Many respondents plan to continue to adopt online alongside store shopping with 59% saying they plan to continue using online channel. The tipping point for online is well and truly here.

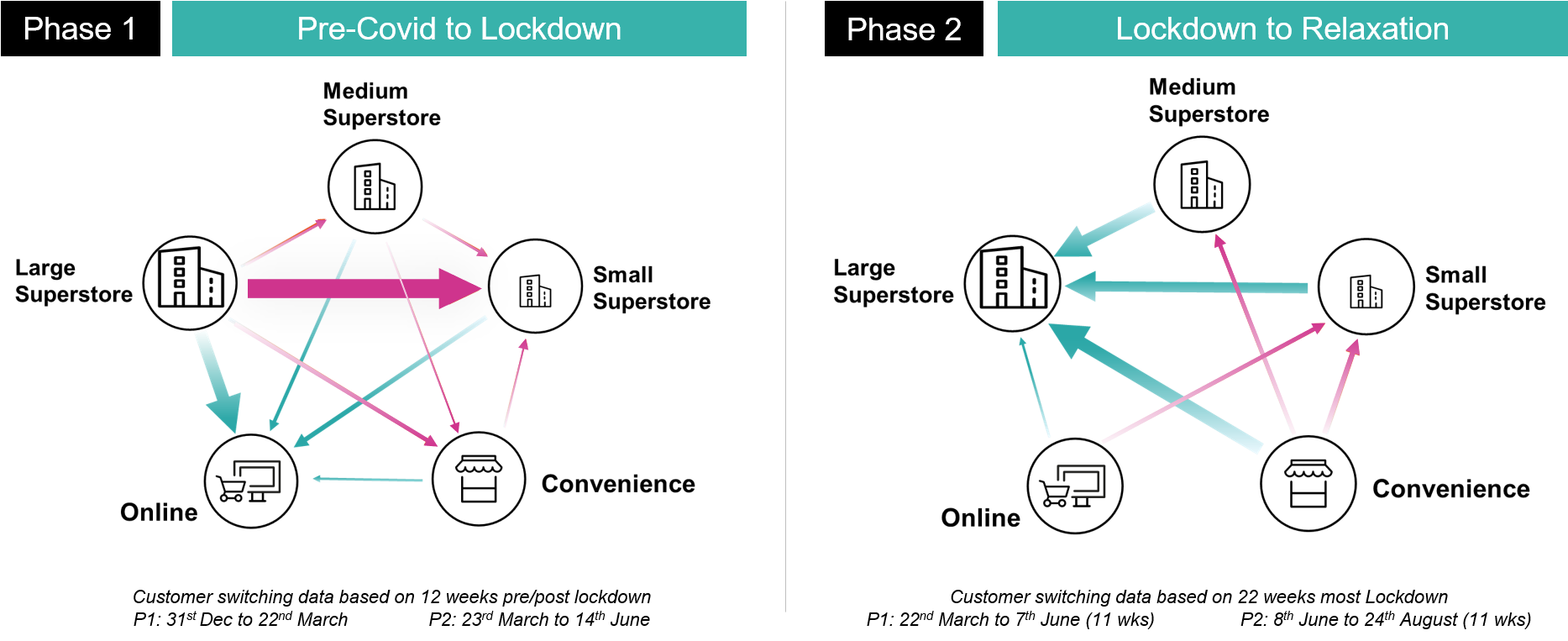

Although many of the pandemic-based trends have remained consistent during the past half year, some shifting dynamics are worth bearing in mind. In the UK specifically, while the initial outbreak saw large superstores lose much of their trade to both smaller shops and digital channels, much of that custom is now being pulled back in from small and medium stores, as well as convenience locations.

Financial worries have remained constant, and frugal behaviours are rising as a result

In regard to both their personal finances and the economic outlook for their country as a whole, many shoppers are now a little more optimistic than they were when the Customer Pulse began. That said, concern is still rife; around half (47%) of consumers have worries about their own financial situation, and more than two-thirds (67%) say the same about their national economy.

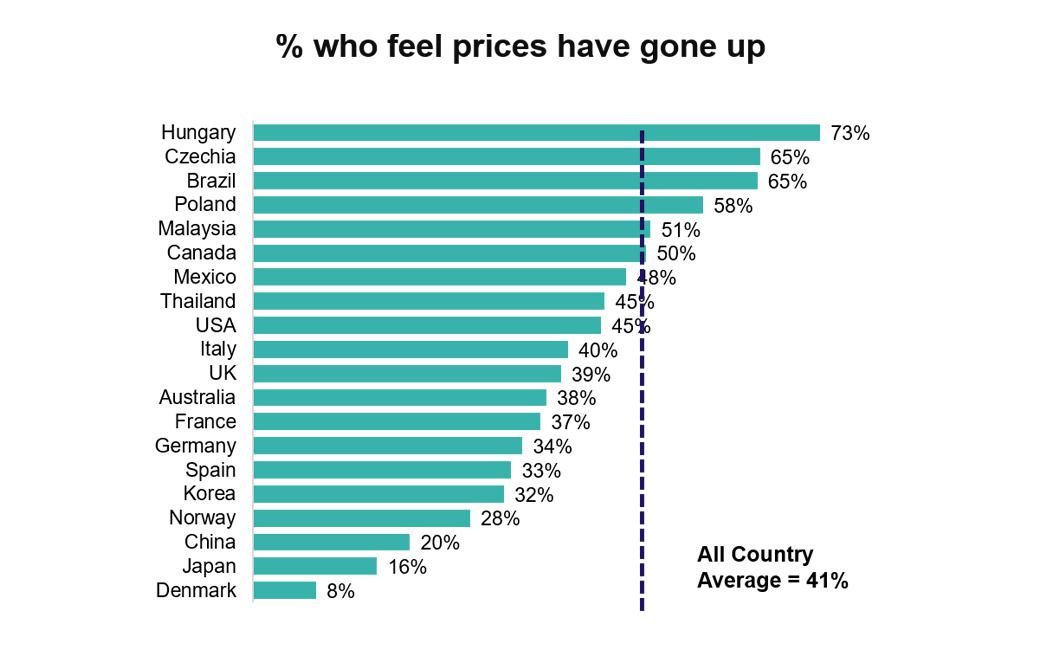

Accurately or not, this prolonged concern has translated into widespread belief that grocery shopping is becoming more expensive. Some 41% of global respondents believe that prices have risen, with many countries showing a significant increase since May. France is the only country in which this figure has declined.

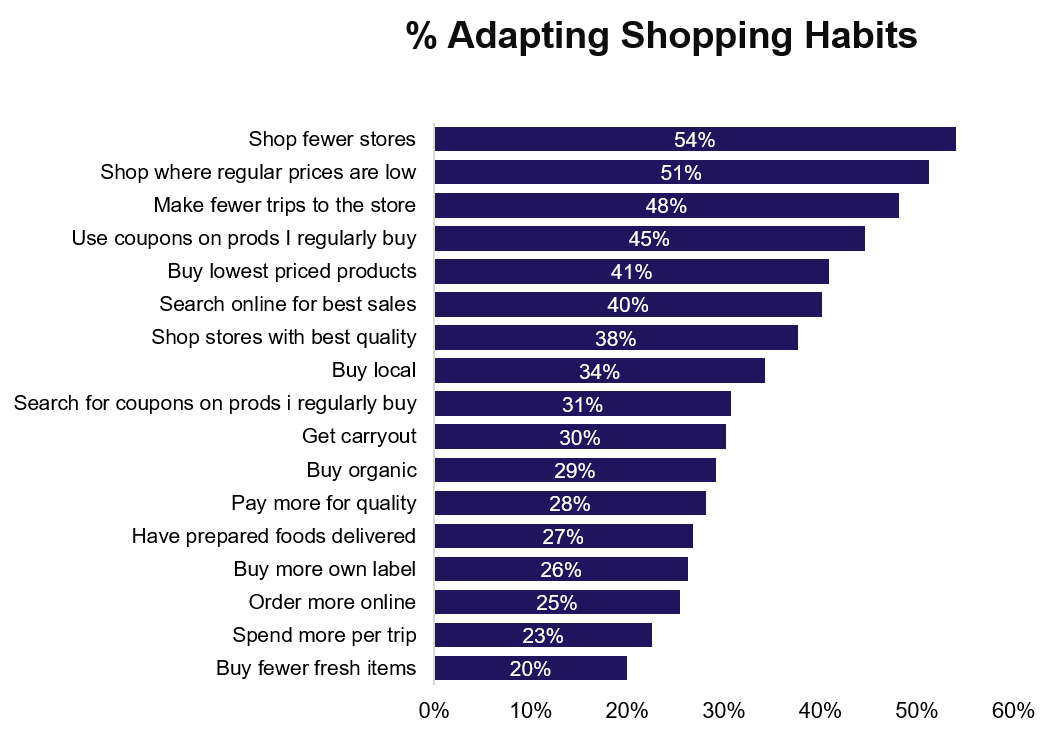

The upshot of this persistent financial worry is that many Customers are now beginning to act more frugally. More than half (51%) are looking to lower-priced stores, with similar numbers increasing coupon usage (45%), opting for the lowest-priced goods (41%), and looking online for the best available sales. As we reported in June, a new age of value perception is here.

Eight important shifts will define the future for Grocery Retail

As Customer behaviours continue to flex around the impact of COVID-19, we believe that Retailers need to continue to focus on eight key shifts and business enablers as they continue to respond and future proof their business for the future. Consumer behaviours

- Value: as discussed above, demonstrating value to Customers will become increasingly important over the coming months with continued pressure on household budgets.

- Local: with shoppers preferring to stay local, range and assortment will need to be tailored as a result across formats.

- Food at home: despite recent increases in the number of people dining out, many shoppers continue to favour recreating meal experiences at home, both in cooking from scratch and food to go solutions from grocers.

- Personal wellbeing: a growing trend towards health, wellness, and better eating habits will need to be catered for.

Retailer adaptation

- Online: while the sharp rise in ecommerce adoption has now begun to plateau, utilisation remains significantly higher than it was pre-pandemic.

- Digital acceleration: with more Customers heading online, a greater opportunity to engage and inspire using digital channels comes into play.

- New revenue streams: with margins growing tighter as the cost of managing the Pandemic and online fulfilment rises, Retailers will need to find new sources of revenue to offset this expenditure. New retail services, and monetising data and media are key opportunity areas.

- Efficiency and SKU consolidation: related to the above, the need for Retailers to optimise and solidify their operations will become greater too with heightened focus on optimising and simplifying assortment.

For more information about COVID-19's impact on Grocery Retail, please visit our dedicated resource hub.

* Data from this edition of the Consumer Pulse has been supplemented with recent insights from HuYu, dunnhumby's receipt scanning and rewards platform.

Keep Reading...

Show less