Retailers and brands are facing a double whammy of keeping sales and profits buoyant, while facing a period of unprecedented change with an explosion of new market entrants. Many are seeking new ways to create revenue. This month for our 3-minute interview, we talked to Sandrine Devy, Global Manufacturer Practice Managing Director to learn more about why retailers should be monetising their data, how brands can benefit, and what they need in place to make this happen.

With current pressures in the retail landscape, what factors do you think brands and retailers need to prioritise more than ever?

With grocery channels under pressure, driving growth, creating efficiencies and developing new revenue through monetisation are the 3 main areas of focus for retailers and brands (make, save and find money).

Today, one quarter of the top 250 retailers in the world are monetising their Customer Data through insights (many more are doing so with their Sales Data), generating direct income of an estimated £320m from their supplier base. This has grown by 40% in the last two years and we estimate it will double in the next three years – not just by the number of retailers, but by revenue per retailer as well.

Retailers who are not currently thinking about monetising their data and media assets are in danger of missing this opportunity to secure additional income outside their core grocery sales business. But more importantly, they are missing an opportunity to gain wider benefit from Customer-First retailing by aligning their suppliers to this way of doing business.

In developing markets, where sales are still growing, retailers and brands really have to structure their category management approach to become more Customer-First focused. When a business understands the Customer and activates against their needs, they'll not only be more responsive to changes in consumer behaviour, they'll improve the Customer experience and generate long term loyalty. This type of operating model creates a platform for sustainable, strategic growth. And the best way to maximize this is to engage suppliers through insights, focusing the collaboration on what matters most to Customers in categories.

In mature markets, where sales growth is more limited, many retailers and brands will need to focus firmly on efficiencies. The challenge here is around promotions, and how to optimise them – driving more sales from a smaller investment. While promotions are already a key element in the relationship between retailers and their suppliers, analysis of their true performance generally suffers from lack of transparency.

What are the key things retailers need to address for monetisation? What are the main barriers?

There are a couple of ingredients which are vital for launching successful monetisation strategies. First is having the right data to monetise. EPOS (electronic point of sale) data is not enough nowadays, but loyalty card data or tokenised data which enables richer insights on actual Customer level purchase behaviour is the way forward.

Secondly, and in some ways more importantly, if a business does not have the will to change the cultural mindset to become data-driven, then monetisation will fail. And changing the culture of a business is not a simple task – it requires total and absolute commitment from the top-down and bottom-up to drive a change in attitude and processes.

So while having a direct Customer data feed is paramount for any monetisation strategy, for it to be sustainable, the business must adopt a Customer-First approach to decision making. If you fail to consider the impact of your monetisation approach on your Customer experience, then you risk losing the very asset that's driving the revenue – your Customers. Business decisions should be made to improve Customer experience in equal measure as to drive revenue; the two are not mutually exclusive.

And lastly, the retailer must have the desire to collaborate with their suppliers in a transparent way that creates a working relationship for shared success. The ultimate goal for both parties should be improving the Customer experience to grow sales.

Tell us a little bit about how the Manufacturer Practice team at dunnhumby helps clients win.

Most brands and manufacturers are one step removed from their shoppers, as generally the retailer owns the relationship with the Customer. We help manufacturers collaborate more effectively with retailers, giving them deeper knowledge of shopper behaviours, so they can understand which new products work best, which ranges should be put in which stores to be Customer relevant, and which promotions are most effective to optimise sales and profits. And the starting point of this is to define and agree the collaboration framework with our retail partners.

What are your retail trend predictions for the next 12 months?

Brands, especially bigger brands, may lose out as consumers turn from global to local, seeking out niche products, looking for more personalised, relevant experiences from the brands they love. Understanding Customer needs more deeply will become increasingly important to brands as they need to adjust their strategies to engage on a personal level.

More retailers will monetise their Customer Data and their media assets. Doing both – media and insights – simultaneously will provide added value to retailers (and their suppliers), as the optimum way to improve the Customer experience in a relevant and engaging way, rather than just acting as a mechanism for generating extra income.

And finally, trade and promotions planning will become increasingly automated, especially in mature markets, driving massive efficiencies in the industry and allowing more time and investment to be directed towards new product development, proposition and experience development, to support changing Customer needs.

Keep Reading...

Show less

With the balance of power shifting from business to consumer, it's no surprise that improving the Customer experience is something high on the agenda of many brands and retailers right now. This month for our 3 minute interview, we talked to Emily Turner, Customer Engagement Director for dunnhumby in North America, to hear her views on what retailers and brands must prioritise to deliver truly high-value Customer experiences…

With the changes going on in the retail landscape, what factors do you think retailers and brands need to prioritise more than ever?

Building trusted and transparent relationships with their customers. A good relationship starts with being open and honest about how they use their Customers' data and what benefits they deliver in return.

Customers generally trust retailers with their shopping data and are happy to share it providing there is a fair exchange of value. Not providing value back to customers in return through the experiences retailers and brands deliver, whether that's in the form of irrelevant messages or ignoring channel preferences, is one of the fastest ways to erode that trust.

By using Customer data to design and deliver a superior experience for the Customer, retailers and brands have a greater opportunity of making every interaction more personalized and more rewarding, meeting the customers' needs in that moment.

What do you see being the biggest challenge that retailers face in putting Customers First?

Commitment. Being truly Customer First takes unwavering organisational commitment. It is not for the faint of heart!

Yet to keep pace with Customers' ever-evolving needs and expectations, retailers can't afford not to put the Customer at the heart of their decision-making. We work with many partners around the world to develop the right strategies that enable them to undergo this transformation.

It's not easy to do and another of the biggest challenges is knowing where to start and how to make the change manageable. With over 30 years' experience in using Customer data and advanced science to create unique and meaningful Customer moments, we have the necessary know-how to help retailers and brands achieve it.

Tell us a little bit about how the Customer Engagement team at dunnhumby helps customers win.

We start and end with the customer. We're committed to helping our clients keep up with their connected Customers to improve every interaction their customers have with them, by delivering highly personalised and relevant experiences.

What are your trend predictions for the upcoming year?

Customers will continue to want to be treated like individuals, to choose how and when they want retailers and brands to communicate with them. They're also increasingly looking to exercise more control over the experience they receive through things like selecting the benefits they want within a loyalty program for example.

For retailers, there will be an increased focus on removing friction, reducing barriers and building seamless Customer journeys across channels.

Customers are becoming more and more aware of the value of their personal data, questioning who is collecting it and why. They expect companies to treat it with respect and use it wisely to provide more personalised services and offers.

Customers are only going to get more demanding, and as such, retailers and brands will need to relentlessly pursue what matters most to their Customers. Or else someone else will.

The Customer Engagement team at dunnhumby helps retailers and brands identify and quantify Customer headroom opportunities, to enable personalised communication strategies and enhanced Customer experiences. Contact us to find out more.

Keep Reading...

Show less

Points are Passé: How Loyalty Programs Should Be Evolving to Better Delight Customers – Part 2

October 26 2020

Part 2: Foundational principles for developing a brilliant loyalty strategy. View part 1 here.

The Evolution of Loyalty: Loyalty Programs are already changing

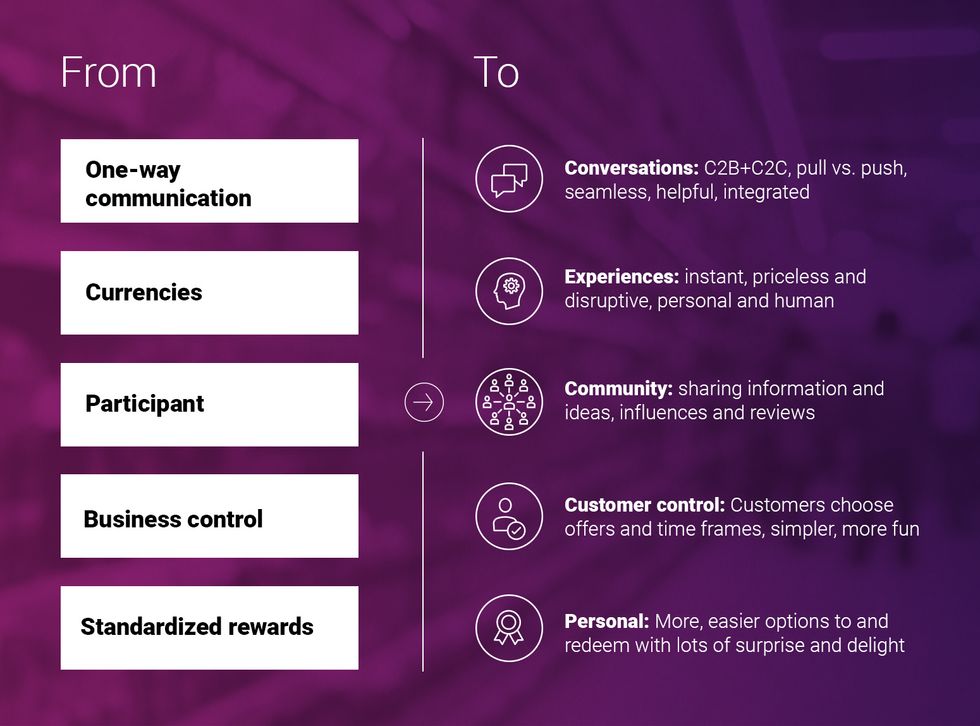

Technology has driven fundamental changes in Customer behavior and how they shop. Today, Customers search for products, seek thoughts and opinions of other Customers, and increasingly order and pay for items online and via apps. Customers are also commenting on social media and even playing online games to earn virtual rewards. Thus, retailers have increased opportunities to listen to Customers and connect with them to deliver added value and help meet their needs at every touch point. For example, we can recognize our loyal Customers and drive engagement by providing advice on wine pairings, for example, or thanking them for posting a review and surprising them with a personalized offer while they are shopping online. By tracking and rewarding interactions beyond spend, we obtain a deeper understanding of our Customers to build stronger relationships. It's about creating lasting connections through relevant rewards and experiences where and when Customers want them.

The evolution is already underway, and the 'table stakes' have changed, as illustrated in this chart:

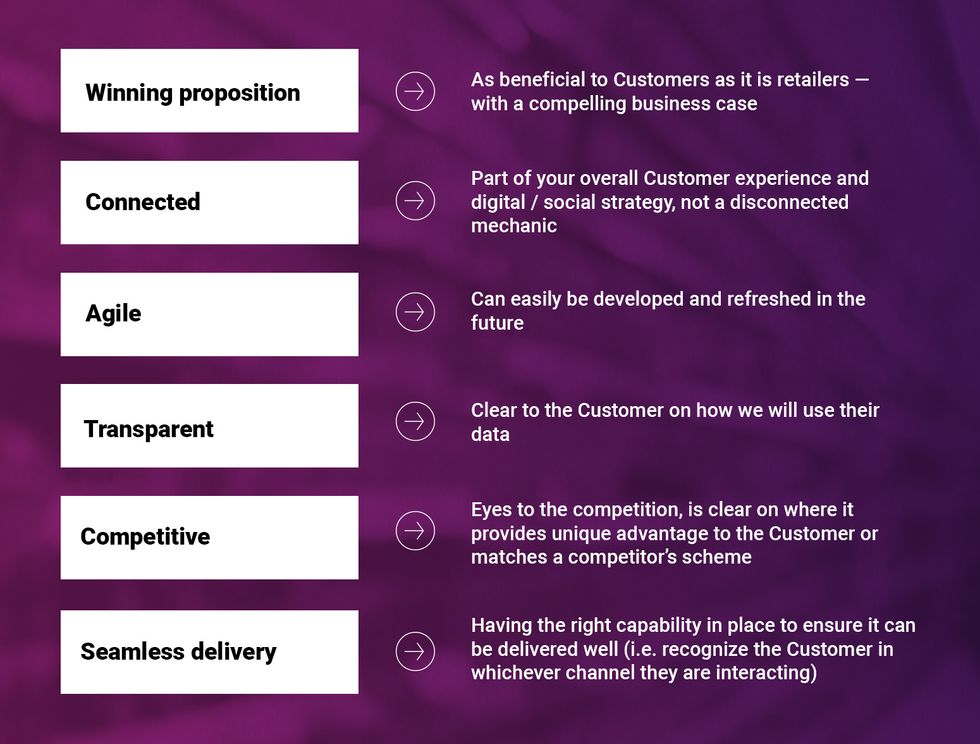

Foundational principles for developing a brilliant loyalty strategy

Below are principles to follow to develop a successful loyalty strategy:

What to Avoid

Although loyalty programs have been around a long time, many of them still have fundamental limitations.For some consumers the rewards are not worth the effort to participate in the program. For others, the requirements of participating are inconvenient, such as showing your card to earn points or getting paper versus digital rewards. If the proposition is too complex, busy Customers will just opt out. If reward thresholds are too high, it may take too long to earn a reward so Customers may just stop give up.Below are program pitfalls to avoid:

- Low relevance for Customers

- Low perception of generosity

- Barriers across the Customer experience

- Reward/tier thresholds that are too high

- Developing a complex proposition which is difficult to understand

- Treating the program just as a promotional tool

- Having partners lack appeal or relevance

- Requiring too much effort for the Customer to participate

A Look to the Future

Programs designed today should consider emerging trends to be relevant into the future. Below are my thoughts on what to expect:"Digital" and "omni-channel" are outdated termsBoth have been buzzwords in recent years, and with good reason. Customers own an average of 3.4 devices, and think of themselves, of course, as one person who just naturally integrates several modes of connection. Retailers and brands must recognize and interact with their Customers across all channels cohesively; 53% of Customers expect this right now, an expectation that grows exponentially every digital moment.Accordingly, a separate 'digital' or 'omni-channel' strategy is meaninglessBoth are elements of a larger Customer strategy, or as simple communication channels / executions within the loyalty or marketing strategy. Companies who have separate initiatives or departments focusing on digital or omni-channel are already almost hopelessly behind the curve. If your digital marketing strategy is different than your brand marketing strategy or your Customer Strategy, you are in big trouble.Also becoming outdated are "points"Points are becoming increasingly implicit within loyalty programs. Programs' messages should focus more on the actions and rewards, rather than the point process within the program. Lately, best practices are really recognition and engagement programs that use 'softer' or implicit points within a loyalty proposition. As members make purchases within these type of programs, they receive more interactions, benefits, offers, and insider access, and those are the desired payoffs.Companies are targeting Generation Z as they become more active CustomersGen Z is coming into the spending picture more now at ages 12-23. The interesting thing about this age group is that they have never known a world without technology, mobile, and social. They are more tech-savvy and tech-demanding than other age groups. This will advance the mobile trends we have already seen in recent years, and require companies to pay even closer attention to their behaviors as they define their shopping identities.Customers want companies to demonstrate a commitment to doing goodAlthough not typically viewed as a component of loyalty programs, consumers are increasingly aware of companies' corporate social responsibility and it influences their opinions of brands. Corporate responsibility and philanthropy are nothing new, but it is now being incorporated into loyalty programs. Many programs today include charitable actions in their messaging, and more importantly to directly impact Customers, are offering opportunities for Customers to participate in charitable elements.. One example, members can choose donations to a relevant cause as a reward option.Customers co-create their own experiencesPerhaps the most exciting and interesting concept, and one that Customers truly appreciate, is the opportunity for Customers to create their own experiences. Tesco's former BuyaPowa proposition put Customers in the role of pricing managers – the more wine they encouraged their friends to buy, the cheaper the price was per bottle for everyone. Walmart enlists Customers to be new product developers and then category managers, driving innovation in new products. Canadian Tire's Customer-driven 'Tested' panel are de facto quality control experts. Even the constitution of Iceland was rewritten by its citizens, who contributed their thoughts for a better society in a social media campaign.

Measuring the Success of Loyalty Programs

There are many ways to measure loyalty programs– diagnostic measures that evaluate how well the program is being executed. Do you have awareness, appeal, and participation? Is the program driving engagement and increased loyalty among members? Stay tuned for Part 3: Measuring the Success of Loyalty Programs.

This is the ninth in a series of LinkedIn articles from David Ciancio, advocating the voice of the customer in the highly competitive food-retail industry.

Keep Reading...

Show less

Points are passé: How Loyalty Programs should be evolving to better delight Customers – Part 1

October 26 2020

brown round coins on brown wooden surface

Photo by Dan Dennis on Unsplash

Part 1: The Evolution of Loyalty

Today's 'always on, always connected' customers have become much savvier and discriminating. Unsurprisingly, they have lost their appetite for loyalty programs that deliver irrelevant offers and rewards via the same-old, tired propositions and experiences. Although the retail industry has generally graduated to 'loyalty 2.0' – more personalized communications, coupons, and channels based on data and segmentation science – the majority of loyalty programs are simply not keeping pace with the needs and expectations of today's shopper.

Customers now have much higher expectations of how rewards programs use of their gift of personal information – ever more valuable benefits and "hyper-relevant" experiences where and when the Customer wants it. Hence, the next (and long overdue) evolution of loyalty must no longer limit its focus to earning and redeeming, but also on continual and active Customer engagement. The 'program' must become a 'conversation' that creates interactions throughout the whole Customer journey to better demonstrate the retailer's loyalty to the Customer, and thereby winning incremental loyalty in return.

Customer Needs and Expectations Have Raised the Bar

Customers expect their experience with a retailer to be fully integrated and seamless across touch points. Whether they are searching for product information, checking reward status, making an online purchase or browsing in the store, they want to be recognized and have their needs understood and reflected in the retailer's offerings and the personalized service provided. Their lives are so busy, retailers who make shopping easier will be rewarded. Convenience and ease are key – whether it's making relevant suggestions and offers based on past purchases, making access to the rewards program fully digital, or offering an app that provides information, offers and payment options at their fingertips.

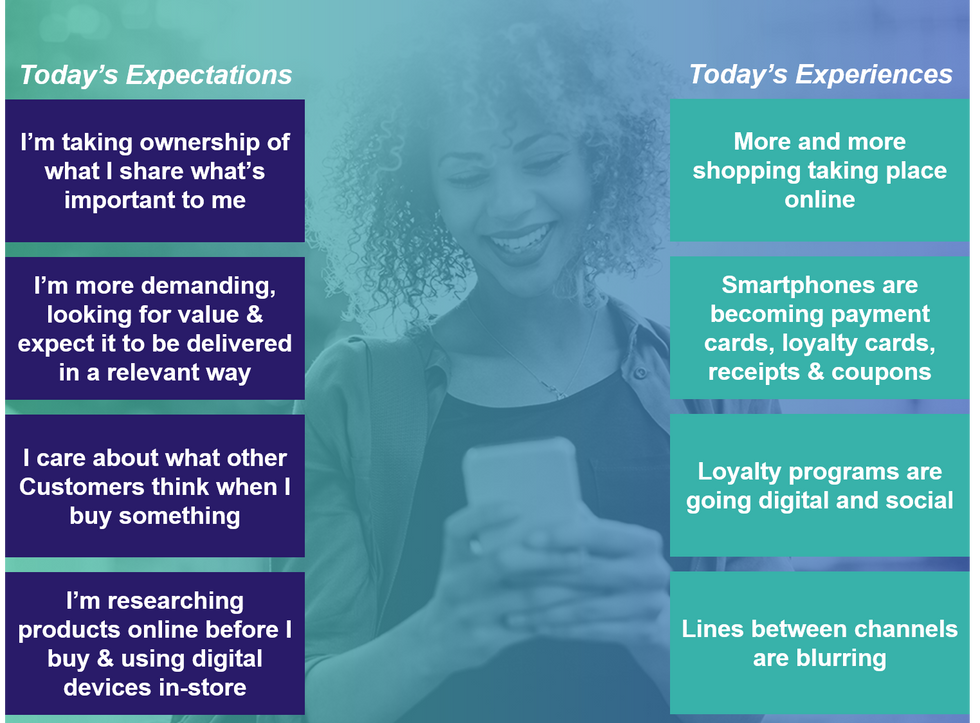

The following graphic illustrates how some of these expectations are playing out:

What This Means for Loyalty Programs Today and Tomorrow

The importance of a loyalty approach over a loyalty ‘program’

We live in an "attention economy" – Customers are attracted to offerings and retailers that win their attention in an otherwise cluttered and confusing multichannel world. Retail growth (and indeed, retail survival in a non-growth market) comes down to who best attracts meaningful attention. It's almost as if there are two choices that retailers face: win attention by being cheaper or by being more personally relevant (for Customers, this can be translated as better service, selection, convenience, etc.).

Arguably, in today's multichannel, post-recession world, the decision is binary and any middle position is short-lived and profit-starved. Being cheaper means competing in a continual race to the bottom against every type of price competitor and disruptor. Being more relevant means understanding Customers better than others, resulting in the ability to deliver an experience that Customers personally value. And, it means being more loyal to Customers than others are. In this way, a loyalty approach powers the growth strategy.

To earn loyalty rather than be given loyalty – to think of loyalty as a relationship earned through ever-relevant shopping experiences, offers, and conversations – is an important and powerful distinction with significant implications for any organisation in the multichannel world. One view puts the responsibility to change on the organization itself, while the other presumes that the Customer owns the change journey (from less loyal to more so). Only the former approach has been proven to drive sustainable growth, measured in organic, like-for-like terms.

Earning more loyalty means earning more sales – one more item, one more visit, one more customer, and so on.

Therefore, the essential question is around which type of loyalty program – points, discounts, surprise and delight, experiences, etc. – will best enable the practice of a loyalty approach? In our experience, the answer depends on how willing the business is to use data and insights to truly change the experience for its Customers.

Loyalty Trends and Best Practices

Customers have redefined what "relevance" means to them, rewarding retailers who deliver value and experiences that best meet both transactional and emotional needs. Clearly, today's customers are saying that points and discounts alone are insufficient. The most successful and appreciated loyalty propositions in practice today are focused on responding to the following Customer needs:

1) Sharing – Socially enabled and connected, local, advocacy and reviews, C2C and C2B. Customers expect propositions that listen more than talk, and marketing communications that speak with / on behalf of (not to) them. Think of propositions that help create communities, enable influence, ideas and reviews, and which enable Customers to gift their rewards.

2) Digital – Seamless omni-channel experiences, mobile enablers and connections. Customers expect programs that recognize them with or without a card and offers / status whenever and wherever they want. Integrate payment and 'discover' options.

3) Experiential – Experiences that are entertaining, fun, interactive, disruptive (the concept of gamification fits here), and priceless. Customers expect rewards for activities above just dollars spent and authentic 'thank you' messaging. Think of experiences that gratify instantly, are priceless and disruptive, personalizing and human.

4) Control – Of the offer, of time, of promotions and privileges. Customers expect transparency, simplicity, and curated choice. Think of experiences that are easier to enjoy and eliminate hoops.

Stay tuned for Part 2 coming soon: Foundational principles for developing a brilliant loyalty strategy

This is the eighth in a series of LinkedIn articles from David Ciancio, advocating the voice of the customer in the highly competitive food-retail industry.

Keep Reading...

Show less

Big data is no longer an advantage for only the big guys. Just ask Heinen's.

As I wrote in my previous article, being truly loyal to customers is, above all else, about creating a better store experience. Naturally then, the role of big data analytics (customer science) must be to improve the traditional '4 P's of marketing – so that customers better find the right products, at prices that shout better value for money, and in promotions that more clearly deliver exciting value.

Typically, the costs and complexities of harvesting insights from big data to improve the 4 P's have shut out smaller retailers. But today's cheaper cloud computing and open source technologies can now enable big data advantages to small companies. Data has been 'democratized' in a way that size of retailer no longer matters. To wit: leading the application of big insights in small spaces is Heinen's, a 23-store chain headquartered in Cleveland, Ohio.

If you want to see an amazing store experience born from inspired retail art together with applied customer science, you've got to see the Heinen's store in downtown Cleveland. You are sure to notice that Heinen's have transcended the traditional 4 P's to add 3 new P's of Customer Engagement – People, Place, and Personal – and have thereby become even more loyal to their customers. There's a link to a special video feature about this incredible store at the end of this article.

In the age of Amazon, it pays to think big when you’re small

These are dangerous times of disruption and of tectonic shifts in structures, formats, and channels for both retailers and brands. A new epoch of retail has arrived, wherein, once again, only those most agile / most adaptable to change will survive. The challenge is even more acute for smaller retailers.

"The brick and mortar solution won't survive very well unless we up our game and create an even better experience for customers than we have in the past." – Tom Heinen

And the way to create an even better experience? Use Customer Data Science to understand customers better than in the past, and apply insights to improve the store itself. I contend that deeper, truer loyalty can be better earned by responsive regional and smaller operators because they have a natural head start as 'local' puts them inherently closer to their customers.

The paradox of disrupted retail is that the big companies must think small, and the small must think big. Those bigger to become more local and personal, and those smaller to embrace the advantages of big data.

Speedboats vs. cruise ships

As the saying goes, it's about the size of the fight in the dog (and not the size of the dog in the fight). In Tom's words, "Being small when you deal with data is actually an advantage. Big companies are like driving a cruise ship; we're a speedboat. What levels the playing field for smaller companies is, in fact, good data-driven decisions."

The principles around using customer data to better engage customers are applicable regardless the size of your business, and no matter the channel – convenience, traditional offline, online, e-m-or v-commerce. These are the universal customer principles of retail:

- Loyalty = Trust + Value. Customers define what 'trust' and 'value' mean to them, personally. This loyalty is a thing earned, not expected

- Relevance is everything

- Customers leave for a reason – they are usually pushed, not pulled away

- Those most adaptable to change are those most likely to survive

To Chris Foltz, Heinen's Director of Operations, survival today is about investing in data science, and the benefits thereof are simple; "…to find insights that enable us to engage customers differently. We need to better change to meet their changing needs and find new ways to delight them".

3 P's of Customer Engagement

Chris and Heinen's understand – and practice perhaps better than anyone – that engaging and delighting customers goes far beyond executing on only 4 P's. I see three more P's in their brilliant operating model; the human P's, if you will – People, Place (in the sense of Ray Oldenburg's Third Places) and Personal.

People: Heinen's have energised and empowered staff by giving them ownership of the customer and the superpower of trust to satisfy customers using their own best judgement. Upskilling is not only about how to do a task, but also about the applications of good judgement and warm behaviours of empathy, dignity, and respect for shoppers. One store, one person can make a big difference for customers.

Personal: Treating all employees with dignity and remembering that each employee is an individual with different needs and aspirations teaches employees that all customers deserve to be treated with respect and individuality (what I call true 'personalisation'). Heinen's employees, following the example of their leaders, learn how to build up relational bank accounts with customers – earning credits for giving recognition, appreciation, thanks, kindness, dignity and respect to shoppers as individuals. When it comes to empathy and respect, the apple doesn't fall far from the tree at Heinen's.

Place: Oldenburg describes spaces at the heart of a community's social vitality a "third place". In contrast to first places (home) and second places (work), third places allow people to put aside their concerns and simply enjoy other people and the space around them. Heinen's downtown Cleveland store stands as a model for grocers to create this very human and psychologically important third space, and demonstrates again how Tom and Jeff Heinen are loyal to their customers and to their community.

For a look at this amazing place and the loyal application of the 4 P's to enhance the customer experience, please watch the below video.

Implications for retail leaders

- You don't have to be big to benefit from big data

- The principles of earning loyalty from your customers apply regardless of the number of stores, or of format

- Retail art must be informed by customer science if you want to win in the age of Amazon

- In the age of artificial intelligence, it's the human intelligence that wins customer engagement

This is the sixth in a series of LinkedIn articles from David Ciancio, advocating the voice of the customer in the highly competitive food-retail industry.

Keep Reading...

Show less

Never Mind The Retail Apocalypse. We’re Still In The Middle Of The Post-Recession Storm

October 26 2020

Why shoppers today are different, and how retailers can weather the changes

Today's shopper is drastically different than even just a decade ago. Contrary to the 1980's and 90's, when incomes were on the rise and Customers were demanding high quality, premium items; the new millennium brought about stagnant incomes, the housing bubble and the Great Recession. As Americans faced the harshest and longest lasting recession since the Great Depression, Customers' attitudes, values, and preferences—particularly around money spend—had shifted greatly. The National Bureau of Economic Research (NBER) saw shoppers began saving by taking advantage of coupons, sales, private brands, and larger pack sizes, making more shopping trips, and shopping more at discount stores.

A key question coming out of the recession was, "When will shoppers return to their pre-recession behaviors?" In 2019, after five years of robust economic growth, does the data show consumers shifting back to pre-recession behaviors, or are the consumer changes more permanent?

To address that question, we will look at the three most interesting behavioral changes from the NBER report:

- Private brand sales

- Shifting to discount retailers

- Making more trips

Private Brand

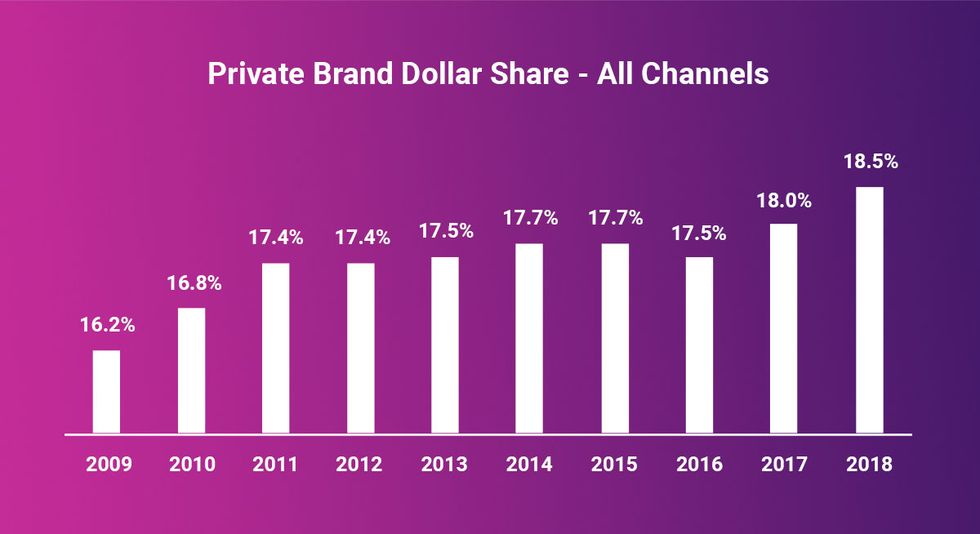

According to Nielsen, private brand's share of the market grew from 16.2% in 2009 to 18.0% in 2017 (source: Nielsen). This is a sizable chunk of the $682 billion grocery market (source: Nielsen TDLinx and Progressive Grocer).

Private brands have also grown faster than branded products from 2013-2017, when the private brand CAGR was 2.0% versus 1.2% for branded products. And the YOY number (2016 vs 2017) was 3.0% for private brand and -0.5% for branded products.

Discount Retailers

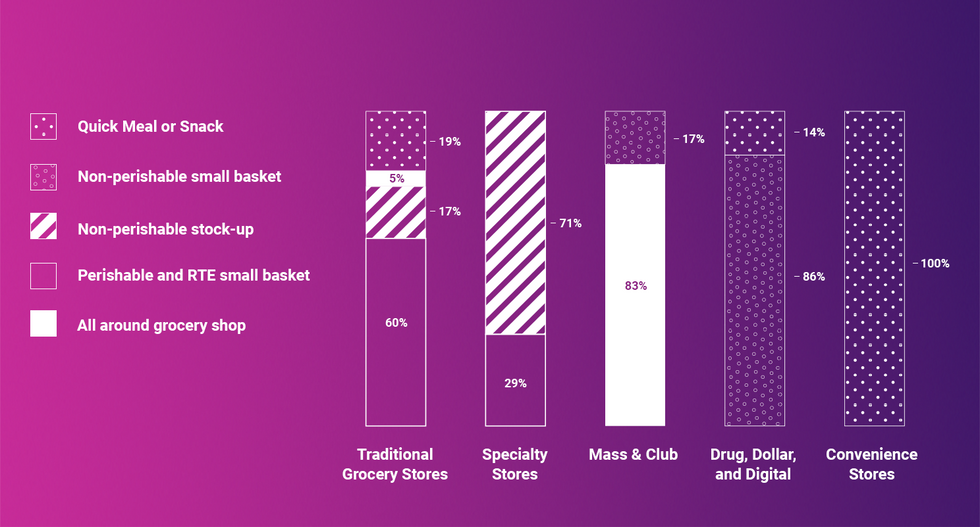

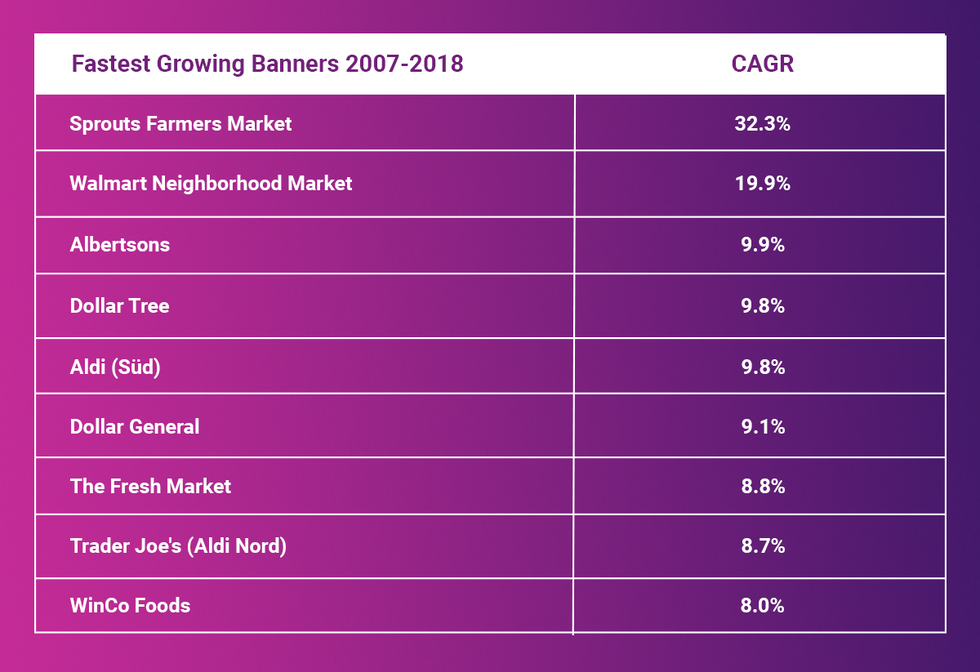

Looking at the top 10 fastest growing banners for grocery sales* since the Great Recession, five are price focused or discount retailers: Walmart Neighborhood, Dollar Tree, Aldi, Dollar General, and Winco Foods. Sprouts and Trader Joe's are not discounters but are known for the best prices within the premium segment. The Fresh Market is the only true premium banner, while Albertson's made the list because of an acquisition.

*(source: Planet Retail grocery sales. Filtered by banners exceeding $1 billion in 2018 grocery revenue)

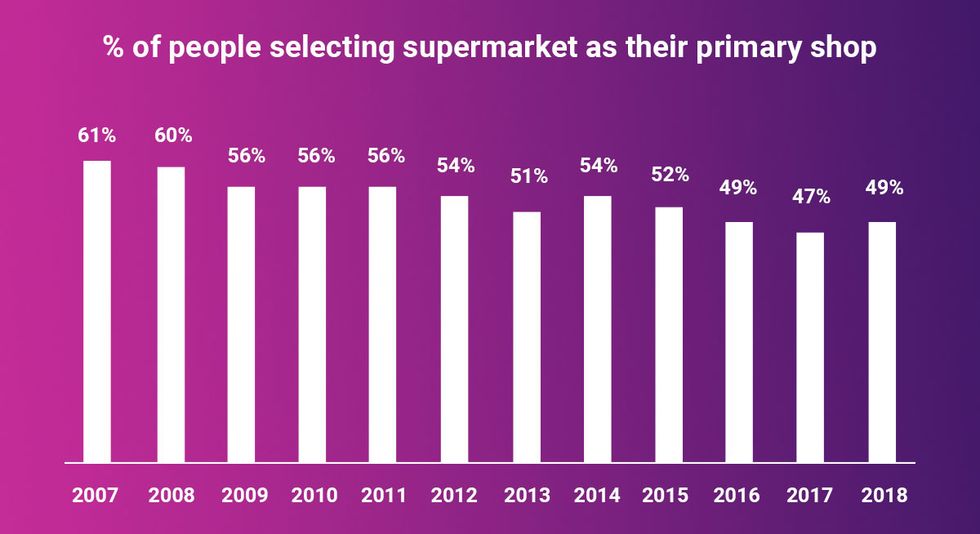

Moreover, since the Great Recession, fewer people define the traditional supermarket as their primary place to shop. FMI data shows a 12-percentage point decline since the Great Recession. And immediately following the 2009 recession, it dropped 5 percentage points as people explored lower cost channels.

More trips

More trips opened the door to visiting multiple retailers, allowing shoppers to find their preferred combination of price, quality, and store experience. In recent years, visits have fallen somewhat, but the number of channels and retailers visited continues to grow, according to the Food Marketing Institute (FMI). In fact, it's grown by almost 20% since 2015. Moreover, FMI, along with dunnhumby's RPI, finds that the average household visits about four different retailers in a month (source: FMI Grocery Trends 2018).

When will pre-recession behaviour return?

The evidence suggests that much of this price-conscious behaviour continues into 2019 and will likely persist for many more years. Private brand will likely continue to strengthen as Aldi, Lidl, Costco, and Trader Joe's continue growing. Many retailers are realizing that a strong private brand is key to their success, as it drives differentiation, improves value perceptions, and builds the overall retailer's brand.

Shoppers are also likely to continue shifting toward discounters, particularly for the commodity categories and items. Ecommerce will also make it easier by buying commodity items from low-cost providers. Lastly, Brick and Mortar visits could continue to fall as Ecommerce gains share and shopping multiple banners will likely continue as the market continues to fragment and specialize.

What does this mean for traditional supermarkets?

The key takeaway? We think about value differently since the Great Recession. Perceived value is the combination of our perceptions of quality and price. Before the recession, value was driven more by quality, but since the recession, it's driven more by price. Quality is still important, but when deciding to take action, retailers must carefully consider how those changes will impact price perceptions.

For example, many regional retailers think they can differentiate themselves by moving more upmarket, either more premium and/or more natural/organic. Still others think that becoming more digital and multichannel is the answer. In both instances, retailers should understand how these changes will impact both quality and price perceptions. In today's post-recession market where shoppers' price anchors are increasingly influenced by Walmart, Costco, and Aldi, significant reductions in price perception must be countered by significant improvements in quality perceptions. Moreover, if a retailer's footprint covers lower, middle, and higher income markets, it is not likely that the quality improvements will exceed the lower price perceptions. If a retailer wants to move more upmarket, targeted real estate becomes essential for success.

This also holds for digital and eCommerce. Will the benefits exceed the costs? eCommerce often requires fees or increased prices to cover the incremental costs. Does the improvement in quality exceed the hit to price? Dozens of grocery retailers believe it does, while one of the most successful--Trader Joe's--recently cancelled their eCommerce pilot because they felt the added costs exceeded the benefits.

What can traditional supermarkets do to improve value perceptions?

The good news is that several factors can shape value perceptions besides investing in price. dunnhumby research finds that about one-third to half of a banner's value perception is impacted by base price – meaning that there are other areas that contribute. The most effective method is to layer lower prices with changes in assortment, merchandising, and store experience, and then tell your customers about these changes with carefully crafted messages.

The first step is to build a highly efficient organization. Efficiency and keeping costs low are essential for any retailer to compete in today's market. This is seemingly quite obvious but getting there can be painful. Labor is a big cost. Do you really need someone behind that counter? Trader Joe's, Costco, and Walmart are almost exclusively self-serve. How about ready-to-eat foods? This department can also be very costly, so do the benefits exceed the costs? Trader Joe's has minimal fresh prepared foods but fills that vacuum with high-quality frozen prepared foods that are easy to prepare. This reduces shrink and maximizes profit.

Of course, the pricing blocking and tackling plays a role. The high-volume items play a bigger role in price perception than the lower volume items. Are these higher volume items priced competitively? Could you increase prices on lower volume items? What about entry level price points or the minimum and maximum gap across the category? Lower entry price points and smaller gaps have both been shown to improve price perceptions.

Assortment and merchandising can also affect value perceptions. How much variety is on the shelf? Are there opportunities to simplify the SKU? Research has shown that too many choices can negatively impact variety perceptions and reduce the likelihood of purchase. How is the store merchandised? What products occupy endcaps? High volume, competitively priced items or less relevant overstocked items? What's at eye-level on the shelf? Is this filled with your key value items or expensive premium and natural/organic items? What do customers see when they shop your store?

Private brand is also a key element within assortment and is unique in impacting both quality and price. On the quality side, it can uniquely help differentiate the overall brand by providing products that can only be found at your store. They have your logo on them and are the quickest way to build overall brand equity. There is also an opportunity to aggressively price these items, defending you against the more price-focused banners. And once you have a strong private brand, those items can occupy your end caps and prime space throughout the store.

The fact of the matter is, today's consumers are different. So how can you adjust your value proposition to better align with the fundamental shifts? Of course, there is no silver bullet, but a review of which banners are succeeding, and which ones aren't, is a clear indicator of what works and what doesn't. In the meantime -- recalling a fictional storm memorialized in film -- we are clearly not in Kansas anymore. Nor are we likely to ever return. There's a new normal in retail, and the smartest players are adjusting to the realities. For more on who is succeeding, see our most recent Retailer Preference Index report.

Keep Reading...

Show less

In part two of our blog series exploring some of the common challenges in setting up a Retail Media operation, we take a look at the building blocks of a strong business case.

In July last year, we estimated that grocery Retailers in the UK could be missing out on as much as £1.7bn in unrealised media revenues – equivalent to some £11bn across EMEA. While those numbers might give us an indication of the overall scale of the Retail Media opportunity, they tell us a little less about its potential on a business-by-business basis.

One way to start working that out for your own organisation is via the creation of a business case. Not only will this help you evaluate your current capabilities around Retail Media, it will give any other stakeholders involved a clear analysis of the benefits, costs and risks involved.

The good news is that, for many Retailers, the key components needed to turn Retail Media into a profitable reality will already be in place. And where they aren't, many options exist for augmenting your existing activity to maximise the value it can deliver.

Let's take a look at some of the most common considerations, and the questions that will need to be addressed in an accompanying business case.

Channels

Every Retailer today owns valuable, engaging advertising inventory. From in-store space to apps, websites and more, Retailers have an opportunity like few others to reach Customers with relevant, timely content across the duration of their shopping journey.

Many Retailers, of course, already utilise these channels for advertising to some degree. As a result, the biggest question that needs to be answered as part of a business case here is not "can we do this?", but "can we do this better?".

Historically, most Retailers have included advertising opportunities as part of trade negotiations with consumer packaged goods (CPG) suppliers. But with access to Customer data on an unprecedented scale, Retailers now have a gigantic opportunity to offer those brands a more targeted and personalised way to reach out to shoppers – maximising the value of their media inventory in the process.

The major questions to answer in your business case around channels are:

- Does our store portfolio give us the ability to execute consistent advertising campaigns in partnership with or on behalf of our CPG suppliers?

- How many customers can we reach out-of-store through channels such as websites, apps, email or direct mail?

- Is there a strong enough financial incentive for us to offer this service to CPG brands?

If the answer to those questions is yes, then you may also want to consider maximising the effectiveness of your channels by:

- Providing your CPG partners with insight and measurement solutions that prove the value of data-driven, personalised campaigns.

- Adapting your primary ecommerce channels to take advantage of banner ads, search-led promotions and other non-intrusive advertising techniques.

- Offering CPG partners the ability to book, execute and optimise media campaigns across your inventory using self-service tools or via a dedicated managed service.

Data

As is the case with media inventory, Retailers are in a unique position in terms of their ability to gather and analyse data on Customers and their purchasing habits. If digital media revolutionised advertising by introducing unseen levels of precision and measurability compared to traditional media, Retail Media makes a similarly evolutional shift by allowing Retailers to add real purchasing behaviour into that equation.

As vital as this data is to Retailers for their own planning and loyalty purposes, it can be just as invaluable to CPG suppliers looking to maximise their own return on advertising spend. Put simply, the easier you can make it for them to target, reach, and influence the Customers they care about, the more likely they are to spend on advertising with you.

Monetising data in this way isn't just about pure profitability either. For your stakeholders with an invested interest in loyalty and satisfaction, they'll no doubt be pleased to hear that around two-thirds of Retailers who do monetize their data see an improved Customer experience as a result[1].

The major questions to answer in your business case around data are:

- Do we operate a loyalty card scheme or have customer-level transaction data that allows us to track the relation between delivery of promotions and purchase behaviour in-store and online?

- Do we capture enough information on our ecommerce channels to be able to make data-driven decisions about Customer behaviour?

- Is the quality of the information that we hold on Customers as accurate, current, and complete as it could be? Do we hold the right permissions to use it commercially?

If the answer to those questions is yes, then you may also want to consider maximising the effectiveness of your data by:

- Applying advanced data science to create a deeper understanding of your Customers' needs.

- Linking and packaging this data in a way that makes it useful and valuable to CPG suppliers – i.e. by helping them identify target and high-intent audiences or set pricing strategies.

- Exploring the possibility of using this data to help CPG brands target customers across digital, social and physical channels.

Other considerations

While effective use of data and channels form the backbone of an effective Retail Media operation, some other issues are worth addressing as part of your business case. As with the above, few of these questions should prove difficult to answer.

- How many CPG suppliers do we work with, and how strong are our relationships with them? How best will we generate demand and become their marketing partner of choice?

- What percentage of my product sales are own brand compared to CPG lines? In which categories are the greatest opportunities?

- What does success look like, and how will it be measured? Is it purely revenue-based, or will we measure improvements in Customer loyalty, satisfaction, and the strength of your relationships with CPGs? How will you measure the contribution of Retail Media to these criteria if so?

- Which departments within your organisation will have a role to play, and are there any skills or areas of expertise that you should invest in?

- Ultimately, when putting together a business case around Retail Media, the majority of grocery chains will likely discover that they already have many of the fundamental elements in place and running well. The challenge will be not in making sweeping changes or justifying grand expenditure, but in fine tuning existing processes in order to maximise their value – something that external expertise can really assist with.

Next in this series, we'll be looking at building the perfect Retail Media blueprint.

[1]The Future Of Retail Revenues Must Be Data Led, Forrester Consulting, November 2019

Keep Reading...

Show less

FOR RETAILERS

Smarter operations and sustainable growth, powered by Customer Data Science.

FOR BRANDS

Better understand and activate your Shoppers to grow sales.

Upcoming Webinar | Insights from the 2021 dunnhumby Retailer Preference Index for U.S. Grocery

January 14 2021

The Great Recession programmed lasting value-consciousness into the minds of consumers. How might COVID-19 rewire us again?

The fourth annual dunnhumby Retailer Preference Index for U.S. Grocery (RPI) sheds light on what makes a retail winner, and how the pandemic has impacted consumer shopping behaviors. Known as retail's equivalent of the Gartner Magic Quadrant, the RPI surveyed about 10,000 consumers to understand what's driving customer preference and rank the top 57 grocery retailers in the United States.

Join dunnhumby CEO Guillaume Bacuvier as he dives into the latest study, revealing the levers for success, and which retailers are winning the hearts, and wallets, of shoppers today.

Register now

Retail leaders must objectively understand how their business currently considers Customers before trying to set a more Customer-centric direction and focus. There are some formal assessment methodologies, like dunnhumby's Retail Preference Index (RPI) and Customer Centricity Assessment (CCA), which offer detailed evaluations of a business' capabilities, strengths and weaknesses based on Customer perceptions (RPI) or global best practices (CCA).

The approach outlined below is not intended to replace these formal tools; rather, these observations are intended as a kind of 'toe in the water' to help retail leaders form early hypotheses and points of views. These are rules of thumb, heuristics culled from global experience. Later, leaders might use these observations to informally check progress from time to time as a way of assessing whether the "program in the stores matches the program in our heads".

Hence, the context and laboratory for these suggestions is the retail store, where the rubber meets the road, so to speak.

1. Who really runs the store?

Walking around a store (or better, walking around several), can give many clues toward understanding a retailer's attitude about its Customers, as well as revealing some of the challenges ahead for installing Customer First. As Customers ourselves, we are qualified to assess an organization's 'readiness' for Customer First, simply starting by walking around.

How a Customer experiences the store shapes their perception of the brand, and there are dozens (even hundreds) of 'moments of truth' for Customers in each shopping trip – opportunities for the retailer to win more loyalty, or indeed to lose it. And it only takes one 'bad' experience to erase all the good.

Leaders can form an opinion about the Customers' true shopping experience by observing 'Who really runs the store?' – a way to put on a Customer lens to assess if the Customer, the retailer, the supplier, or no one is driving shopping experience decisions, like range and presentation. For example:

- Choose three sections across the store (telling categories include yogurt, pasta sauces, milk, and packaged lunch meats). Look to see how the product is organized and presented (remember to try to see through the eyes of a Customer).

- Is the section organized by brand (e.g. all Danone yogurt is merchandised together in a recognizable Danone brand block)?

- By Customer benefit or usage (e.g. all brands of probiotic yogurt are merchandised together, as are all Greek style yogurts, all kid's yogurts, etc)?

- Or, by some hybrid but logical planogram rather random plan, with little recognizable logic at all?

- Would you conclude that the product display / layout logic is influenced more by supply chain, by brands, or by the Customer need states or trip missions?

- How broad is the range (e.g., number of varieties or sizes)? How deep (e.g., number of brands of the same flavor or variety)? Does the breadth and depth feel Customer friendly, or confusing?

Of course, analysing any available loyalty data will later tell us how Customers shop the category and that might well be by brand (or flavour or size, etc., and will certainly vary by section). But this first assessment helps us begin to form our perspective on how tuned-in the business is around its Customers, and about where within the business leaders might need to begin to install insights and the Customer language.

2. What messages are Customers receiving?

Store signage not only delivers a written message, but also a type of 'body language' that Customers tune in to, albeit not always consciously. Look around the store to see both the written and hidden messages, and hear the tone being communicated: ask, do messages speak respectfully to Customers? For example:

- Signage at the entrance rudely telling Customers what the rules are, even though 99.999% of Customers will never even think of shopping without shirts or shoes, or wearing roller blades

- Narrow limits on the quantities of promoted products or services.

- Rules and restrictions, terms and conditions.

- Aggressive security barriers and gates at entrances – although sometimes operationally necessary, these also tell honest Customers that they, the shoppers, are not to be trusted.

- Phony expiration dates for promoted prices – Customers learn that the deal will be repeated soon, if not immediately. Best example is the many carbonated soft drink promotions below shelf price that are repeated frequently, and the innumerable 'roller' prices practiced by many retailers.

- Stupid pricing signs (any stupid sign, really).

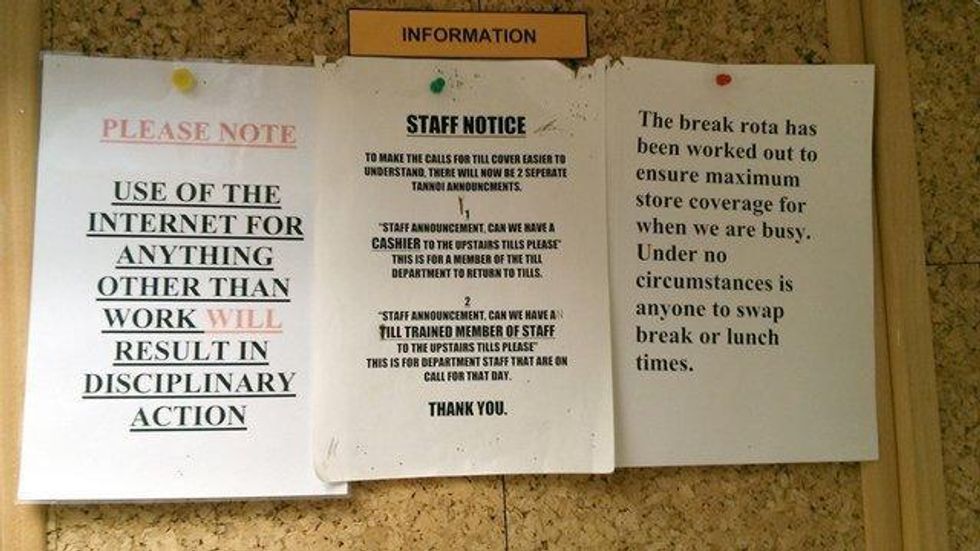

3. What messages are Employees receiving?

While walking the store, traveling through stock rooms and the employee break room, note the signage and messaging aimed at staff. What seems to be valued more – numbers or people?

What policies and rules guide employee behaviour?

How are they expected to interact with Customers?

Are the messages respectful of staff? Of Customers?

What do signs say about the culture around Customers?

4. Who has the power to satisfy Customers?

dunnhumby's Loyalty Drivers analysis suggests that Customers exhibit four 'mindsets' in their shopping journey – Discover, Shop, Buy, and Reflect. One element of the 'Reflect' mind-set includes the decision to return, exchange, or to request a refund when the product or service does not quite suit.

On your store walk, observe who has the power to satisfy Customers making a return or wanting a refund: is the front-line employee empowered to satisfy the Customer, or must the Manager be called? Is there one 'service' desk where Customers must queue to get their money back, or can the helpful cashier make it good on the spot?

Examine the return policy to assess its sensibility and ease from a Customer viewpoint. For example, must a Customer act within 7 or 30 days, and is a receipt required and signature under penalty of perjury? Is the taking of an oath necessary, or perhaps a drop of blood? The store's practice says volumes about who deserves trust in the eyes of the business. Requiring levels of approvals and higher management involvement (or some other form of hoop-jumping) is neither trusting of employees nor Customers.

The return / refund policies and practices are strong indicators of a company's readiness for, or progress along the Customer-centric journey. Customer First organizations give front-line employees broader authority to resolve Customer needs, and extend the power to satisfy Customers to most members of staff, in some form. For best practices in this area, please see the policies from Nordstrom in the U.S. and Ritz-Carlton globally.

5. Do the words of your leaders matter?

Senior leaders set the tone for how Customers are regarded and treated in the business both by their words and their actions, of course. And the C.E.O.S – Customers, Employees, Owners, and Suppliers – all take notice. It's widely documented that leaders who walk the walk are more effective than those who only talk the talk.

One simple yet powerful way to assess readiness and progress is seeing how leadership's walk and talk align. A word cloud, like the one illustrated below, makes the point very clear. In this example, recent shareholder statements (same quarter) were compared for two companies on a Customer-centric journey. We can see different progress in a form of 'walking the walk' at Retailer X and Retailer Y. The C.E.O.S are hearing what really matters to the leaders, and are forming the Customer culture accordingly, all the way down to store level.

Implications for retail leaders

The store shapes Customers' perception of the brand; there are hundreds of opportunities for the retailer to win or lose loyalty in each shopping trip. Customers take clues, consciously and unconsciously, throughout their entire shopping experience, and draw conclusions about retailer warmth and attitude toward shoppers. And it only takes one disappointing experience to erase all the good.

Retail leaders must take an objective assessment of the shopping experience using a Customer lens to understand their current state and readiness for customer centricity. Pay close attention to the body language and tone of your policies. Store signage, employee empowerment and communications, and practices around assortment and presentation are clear indicators of the organization's attitude about the Customer.

Who actually runs your store?

This is the first in a series of LinkedIn articles from David Ciancio, advocating the voice of the customer in the highly competitive food-retail industry.

Keep Reading...

Show less

Prophets of Aisle Six, Episode 2: Heinen’s Fine Foods

January 03 2021

dunnhumby’s Prophets of Aisle Six, Episode 2: Heinen's Fine Foods

The Prophets of Aisle Six is the first online reality series focusing on innovation in the food retail industry. In this episode, Jose Gomes, dunnhumby's North America Managing Director, travels to the downtown Cleveland store of Heinen's Fine Foods. Jose meets with Tom and Jeff Heinen, co-owners and brothers, and learns how they are evolving their grandfather's mission of delivering excellent customer service. With 23 stores in Northeast Ohio and the greater Chicago area, and a 90-year legacy, Heinen's is proving that being a small retailer can be an advantage when it comes to data.

In this series, dunnhumby tours the globe and speaks with some of the world's greatest brands, exploring their biggest challenges and how they are using customer data science to meet those challenges.

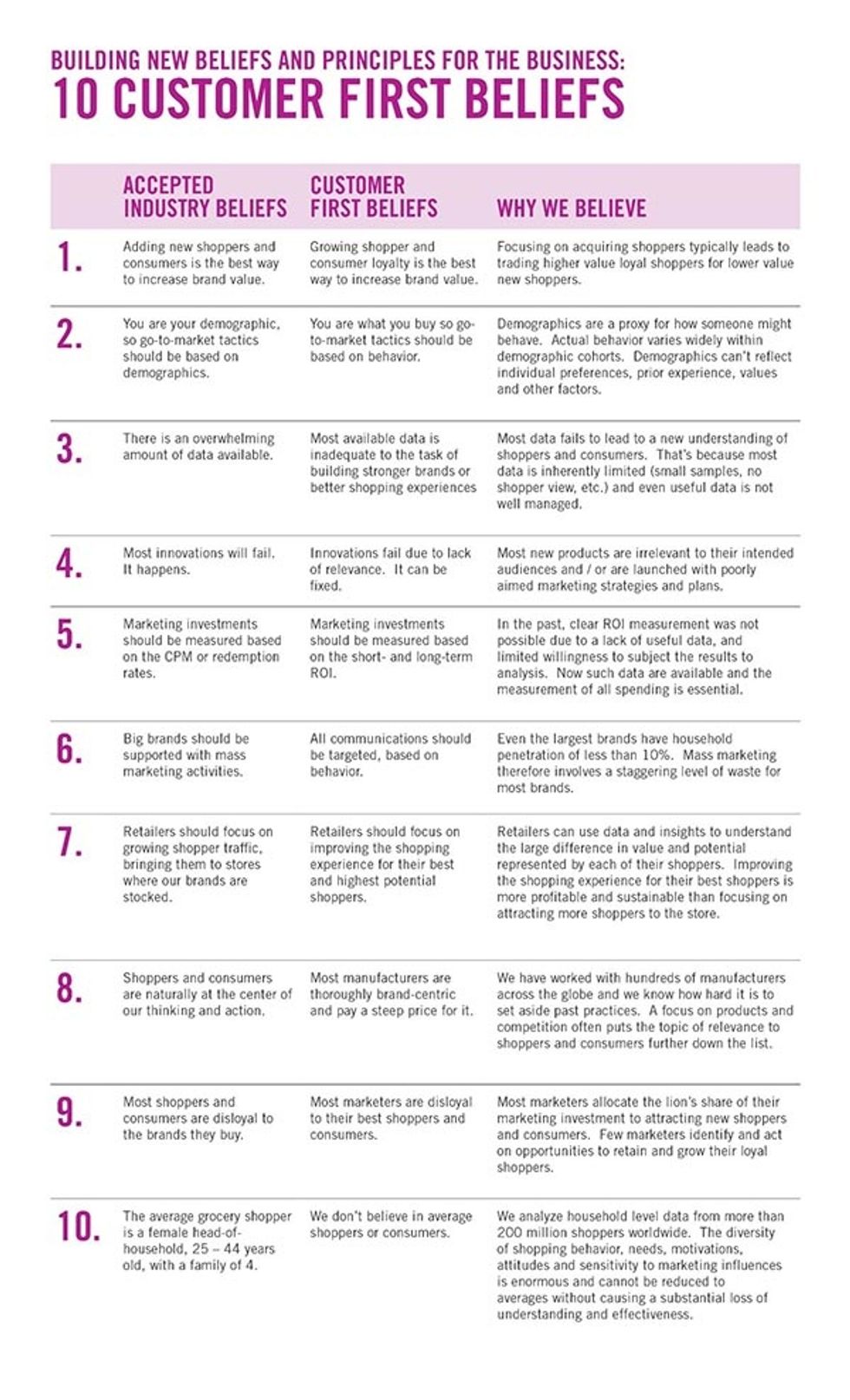

In my last post, I posed five questions to retailers to help them determine whether they're ready for a customer-first mindset. Now, I'd like to challenge the retail basics that seasoned retailers were trained on, and suggest instead a new customer data science approach.

"Retail is detail" is common industry wisdom, and it means that achieving success is subtle and difficult. Success in any field demands practice and experience, and so it is little wonder that many senior retail and brand leaders and managers have vast years of involvement, and that most have grown up through the business in progressive steps.

Accordingly, business decisions are heavily based on experience, and more often on personal memory of choices and executions and how a thing has traditionally been done. As Chris Foltz, director of operations at Heinen's Fine Foods, told me, "Our industry, and our company, was very opinion-based, albeit expert opinions. We realized early on that we needed data on customer needs, customer satisfaction and customer buying behavior to improve our decision-making. As we adopted this metric-driven approach, I believe we prioritized our investments and effort to deliver a better customer experience."

These are a just few of the things that most retailers absolutely know for sure:

- We must acquire new customers in order to grow our business.

- Price-sensitive and "cherry picker" customers are not profitable. The competition is welcome to them.

- Customers are different in every region of the country. There are also differences between urban and suburban shoppers.

- Loyal customers are already giving retailers most of their spend in the categories offered.

- Weekly flyers and promotions always drive footfall and sales.

- After all these many years in the business, we know what customers want.

Why What We Know About Customers Just Ain’t So

The old axioms are no longer factual because customers themselves have dramatically changed, in their needs, expectations and experiences. Separating fact from fiction—and business truths from myths—will change how the business sees itself and how it will make decisions. The following are some of the new truths of retailing in the 21st century:

- Expanding share of wallet from customers who are already "loyal" can better optimize growth.

- Loyal customers need more love and investment than new customers.

- Retaining loyal customers and reducing churn among "opportunity" customers can drive more growth than acquiring new customers.

- Price-sensitive customers are often more profitable than other segments because their basket mix includes more private label products or higher-margin portion sizes.

- Behavioral "buy-o-graphics" and intended trip missions matter much more than demographics or geographics.

- Customer segments are typically distributed variably within geographic regions or zones, but all customer types exist in all stores.

- Store clusters built upon customer dimensions are more useful to operations and execution than store groupings based on geographic zones or volumetrics.

What We Know for Sure Can Fit on a Post-It Note

Agility in retail can only be maintained by understanding customers and using data in all available quantitative and qualitative forms. Here's a personal story to illustrate:

A perception-based research tool measured one retailer's progress against factors that customers themselves had said are most important to them. Before the first customer perception report was published, I set out to learn how the customer ranking compared to the rankings that the senior decision-makers would assign.

The regular weekly senior team meeting brought together many of the wisest and most seasoned leaders in the business. After briefly introducing the research methodology, I asked the team to list what factors they thought customers would list as important, and in what order they thought customers would place them.

Not surprisingly, each merchant tended to rank factors in their department higher on the list than those for other parts of the store. Although little agreement was reached, a compromise ranking was eventually defined.

Comparing our list to the customers' list revealed spectacular differences; leaders had listed most of the same elements as did customers, but in completely the wrong order. That day, the team experienced a true epiphany—they realized that "we didn't know what we didn't know."

The lessons learned were:

- Humility gained in discovering that "we don't know what we don't know" empowers the customer-first journey.

- To become more relevant to customers, we must become fact-based deciders and activators.

- Using customer data well creates true consensus and inclusive action.

In summary, “In God We Trust” ... all others must bring data.

David Ciancio is global customer strategist for Dunnhumby, a pioneer in customer data science, serving the world's most customer-centric brands in a number of industries, including retail. David has 48 years' experience in retail, 25 of which were in store management. He can be reached at david.ciancio@dunnhumby.com

Keep Reading...

Show less