So many tactics, so little strategy: How data can help retailers make smarter investments to better compete

people collaborating about smarter retail investments

Grocery retailers can employ a countless number of tactics to compete in today's dynamic market. The issue is not the ability to do many different things at once, which retailers are often good at, but resources are finite. It's important to determine the right strategies to prioritize investments and which tactics they should stop entirely.

Many organizations, not just in retail, struggle to focus resources and attention on the areas that are most important to the health of the business. This often results in organizations chasing too many priorities, with few areas receiving the attention required to make meaningful improvements. Retailers that cannot markedly improve the business in areas that drive value perceptions and visits will find it difficult to navigate an increasingly fragmented and competitive market. The issue is further exacerbated by thin profit margins and scarce resources that require an even more thoughtful and strategic allocation of resources.

At the root of the problem is the inability to systematically assess and diagnose key issues across the business. Without the right data, systems, and processes, coupled with silos and day-to-day demands, diagnosing key macro issues is quite difficult. As a result, few organizations spend the resources or time needed to carefully align their strengths and weaknesses with the demands of Customers, competitors, and technology.

Artwork courtesy of Roger Penwill

The inability to confidently diagnose also leads to a largely internal focus and a planning process that centers on marginally adjusting next year's spend, hoping next year will be better.

Over time, this internal focus can result in a disconnect with Customers and too much influence from external organizations with conflicted priorities. This Customer disconnect causes a misalignment between the evolving Customer needs and the retailer's value proposition, which opens the door for competitors and new market entrants. This was the case with Walmart, Trader Joe's, and Costco who have all significantly expanded their market share over the last 20 years at the expense of traditional supermarkets. Ironically, this also happened with discounters in the U.K, who now control over 12% of the grocery market.

If a retailer can confidently diagnose key issues and identify opportunities, knowing that performance will improve, they would be more confident reallocating available resources. More importantly, they will have the knowledge and information to scale back in areas less important to the health of the business.

"The essence of strategy is choosing what not to do." Michael Porter – What is Strategy, HBR 1996

However, reducing or reallocating resources is difficult for most organizations. Relationships, culture, and legacy are baked into many systems, processes, and activities that are simply disconnected from the Customer and the overall performance of the business.

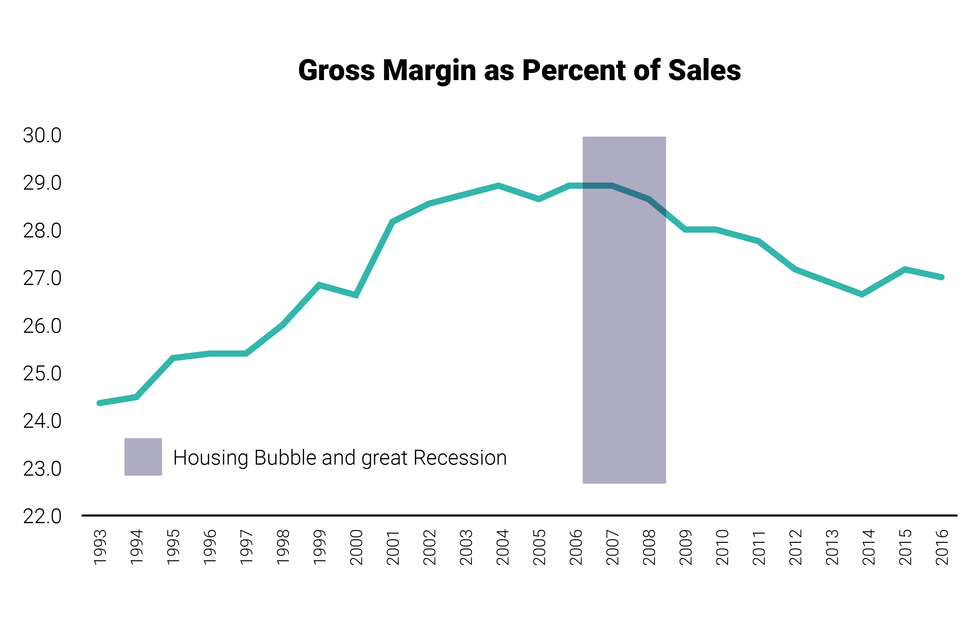

For example, many inwardly-focused traditional grocers failed to recognize the shift in the consumer and the market in the post-recession period. Looking at gross margins in the post-recession period, industry-wide gross margin as a percent of sales fell from 28.9% in 2007 to 26.7% in 2014.

U.S. Grocery Margin as Percent of Sales

Yet, other traditional retailers continued to incrementally increase their gross margins as they did in the pre-recession period, which may have helped them hit their short-term financial goals but damaged their long-term value perception. By 2006, Costco, Walmart and Trader Joe's had expanded into many markets and leveraged their strong value proposition in the post-recession period to steal significant share from supermarkets.

If traditional grocers diligently monitored the external market, changing Customer needs and diagnosed key issues, they might have responded by aggressively cutting back on expenses and investments. Consequently, they might have better managed the price perception gap and share loss over the long-term, rather than having to close stores today.

For example, a major retailer had a 2-percentage point gap in gross margin during the pre-recession market period and today it is over 5-percentage points. The premium price gap begins to reach a point where some retailers are simply no longer price competitive. Our research has shown that this lack of price competitiveness erodes not only financials, but also the emotional connection which used to be a strength for many regional grocers. Once the emotional connection starts to fade, it becomes increasingly difficult to win Customers and their wallets back.

So, how can retailers improve the ability to consistently identify key issues and take advantage of opportunities? It starts with a combination of people, process and data analysis to build the evidence-backed business case that can be used to develop a consensus across departments and alignment throughout the company. Depending on internal resources, this can include enlisting a partner like dunnhumby to help connect all available data sources, like Customer information from transactional data, market research, and online sources. In our upcoming Strategy posts, we'll look at strategic frameworks and other requirements to isolate key business issues and identify new and important opportunities.

FOR RETAILERS

Smarter operations and sustainable growth, powered by Customer Data Science.

FOR BRANDS

Better understand and activate your Shoppers to grow sales.

The "new normal" isn't really normal at all. Life amid COVID-19 has forced U.S. consumers to adopt new behaviors, dramatically impacting how they shop, work and go about their daily lives. Trips to the grocery store are now once weekly trips to buy essentials and stock the pantry for home cooking. And, vulnerable consumers now rely on online ordering and delivery services they were once reluctant to try.

On average, it takes 66 days for new behaviors to become automatic. The majority of U.S. consumers will cross that milestone under pandemic restrictions very soon. Retailers should prepare now to successfully serve their customers after the "COVID curve."

Join dunnhumby's Jose Gomes, President for North America, and Eric Karlson, Head of Strategy for North America, as they discuss:

- dunnhumby's model of the three phases of the COVID-19 pandemic

- Insights and learnings from retailers around the globe

- How retailers should prepare to adapt their customer strategy for the "new normal" of customer behaviors and expectations

This webinar originally took place on Tuesday, May 5, 2020 as part of an exclusive four-part webinar series with Retail Leader and Progressive Grocer about how to adapt your Customer Strategy now for life after the curve, and possible implications for Customer Engagement, Category Management, and Price & Promotions.

Customer First: How Retailers Can Improve Value Perception to Drive Preference and Performance

Growing competition from traditional players and new market entrants. Machine learning and artificial intelligence. The Connected Consumer. Retail has never been more challenging. But, forget the so-called "retail apocalypse." The end is not here. We're in the midst of a retail revolution where the winners and the losers are yet to be determined. As retail continues to fragment, understanding how to develop a strong value proposition is vital for future success.

Hear results and insights from dunnhumby's second-annual Retailer Preference Index (RPI), a comprehensive nationwide study of 7,000 US households. The webinar will shed light on what's most important to Customers, and highlight which strategic levers retailers must pull to influence value perception and win in their markets.

Join the webinar to learn:

- What drives preference?

- Who is winning and losing? And why?

- What can grocery retailers do to improve consumer preference and financial performance?

Webinar Date: Thursday, March 28, 2019

Duration: 1 hour

Webinar On Demand with Chain Store Age: How Value Perception Shapes Consumer Retail Preference

Want to improve your financial performance and deepen engagement with your customers? Improving your value perception is key. How customers feel about your prices and quality are the 2 biggest drivers of financial performance and emotional connection for a brand, as shown in dunnhumby's nationwide study, the Retailer Preference Index (RPI). With findings from 11,000 US households, the study sheds light on what's most important to customers, and highlights which marketing levers retailers must pull to influence value perception. As retail continues to fragment and commoditize, understanding how to develop a strong value proposition is vital for future success.

Watch Chain Store Age's webinar to hear our Pricing and Strategy experts Ted Eichten and Eric Karlson present key findings from the RPI which can help retailers shape winning strategies.

Download today to learn:

- What drives retailer preference among customers?

- Which retailers are winning and losing? And why?

- Which 3 factors have the greatest influence on performance?