https://vimeo.com/470757130/b937a6b921

Webinar On Demand | Customer First Retail Strategy and COVID-19: Life After the Curve

May 05 2020

WebinarsThank you! Your copy of the report opened in a new tab. If you have trouble viewing it,click here.

Thank you! Your copy of Webinar is opened in new tab, If you have trouble viewing it,click here.

The "new normal" isn't really normal at all. Life amid COVID-19 has forced U.S. consumers to adopt new behaviors, dramatically impacting how they shop, work and go about their daily lives. Trips to the grocery store are now once weekly trips to buy essentials and stock the pantry for home cooking. And, vulnerable consumers now rely on online ordering and delivery services they were once reluctant to try.

On average, it takes 66 days for new behaviors to become automatic. The majority of U.S. consumers will cross that milestone under pandemic restrictions very soon. Retailers should prepare now to successfully serve their customers after the "COVID curve."

Join dunnhumby's Jose Gomes, President for North America, and Eric Karlson, Head of Strategy for North America, as they discuss:

This webinar originally took place on Tuesday, May 5, 2020 as part of an exclusive four-part webinar series with Retail Leader and Progressive Grocer about how to adapt your Customer Strategy now for life after the curve, and possible implications for Customer Engagement, Category Management, and Price & Promotions.

Find out how COVID-19 has accelerated the shift to grocery ecommerce, and explore the successful strategies to follow.

2020 has seen an acceleration of grocery e-commerce with globally 29% of shoppers saying they are using pick up or delivery weekly for their grocery of eat at home consumption.

Whilst there was an initial surge in demand at the height of the Covid-19 crisis that was hard to meet, there has been a significant increase in capacity across retailers in recent months. Consumers have also started to adopt the channel more with 59% saying they will continue to stick with online pick up and delivery, alongside going to store.

In this session we explore successful strategies for meeting these new consumer needs. This will look at ways to capture this new growth channel, and grow customer adoption as well as ensuring a seamless omni-channel experience and a scalable, more profitable operation.

The 45-minute session will be by a live Q&A with the presenters.

When: Wednesday 4 November 2020, 16:00 GMT

Presenters:

Retail success takes many forms in today's dynamic marketplace. From large legacy retailers to disruptive start-ups and all manner of competitors in between, the paths to retail success involves common principals around which there is a wide variation of understanding and execution.

To bring clarity to the issue of what makes a winner, dunnhumby, the global customer data science firm, conducted a massive survey of more than 7,000 U.S. shoppers for the second annual Retailer Preference Index (RPI), the first study of its kind in the industry. In what's quickly become known as retailing's equivalent of research firm Gartner's often-cited Magic Quadrant, dunnhumby's RPI is a ranking of more than 50 large food and consumable retailers based on a combination of shopper sentiment and financial performance.

Join Retail Leader and dunnhumby's Grant Steadman, SVP of Client Services, and Erich Kahner, Associate Director of Strategy, for a deep dive into the RPI, the levers for success, and an unvarnished look at why some retailers win and others don't.

Topics discussed include:

For a look at the retailer rankings and to understand how your business can benefit from implementing the RPI success framework, watch our webinar which took place on Thursday, September 5, 2019.

The events of the past six months have had huge repercussions for grocery retail.

But despite reporting record revenues, many retailers are struggling to convert sales into profits. With higher running costs, changes in Customer behaviour, stock shortages, social distancing, and growing price sensitivity, there is little doubt that this will continue for some time to come.

There's never been more value in being able to track how Customers are influenced by the changes going on around them and respond to future trends before they even materialise. Doing this effectively, however, requires Retailers and CPGs to come together, pool their insights, and work out how best to meet those future Customer needs.

In this webinar, we'll explore how to overcome the barriers that are holding many Retailers and CPGs back, what needs to change, and how both parties can benefit from Customer-First Insight Activation.

Join experts from dunnhumby as we:

The "new normal" isn't really normal at all. Life amid COVID-19 has forced U.S. consumers to adopt new behaviors, dramatically impacting how they shop, work and go about their daily lives. Trips to the grocery store are now once weekly trips to buy essentials and stock the pantry for home cooking. And, vulnerable consumers now rely on online ordering and delivery services they were once reluctant to try.

On average, it takes 66 days for new behaviors to become automatic. The majority of U.S. consumers will cross that milestone under pandemic restrictions very soon. Retailers should prepare now to successfully serve their customers after the "COVID curve."

Join dunnhumby's Ted Eichten, Head of Price & Promotion for North America, and John O'Reilly, Head of Customer Development for North America, as they discuss:

The "new normal" isn't really normal at all. Life amid COVID-19 has forced U.S. consumers to adopt new behaviors, dramatically impacting how they shop, work and go about their daily lives. Trips to the grocery store are now once weekly trips to buy essentials and stock the pantry for home cooking. And, vulnerable consumers now rely on online ordering and delivery services they were once reluctant to try.

On average, it takes 66 days for new behaviors to become automatic. The majority of U.S. consumers will cross that milestone under pandemic restrictions very soon. Retailers should prepare now to successfully serve their customers after the "COVID curve."

Join dunnhumby's Daryl Wehmeyer, Head of Category Management for North America, and John O'Reilly, Head of Customer Development for North America, as they discuss:

The "new normal" isn't really normal at all. Life amid COVID-19 has forced U.S. consumers to adopt new behaviors, dramatically impacting how they shop, work and go about their daily lives. Trips to the grocery store are now once weekly trips to buy essentials and stock the pantry for home cooking. And, vulnerable consumers now rely on online ordering and delivery services they were once reluctant to try.

On average, it takes 66 days for new behaviors to become automatic. The majority of U.S. consumers will cross that milestone under pandemic restrictions very soon. Retailers should prepare now to successfully serve their customers after the "COVID curve."

Join dunnhumby's Emily Turner, Head of Customer Engagement for North America, and John O'Reilly, Head of Customer Development for North America, as they discuss:

Growing competition from traditional players and new market entrants. Machine learning and artificial intelligence. The Connected Consumer. Retail has never been more challenging. But, forget the so-called "retail apocalypse." The end is not here. We're in the midst of a retail revolution where the winners and the losers are yet to be determined. As retail continues to fragment, understanding how to develop a strong value proposition is vital for future success.

Hear results and insights from dunnhumby's second-annual Retailer Preference Index (RPI), a comprehensive nationwide study of 7,000 US households. The webinar will shed light on what's most important to Customers, and highlight which strategic levers retailers must pull to influence value perception and win in their markets.

Join the webinar to learn:

Webinar Date: Thursday, March 28, 2019

Duration: 1 hour

Smarter operations and sustainable growth, powered by Customer Data Science.

Better understand and activate your Shoppers to grow sales.

Retail leaders must objectively understand how their business currently considers Customers before trying to set a more Customer-centric direction and focus. There are some formal assessment methodologies, like dunnhumby's Retail Preference Index (RPI) and Customer Centricity Assessment (CCA), which offer detailed evaluations of a business' capabilities, strengths and weaknesses based on Customer perceptions (RPI) or global best practices (CCA).

The approach outlined below is not intended to replace these formal tools; rather, these observations are intended as a kind of 'toe in the water' to help retail leaders form early hypotheses and points of views. These are rules of thumb, heuristics culled from global experience. Later, leaders might use these observations to informally check progress from time to time as a way of assessing whether the "program in the stores matches the program in our heads".

Hence, the context and laboratory for these suggestions is the retail store, where the rubber meets the road, so to speak.

Walking around a store (or better, walking around several), can give many clues toward understanding a retailer's attitude about its Customers, as well as revealing some of the challenges ahead for installing Customer First. As Customers ourselves, we are qualified to assess an organization's 'readiness' for Customer First, simply starting by walking around.

How a Customer experiences the store shapes their perception of the brand, and there are dozens (even hundreds) of 'moments of truth' for Customers in each shopping trip – opportunities for the retailer to win more loyalty, or indeed to lose it. And it only takes one 'bad' experience to erase all the good.

Leaders can form an opinion about the Customers' true shopping experience by observing 'Who really runs the store?' – a way to put on a Customer lens to assess if the Customer, the retailer, the supplier, or no one is driving shopping experience decisions, like range and presentation. For example:

Of course, analysing any available loyalty data will later tell us how Customers shop the category and that might well be by brand (or flavour or size, etc., and will certainly vary by section). But this first assessment helps us begin to form our perspective on how tuned-in the business is around its Customers, and about where within the business leaders might need to begin to install insights and the Customer language.

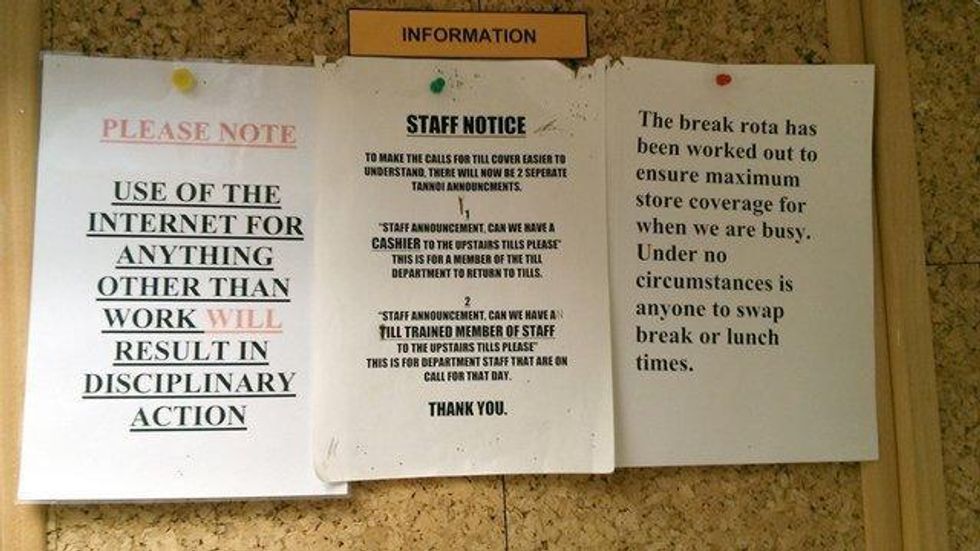

Store signage not only delivers a written message, but also a type of 'body language' that Customers tune in to, albeit not always consciously. Look around the store to see both the written and hidden messages, and hear the tone being communicated: ask, do messages speak respectfully to Customers? For example:

While walking the store, traveling through stock rooms and the employee break room, note the signage and messaging aimed at staff. What seems to be valued more – numbers or people?

What policies and rules guide employee behaviour?

How are they expected to interact with Customers?

Are the messages respectful of staff? Of Customers?

What do signs say about the culture around Customers?

dunnhumby's Loyalty Drivers analysis suggests that Customers exhibit four 'mindsets' in their shopping journey – Discover, Shop, Buy, and Reflect. One element of the 'Reflect' mind-set includes the decision to return, exchange, or to request a refund when the product or service does not quite suit.

On your store walk, observe who has the power to satisfy Customers making a return or wanting a refund: is the front-line employee empowered to satisfy the Customer, or must the Manager be called? Is there one 'service' desk where Customers must queue to get their money back, or can the helpful cashier make it good on the spot?

Examine the return policy to assess its sensibility and ease from a Customer viewpoint. For example, must a Customer act within 7 or 30 days, and is a receipt required and signature under penalty of perjury? Is the taking of an oath necessary, or perhaps a drop of blood? The store's practice says volumes about who deserves trust in the eyes of the business. Requiring levels of approvals and higher management involvement (or some other form of hoop-jumping) is neither trusting of employees nor Customers.

The return / refund policies and practices are strong indicators of a company's readiness for, or progress along the Customer-centric journey. Customer First organizations give front-line employees broader authority to resolve Customer needs, and extend the power to satisfy Customers to most members of staff, in some form. For best practices in this area, please see the policies from Nordstrom in the U.S. and Ritz-Carlton globally.

Senior leaders set the tone for how Customers are regarded and treated in the business both by their words and their actions, of course. And the C.E.O.S – Customers, Employees, Owners, and Suppliers – all take notice. It's widely documented that leaders who walk the walk are more effective than those who only talk the talk.

One simple yet powerful way to assess readiness and progress is seeing how leadership's walk and talk align. A word cloud, like the one illustrated below, makes the point very clear. In this example, recent shareholder statements (same quarter) were compared for two companies on a Customer-centric journey. We can see different progress in a form of 'walking the walk' at Retailer X and Retailer Y. The C.E.O.S are hearing what really matters to the leaders, and are forming the Customer culture accordingly, all the way down to store level.

The store shapes Customers' perception of the brand; there are hundreds of opportunities for the retailer to win or lose loyalty in each shopping trip. Customers take clues, consciously and unconsciously, throughout their entire shopping experience, and draw conclusions about retailer warmth and attitude toward shoppers. And it only takes one disappointing experience to erase all the good.

Retail leaders must take an objective assessment of the shopping experience using a Customer lens to understand their current state and readiness for customer centricity. Pay close attention to the body language and tone of your policies. Store signage, employee empowerment and communications, and practices around assortment and presentation are clear indicators of the organization's attitude about the Customer.

This is the first in a series of LinkedIn articles from David Ciancio, advocating the voice of the customer in the highly competitive food-retail industry.

In the first episode of Customer First Radio, Dave Clements, Global Head of Retail for dunnhumbyand David Ciancio, Global Head of Grocery for dunnhumby kick off the series by discussing what it means to be a truly Customer First business, share which retailers and brands today embody a Customer First mindset, and examine how Customer First materialized during the pandemic with retailers.