In order to reflect on how the grocery world changed in 2020, we have changed how we calculate our overall Grocery RPI score. Given the historically unique metrics we've witnessed in the economy, the restaurant industry and the grocery industry, along with the rare influence a global pandemic has brought to consumer behavior, we're viewing grocery success in 2020 through a different lens than we viewed grocery success in prior years.

View Full Report

FOR RETAILERS

Smarter operations and sustainable growth, powered by Customer Data Science.

FOR BRANDS

Better understand and activate your Shoppers to grow sales.

Customer First Radio Episode 2 | Erich Kahner, Associate Director of Customer Strategy at dunnhumby

The 2021 Retailer Preference Index: Who's winning and why. David Ciancio, Global Head of Grocery discusses the 2021 U.S Retailer Preference Index (RPI): Grocery Edition with the lead author of the RPI, Erich Kahner. They unveil key insights and discuss who is winning and who is best positioned for the future.

In dunnhumby's second annual Retailer Preference Index (RPI) study, a comprehensive nationwide study, we re-examine the evolving US grocery landscape to help retailers navigate an increasingly fragmented market where shoppers are, on average, shopping at four grocery stores per month and regularly buying groceries from at least three other channels. The study focuses on the following questions:

- What drives preference?

- Who is winning and losing?

- Why are they winning or losing?

- What can grocery retailers do to improve preference and performance?

Existing retailer rankings by Consumer Reports or Market Force only use survey data to capture how shoppers feel about the various banners without linking the emotion to financial performance. Others, like Supermarket News, rank banners based on financial metrics but fail to capture how people feel.

Our study is different because it quantifies the preference driver importance based on a combination of a banner's emotional connection and financial performance. The emotional connection was captured through a 15-minute online survey across 7,000 US households about how customers think and feel about 56 US grocery retailers.

The list of banners evaluated, in alphabetical order, include:

|

Acme

Albertsons Aldi Amazon Big Y Foods Bi-Lo BJs Wholesale Brookshires Costco Food City Food Lion Food4Less/Foods Co. Fred Meyer Frys Food Stores Giant Eagle Giant Foods Hannaford Harris Teeter H-E-B Hy-Vee |

Ingles Markets

Jewel-Osco King Soopers Kroger Lidl Lowes Foods Market Basket Meijer Peapod Price Chopper Publix Raley's Ralphs Safeway Sam's Club Save Mart Schnucks Shaws/Star Market ShopRite Smart & Final |

Smiths

Sprouts Farmers Market Stater Bros Stop & Shop Supervalu Target The Fresh Market Tops Trader Joes Vons Walmart Walmart Neighborhood Wegmans Weis Markets WinCo Winn-Dixie |

|---|

To learn more, download a free copy of the report. If your banner is in our report and you'd like your custom brief, contact us.

A new format in grocery retail is emerging: the 50,000 square foot convenience store. Its value proposition to customers is simple: higher quality perishables and ready-to-eat items than your typical grocery store. Thousands of the same center-store products you can also find at Walmart, Target, Amazon, Costco and Sam's Club. Everything at higher prices. Added bonus: since the store is 10x to 20x bigger than your typical c-store, you can get your steps in and burn calories at the same time.

Wait, what?

The reality is that this is not a new format—rather the customer-led repurposing of a familiar one: the traditional, regional grocery store. This finding comes from a follow-up analysis of data collected for the recent 2019 Grocery Retailer Preference Index report, a report which identified winners and losers among the 56 largest retailers in the U.S. Grocery Retail Industry. In this follow-up analysis, we examined the types of trips people took (e.g. bigger vs. smaller) to each retailer, as well as the categories they bought (e.g. produce, ready-to-eat or paper products). The findings cast further light on the problems faced by traditional grocers in an evolving grocery landscape that has seen national mass, club, drug, dollar, convenience and digital players invest more in the grocery game the past few decades.

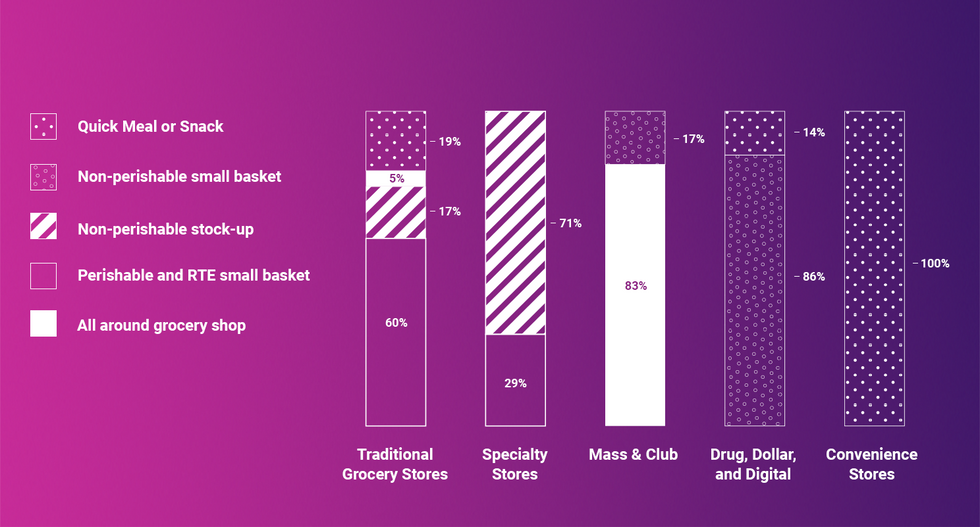

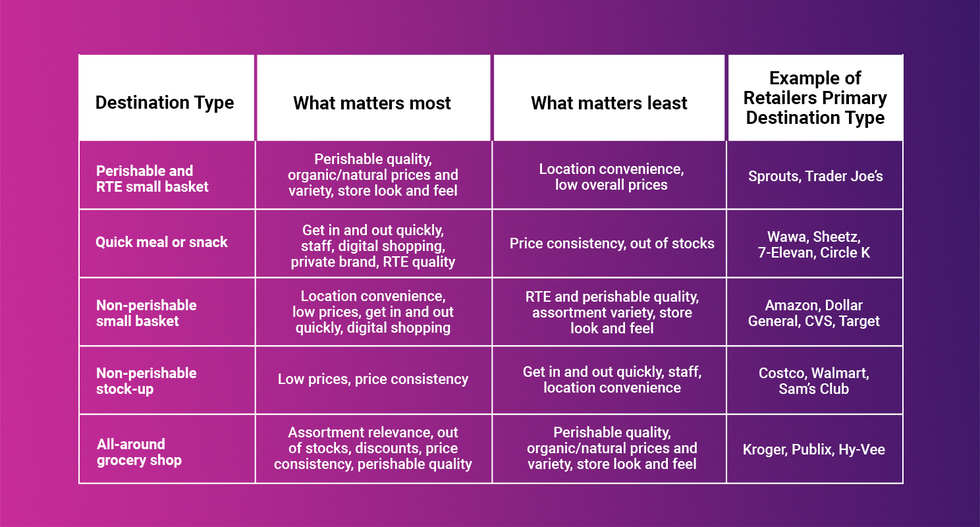

When considering trip types and categories sought by customers, five general types of retail destinations emerge:

- All-around grocery shop

- Perishable and ready-to-eat small basket

- Quick and convenient meal

- Non-perishable stock-up

- Non-perishable small basket

Certain channels lend themselves to certain destination types. Specialty grocers like Trader Joe's or Sprouts, with fewer SKUs and smaller formats than the traditional grocer, tend to fall in the "Perishable and ready-to-eat small basket" destination type. Club and mass are non-perishable stock-up destination. Drug, dollar and digital in non-perishable small basket. C-stores in quick and convenient meals. However, many traditional grocers have an identity crisis. Only 6 in ten are seen primarily as "all around grocery shop" destinations, despite all of them carrying the full complement of SKUs.

In other words, almost half of traditional grocery stores are shopped more like a convenience and specialty store than like a store with 10-20x more products than that. At best, categories beyond perishable and RTE food are typically an afterthought and only shopped in a pinch. At worst, those categories are bypassed completely by shoppers, who instead buy the same products for cheaper at widely available mass, club, digital, dollar or drug channels.

The result of being treated as a perishable c-store is a lower share of customer wallet. Traditional grocers who are all-around grocery destinations win 33% of their customer's share of wallet, versus only 20% for traditional grocers shopped like a perishable c-store.

So, what can traditional grocers who are not being viewed as an all-around grocery shop do about it?

According to an analysis of customer needs gathered from a survey sent to 7,000 shoppers in the U.S., if traditional grocers want to ensure they'll be an all-around grocery shop, they need to ensure some key ingredients are in place:

- Highly relevant assortment, which is rarely out of stock

- Prices that are consistent on inelastic and competitive on key-value items, while offering discounts on the products that are important to customers and responsive to promotions

- Decent perishable quality

For now, traditional retailers aiming to be all-around grocery shops can trade-off on having the best digital offering and the best ability to get customers in and out quickly. These things are less important to customers when picking an all-around grocery destination.

While some traditional grocers are struggling to win the title of all-around grocery shop, one non-traditional store isn't: Aldi. Aldi's consistently industry-leading prices and their ability to manage out of stocks and store cleanliness just as well as your average traditional grocery store, has made them a stock-up destination for perimeter categories, like produce and dairy, as well as center store packaged food items. As a result, despite having stores which carry less than 2,000 SKUs, Aldi's share of customer wallet is in line with that of the average traditional grocery store, which often carry more than 40,000 SKUs.

Of course, the reality is that no single non-traditional competitor is eating away at traditional grocers' hold on the all-around grocery shop. Rather, a host of non-traditional competition, each with unique value propositions, are all taking small bites, which add up. The data suggests that this is because traditional grocers took their eye off the retail basics, perhaps because they grew complacent after decades of dominance and relatively little industry disruption from non-traditional substitutes.

So, the call to action is clear: before overinvesting on any shiny new toys, like eCommerce or technology to speed up checkout, get back to your roots and make sure you're offering the right prices on the right products.

Article originally appeared on Chain Store Age

Forget the headlines. Grocery stores are nowhere near extinction due to the battle between online and brick-and-mortar grocery stores. Although online grocery is now the fastest growing grocery channel with a CAGR of 19.5%, it represents only 2.0% to 4.3% of the $700 billion U.S. grocery market, and has a long way to go to dethrone physical grocery stores. According to IGD, the U.S. online grocery market was $23.9 billion in 2018 and is predicted to grow to $59.5 billion by 2023, still less than 10% of the size of the entire grocery channel.

Grocery stores are in fact in a new period of growth and reinvention. Although the Amazon effect is placing pressure on both brick-and-mortar and online retailers, it is also ushering in a future of transformative changes for grocery stores. Here are some of the changes coming.

Customer experience will be huge

In the future, stores will cater to shoppers' insistence on a seamless experience whether they are in the store or shopping online. Retailers will create experiences that easily guide customers through the store to make shopping trips faster and easier. For example, some stores are activating customer data and working closely with brands to create new in-store experiences that make shopping easier for customers including organizing product sections around consumer needs, such as gluten-free and organics, or moving ready-to-eat meals to the front of stores. Metro, Canada has created new in-store experiences in dairy, frozen food, and beverage and snacks.

Grocers will also be taking a page from retailers that are creating "experience destinations" based on the needs of their communities. For example, Raley's is building a new flagship store that "will emphasize healthy living and destination meal offerings, with key features including a loft dining area, wine tasting room, sushi and bakery departments and 25,000 square feet of outdoor seating."

Future shoppers' grocery store visits will be driven by a desire for inspiration in their leisure time, instead of just needing to restock their kitchens. They'll visit to experience new products in-person and via augmented reality, participate in cooking demonstrations, and enjoy activities like wine tastings.

Convenience will be center stage

Twenty years ago Jeff Bezos predicted that brick and mortar stores would survive only if they provided either entertainment value or immediate convenience, and that has proved largely true for grocery stores. Shoppers in the future will continue to be pressed for time and will want to shop at stores that are conveniently located, have the right variety of products to meet their needs, and where they can get into and out of quickly.

Before even leaving for home, the shopper's integrated smart home will help inventory what items need to be purchased and add those items to the list that is then automatically relayed to the retailer to prepare for the shopper for either home delivery or click and collect in store. Once the shopper arrives, the retailer will alert the shopper of real-time promotions that are based not only on their shopping patterns but also on other variables such as the weather. On a rainy day, a shopper may have soup coupons displayed on their phones, whereas on a hot day a shopper may have coupon deals for a barbecue dinner.

Once inside, shoppers can open a mobile app to enable personal pricing on digital shelf edges. They will also be able to scan and pay for their items with their phone. Before exiting, shoppers will also have "infinite" options available for home delivery or click and collect.

Grocery stores will shrink

While the superstores and hypermarkets still command the largest share of the customer basket today, future grocery stores will be one third to one half the size of what they are today. The average grocery store built over the last 10 years has a footprint of 45,000 square feet but newer stores are already shrinking with many closer to 20,000 square feet. Future grocery stores will be even smaller.

The stores will carry about 5,000 items compared to today's stores that have 45,000+ SKUs. The stores will focus more on local, regional offerings as well as on private brands. Dark stores will likely attach to the smaller footprint store from where products will be picked and staged for pickup or delivery.

Discount grocery shares will capture increasing market share

Beginning with the Great Recession, consumers have become very price conscious and have grown used to looking for the lowest prices for their groceries. And more than 10 years later, consumers remain very price conscious resulting in the price sensitive and low-income consumer demographic is the fastest growing demographic. So, it's not surprising that 2018 saw a 30% increase over 2017 in new grocery store openings according to JLL that were largely propelled by the number of discount stores openings.

Aldi opened 82 stores in 2018, accounting for nearly 16% of all grocery stores opened during the year.

Aldi alone opened 82 stores accounting for nearly 16% of all grocery stores opened in 2018. Over the next five years, the discounter will build 800 more stores and have just shy of 3,000 stores in the U.S. In fact, Aldi plans to be the third largest grocer – after Walmart and Kroger – by 2022. Trader Joe's, part of the Aldi Global family, also plans to add 25 to 30 new stores this year and due to its superior focus on price and quality was named for the second year in a row as the top-rated grocery retailer in dunnhumby's Grocery Retailer Preference Index. Lidl recently announced plans to open 25 more stores in the U.S. as it continues its expansion in the U.S. market.

Discount stores are the second fastest growing grocery channel next to online grocery and are expected to grow at a CAGR of 5.8% and will be $514 billion by 2022. With discount stores offering lower prices, private brands that consumers are growing to love, and with nimble stores to get into and out of quickly, it is not surprising they are expected to continue growing at a brisk rate in the future.

The robots are here — and more are coming

Robots, drones and other forms of automation have already arrived to a number of grocery retailers and more will be coming. Some retailers are already using automation and artificial intelligence to closely monitor inventory and picking in the warehouse and to make sure their inventories can be replenished within a day instead of weekly. Drones will also be used to hover above the aisles and scan inventory. In fact, Pensa, a startup based in Austin, drone solution that does just that is expected to be in stores by the end of the year.

Grocery stores will be automating routine and time-consuming tasks, to not only save money but also free up customer service people to engage with customers. Retailers that have built up troves of customer data through loyalty programs over the years will also be at an advantage. By utilizing video analytics and artificial intelligence, retailers will be able to predict customers' state of mind and then be able to make timely recommendations to customers as they shop.

Autonomous vehicles delivering groceries, similar to the ones Kroger has introduced, will also be in play delivering groceries to customers who don't want to shop in the store. And, robotic assistants like Giant Food Stores' "Marty" will be common place scanning shelves, identifying spills, and even scrubbing floors.

Online or offline, customers will demand an exceptional experience from retailers. And the best way for retailers to ensure they are creating the store of the future their customers want is to make sure they understand not only the technology on the horizon, but more importantly are listening to what their customers are already telling them through their data.