Convenient locations, one-stop shopability, and right product variety make up the Convenience pillar. Convenience is the least important factor for explaining short-term market share gains, and retailers in each of the four Covid Momentum Quartiles performed similarly on Convenience.

customers favored Speed during Covid, which correlates negatively with larger format stores where customers can do all their shopping at once. Moreover, evolving commuting behaviors from people working from home and limited mobility due to stay-at-home orders shifted which stores were now considered Convenient. While people were adjusting to new ways of shopping for food, and making trade-offs on Price and product quality and variety, they were being hit with out-of-stocks, which affected their ability to easily buy their typical brands.

Despite stay-at-home orders, changes in commuting behaviors and erratic outof-stocks (or perhaps because of these things), basket sizes were up and visits per customer were down for every retailer we studied. At the time we surveyed, the average basket size was ~30% higher for shoppers in the market. Additionally, the average share of wallet that customers were giving to their current grocery retailer was ~14% higher. Translation: customers consolidated their shopping to fewer stores, giving more money to each store. This occurred even for stores that were competitively less well-positioned for one-stop-shopability heading into Covid. In fact, stores that scored in the lowest quartile on "I can do all my shopping at this one store" had the largest increases in basket size and share of wallet during Covid. In other words, during Covid, shoppers were more forgiving of a retailers' faults in their quest to fulfil their short-term shopping needs and get home quickly and safely.

Convenience and Covid: Voice of the customer

"With work at home - I cannot shop at the grocery stores I usually shop at because they are in the town where I work - 30 minutes away and feel wasteful driving that far just for groceries."

Why North America’s health and wellbeing could be the next big retail pharmacy battleground

The retail sector has experienced both of these extremes, with some seeing strong sales while others have been forced into bankruptcy and liquidation.

What we have seen is an acceleration of trends that were in motion prior to the pandemic but are now even more essential for success. One such trend is, understandably, the enhanced focus in retail on health and wellness. This is not a new phenomenon especially within Retail Pharmacy as "buy and build" expansion pushed the market towards saturation. More savvy competition, both within the sector, as well as grocery, mass merchant, and ecommerce began to expand into Health & Beauty (H&B) and prescriptions.

Prescription benefit managers (PBMs) grew increasingly powerful and began demanding lower reimbursement terms and restricted access to customers. Some even set up their own mail order prescription businesses and became direct competitors. This direct attack on the pharmacy business model, combined with the erosion of the convenience advantage forced chains to find other ways to extend their reach. For many, the answer lay in diversification and, specifically, the integration of products and services that had previously sat with dedicated medical providers.

Faced with limited development prospects, retail pharmacies once again needed to re-examine their offering and carve out a distinctive customer proposition.

Clinical decisions

In the US, prescription medicines account for around two-thirds of retail pharmacy revenues¹. As a result, repeat business is vital. Clinical services – a longer-term, more consultative offering than pure dispensary – can help to encourage ongoing business by building a stronger relationship between pharmacist and patient.

With that in mind, it's little wonder that for many retail pharmacies in the mid-2000s, the decision to expand into clinical services seemed like a natural evolution.

CVS, Walgreens and others went through a flurry of acquisitions, purchasing small health service companies up and down the US. In-store facilities were rolled out to capture new clinical business and commence the shift into a wider "health services" offering.

Certain activities, such as immunizations, had successful starts. But the growth of these clinics and their services rapidly dropped off and it soon became apparent that success would not be as readily won as those retailers may have hoped.

One major problem lay deep in the complex inner workings of US healthcare. Limited by their insurance plan benefit structures, customers would often find themselves unable to access the full range of services offered in-store. Clinical service costs, while usually lower than those available at a hospital or doctor's office, would likely be higher than the insured co-pay price paid by the consumer at the latter.

Retailers quickly learned that in order to integrate into the healthcare industry, they would need to learn how to influence and control it as well.

Playing a long game

CVS, which made the strongest initial investment into in-store clinics, has spent more than a decade in pursuit of that goal. Major product decisions, such as the removal of tobacco from stores (itself a $1bn annual business) were executed in the name of a slow repositioning towards healthcare.

Strategic acquisitions have only helped to further that ambition. With its first major vertical healthcare purchase – that of PBM Caremark in 2006 – CVS gained control of the levers of customer access and prescription reimbursement for millions of lives. 13 years later, with the acquisition of Aetna, the company added the ability to provide health, dental, vision and other insurance plans to customers.

Taken to its logical conclusion, this trajectory could lead to the eventual formation of an integrated healthcare system supported by some 10,000 points of service.

There is growing evidence that an empire of that kind is firmly in the retailer's plans. CVS has already announced its intention to evolve clinics into more expansive "Health Hubs", bringing enhanced services to 1,500 locations by 2021. Health Hubs include more space devoted to clinical services and a broader focus on proactive wellness and nutrition alongside extensive health services.

That wider remit is immediately evident in an enhanced product assortment, one that includes numerous specialized items and categories for maintaining health and preventative wellness products –. And, perhaps influenced by insights delivered by Aetna, CVS has also chosen to put significant emphasis on chronic condition management, an area that can provide a pharmacy with some of its most valuable customers.

While CVS is playing a highly strategic game, though, it is by no means the only player to watch.

Save money, live better

As the world's largest retailer, just about anything Walmart does is reason for the competition to pay attention. It may have taken more than a quarter of a century for Walmart to start selling groceries after all, but the retail behemoth now holds top position in that segment in North America by an overwhelming margin.

With that precedent in mind, and in light of Walmart now holding the position as the nation's third largest retail pharmacy provider, it seems likely that another fierce battle for the future of retail pharma is about to begin.

Launched in fall 2019, the Walmart Health Care Clinic serves as a good indicator as to the strength of the company's ambitions.

Staffed to deliver an expansive set of services that range from primary care and disease management through to dental, hearing, nutrition and fitness, these sleek, modern facilities offer the same one-stop-shop approach as Walmart's core store.

Moreover, Health Care Clinics also employ the company's "everyday low pricing" model, something that makes for a compelling proposition regardless of insurance coverage. Medicare and Medicaid are both accepted too, encompassing what is likely a significant number of customers.

The battle within

Similar at their core yet, subtly different, these offerings from CVS and Walmart represent a dramatic shift in healthcare delivery in the US.

While the scale of each remains too small at this point to draw many conclusions, those small differences could carve out room enough for both to flourish. CVS' focus on providing specialist-level health and chronic condition care is different enough from Walmart's "low price, one-stop shop" approach to appeal to a distinct group of customers.

Rather than between each other, the biggest challenges ahead for CVS and Walmart may actually be found within. As both companies make fundamental changes in order to facilitate a future in which healthcare is a significant part of their offering, they will need to focus on evolving their relationships with their long-term customers too.

CVS, for instance, will need to ask customers to reconcile the idea that a company that continues to dominate in snacks and candy is now an active participant in their healthcare. And Walmart, famed for its leadership in building highly efficient operations, will need to scale and sustain a healthcare business rooted in flat, affordable pricing, as well as build the credibility as a viable provider of quality healthcare.

Neither challenge is easy. But if history has taught us anything, it's that when companies of this size decide to redefine an industry from the ground-up, they tend to succeed.

The arrival of Covid-19 also introduces a new reality unthinkable less than a year ago. Health and wellness permeates all aspects of our lives and vigilance is essential to protect ourselves and our loved ones.

- PPE has become a category in its own right with massive and sustained demand across such items as masks and sanitizers.

- Hospital capacity is being tested repeatedly with infection surges and unable to address lower level and elective procedures

- Vaccination is now a global necessity requiring a distribution network capable of rapidly reaching billions of people

Build Customer Loyalty with Personalization

FOR RETAILERS

Smarter operations and sustainable growth, powered by Customer Data Science.

FOR BRANDS

Better understand and activate your Shoppers to grow sales.

Upcoming Webinar | Insights from the 2021 dunnhumby Retailer Preference Index for U.S. Grocery

The Great Recession programmed lasting value-consciousness into the minds of consumers. How might COVID-19 rewire us again?

The fourth annual dunnhumby Retailer Preference Index for U.S. Grocery (RPI) sheds light on what makes a retail winner, and how the pandemic has impacted consumer shopping behaviors. Known as retail's equivalent of the Gartner Magic Quadrant, the RPI surveyed about 10,000 consumers to understand what's driving customer preference and rank the top 57 grocery retailers in the United States.

Join dunnhumby CEO Guillaume Bacuvier as he dives into the latest study, revealing the levers for success, and which retailers are winning the hearts, and wallets, of shoppers today.

Register now

Retail leaders must objectively understand how their business currently considers Customers before trying to set a more Customer-centric direction and focus. There are some formal assessment methodologies, like dunnhumby's Retail Preference Index (RPI) and Customer Centricity Assessment (CCA), which offer detailed evaluations of a business' capabilities, strengths and weaknesses based on Customer perceptions (RPI) or global best practices (CCA).

The approach outlined below is not intended to replace these formal tools; rather, these observations are intended as a kind of 'toe in the water' to help retail leaders form early hypotheses and points of views. These are rules of thumb, heuristics culled from global experience. Later, leaders might use these observations to informally check progress from time to time as a way of assessing whether the "program in the stores matches the program in our heads".

Hence, the context and laboratory for these suggestions is the retail store, where the rubber meets the road, so to speak.

1. Who really runs the store?

Walking around a store (or better, walking around several), can give many clues toward understanding a retailer's attitude about its Customers, as well as revealing some of the challenges ahead for installing Customer First. As Customers ourselves, we are qualified to assess an organization's 'readiness' for Customer First, simply starting by walking around.

How a Customer experiences the store shapes their perception of the brand, and there are dozens (even hundreds) of 'moments of truth' for Customers in each shopping trip – opportunities for the retailer to win more loyalty, or indeed to lose it. And it only takes one 'bad' experience to erase all the good.

Leaders can form an opinion about the Customers' true shopping experience by observing 'Who really runs the store?' – a way to put on a Customer lens to assess if the Customer, the retailer, the supplier, or no one is driving shopping experience decisions, like range and presentation. For example:

- Choose three sections across the store (telling categories include yogurt, pasta sauces, milk, and packaged lunch meats). Look to see how the product is organized and presented (remember to try to see through the eyes of a Customer).

- Is the section organized by brand (e.g. all Danone yogurt is merchandised together in a recognizable Danone brand block)?

- By Customer benefit or usage (e.g. all brands of probiotic yogurt are merchandised together, as are all Greek style yogurts, all kid's yogurts, etc)?

- Or, by some hybrid but logical planogram rather random plan, with little recognizable logic at all?

- Would you conclude that the product display / layout logic is influenced more by supply chain, by brands, or by the Customer need states or trip missions?

- How broad is the range (e.g., number of varieties or sizes)? How deep (e.g., number of brands of the same flavor or variety)? Does the breadth and depth feel Customer friendly, or confusing?

Of course, analysing any available loyalty data will later tell us how Customers shop the category and that might well be by brand (or flavour or size, etc., and will certainly vary by section). But this first assessment helps us begin to form our perspective on how tuned-in the business is around its Customers, and about where within the business leaders might need to begin to install insights and the Customer language.

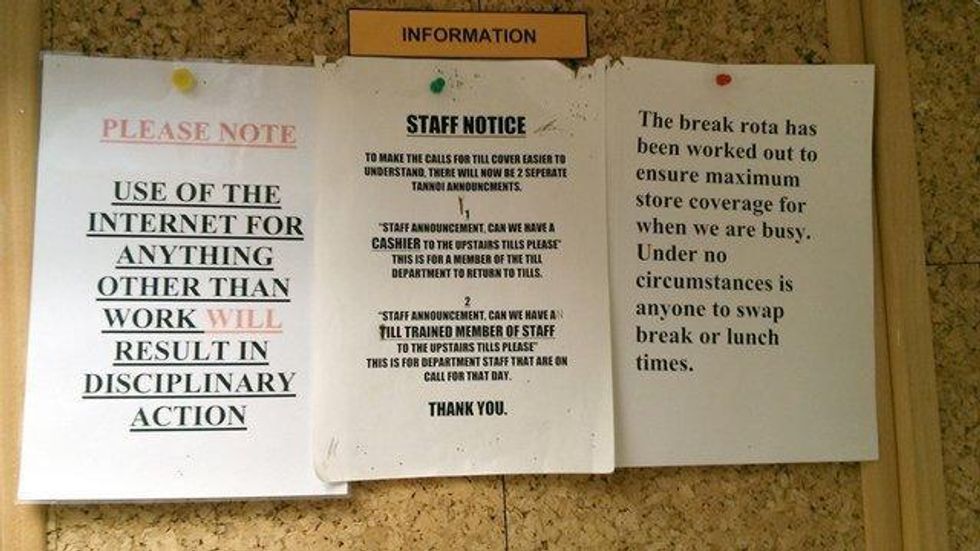

2. What messages are Customers receiving?

Store signage not only delivers a written message, but also a type of 'body language' that Customers tune in to, albeit not always consciously. Look around the store to see both the written and hidden messages, and hear the tone being communicated: ask, do messages speak respectfully to Customers? For example:

- Signage at the entrance rudely telling Customers what the rules are, even though 99.999% of Customers will never even think of shopping without shirts or shoes, or wearing roller blades

- Narrow limits on the quantities of promoted products or services.

- Rules and restrictions, terms and conditions.

- Aggressive security barriers and gates at entrances – although sometimes operationally necessary, these also tell honest Customers that they, the shoppers, are not to be trusted.

- Phony expiration dates for promoted prices – Customers learn that the deal will be repeated soon, if not immediately. Best example is the many carbonated soft drink promotions below shelf price that are repeated frequently, and the innumerable 'roller' prices practiced by many retailers.

- Stupid pricing signs (any stupid sign, really).

3. What messages are Employees receiving?

While walking the store, traveling through stock rooms and the employee break room, note the signage and messaging aimed at staff. What seems to be valued more – numbers or people?

What policies and rules guide employee behaviour?

How are they expected to interact with Customers?

Are the messages respectful of staff? Of Customers?

What do signs say about the culture around Customers?

4. Who has the power to satisfy Customers?

dunnhumby's Loyalty Drivers analysis suggests that Customers exhibit four 'mindsets' in their shopping journey – Discover, Shop, Buy, and Reflect. One element of the 'Reflect' mind-set includes the decision to return, exchange, or to request a refund when the product or service does not quite suit.

On your store walk, observe who has the power to satisfy Customers making a return or wanting a refund: is the front-line employee empowered to satisfy the Customer, or must the Manager be called? Is there one 'service' desk where Customers must queue to get their money back, or can the helpful cashier make it good on the spot?

Examine the return policy to assess its sensibility and ease from a Customer viewpoint. For example, must a Customer act within 7 or 30 days, and is a receipt required and signature under penalty of perjury? Is the taking of an oath necessary, or perhaps a drop of blood? The store's practice says volumes about who deserves trust in the eyes of the business. Requiring levels of approvals and higher management involvement (or some other form of hoop-jumping) is neither trusting of employees nor Customers.

The return / refund policies and practices are strong indicators of a company's readiness for, or progress along the Customer-centric journey. Customer First organizations give front-line employees broader authority to resolve Customer needs, and extend the power to satisfy Customers to most members of staff, in some form. For best practices in this area, please see the policies from Nordstrom in the U.S. and Ritz-Carlton globally.

5. Do the words of your leaders matter?

Senior leaders set the tone for how Customers are regarded and treated in the business both by their words and their actions, of course. And the C.E.O.S – Customers, Employees, Owners, and Suppliers – all take notice. It's widely documented that leaders who walk the walk are more effective than those who only talk the talk.

One simple yet powerful way to assess readiness and progress is seeing how leadership's walk and talk align. A word cloud, like the one illustrated below, makes the point very clear. In this example, recent shareholder statements (same quarter) were compared for two companies on a Customer-centric journey. We can see different progress in a form of 'walking the walk' at Retailer X and Retailer Y. The C.E.O.S are hearing what really matters to the leaders, and are forming the Customer culture accordingly, all the way down to store level.

Implications for retail leaders

The store shapes Customers' perception of the brand; there are hundreds of opportunities for the retailer to win or lose loyalty in each shopping trip. Customers take clues, consciously and unconsciously, throughout their entire shopping experience, and draw conclusions about retailer warmth and attitude toward shoppers. And it only takes one disappointing experience to erase all the good.

Retail leaders must take an objective assessment of the shopping experience using a Customer lens to understand their current state and readiness for customer centricity. Pay close attention to the body language and tone of your policies. Store signage, employee empowerment and communications, and practices around assortment and presentation are clear indicators of the organization's attitude about the Customer.

Who actually runs your store?

This is the first in a series of LinkedIn articles from David Ciancio, advocating the voice of the customer in the highly competitive food-retail industry.

Prophets of Aisle Six, Episode 2: Heinen’s Fine Foods

The Prophets of Aisle Six is the first online reality series focusing on innovation in the food retail industry. In this episode, Jose Gomes, dunnhumby's North America Managing Director, travels to the downtown Cleveland store of Heinen's Fine Foods. Jose meets with Tom and Jeff Heinen, co-owners and brothers, and learns how they are evolving their grandfather's mission of delivering excellent customer service. With 23 stores in Northeast Ohio and the greater Chicago area, and a 90-year legacy, Heinen's is proving that being a small retailer can be an advantage when it comes to data.

In this series, dunnhumby tours the globe and speaks with some of the world's greatest brands, exploring their biggest challenges and how they are using customer data science to meet those challenges.

In my last post, I posed five questions to retailers to help them determine whether they're ready for a customer-first mindset. Now, I'd like to challenge the retail basics that seasoned retailers were trained on, and suggest instead a new customer data science approach.

"Retail is detail" is common industry wisdom, and it means that achieving success is subtle and difficult. Success in any field demands practice and experience, and so it is little wonder that many senior retail and brand leaders and managers have vast years of involvement, and that most have grown up through the business in progressive steps.

Accordingly, business decisions are heavily based on experience, and more often on personal memory of choices and executions and how a thing has traditionally been done. As Chris Foltz, director of operations at Heinen's Fine Foods, told me, "Our industry, and our company, was very opinion-based, albeit expert opinions. We realized early on that we needed data on customer needs, customer satisfaction and customer buying behavior to improve our decision-making. As we adopted this metric-driven approach, I believe we prioritized our investments and effort to deliver a better customer experience."

These are a just few of the things that most retailers absolutely know for sure:

- We must acquire new customers in order to grow our business.

- Price-sensitive and "cherry picker" customers are not profitable. The competition is welcome to them.

- Customers are different in every region of the country. There are also differences between urban and suburban shoppers.

- Loyal customers are already giving retailers most of their spend in the categories offered.

- Weekly flyers and promotions always drive footfall and sales.

- After all these many years in the business, we know what customers want.

Why What We Know About Customers Just Ain’t So

The old axioms are no longer factual because customers themselves have dramatically changed, in their needs, expectations and experiences. Separating fact from fiction—and business truths from myths—will change how the business sees itself and how it will make decisions. The following are some of the new truths of retailing in the 21st century:

- Expanding share of wallet from customers who are already "loyal" can better optimize growth.

- Loyal customers need more love and investment than new customers.

- Retaining loyal customers and reducing churn among "opportunity" customers can drive more growth than acquiring new customers.

- Price-sensitive customers are often more profitable than other segments because their basket mix includes more private label products or higher-margin portion sizes.

- Behavioral "buy-o-graphics" and intended trip missions matter much more than demographics or geographics.

- Customer segments are typically distributed variably within geographic regions or zones, but all customer types exist in all stores.

- Store clusters built upon customer dimensions are more useful to operations and execution than store groupings based on geographic zones or volumetrics.

What We Know for Sure Can Fit on a Post-It Note

Agility in retail can only be maintained by understanding customers and using data in all available quantitative and qualitative forms. Here's a personal story to illustrate:

A perception-based research tool measured one retailer's progress against factors that customers themselves had said are most important to them. Before the first customer perception report was published, I set out to learn how the customer ranking compared to the rankings that the senior decision-makers would assign.

The regular weekly senior team meeting brought together many of the wisest and most seasoned leaders in the business. After briefly introducing the research methodology, I asked the team to list what factors they thought customers would list as important, and in what order they thought customers would place them.

Not surprisingly, each merchant tended to rank factors in their department higher on the list than those for other parts of the store. Although little agreement was reached, a compromise ranking was eventually defined.

Comparing our list to the customers' list revealed spectacular differences; leaders had listed most of the same elements as did customers, but in completely the wrong order. That day, the team experienced a true epiphany—they realized that "we didn't know what we didn't know."

The lessons learned were:

- Humility gained in discovering that "we don't know what we don't know" empowers the customer-first journey.

- To become more relevant to customers, we must become fact-based deciders and activators.

- Using customer data well creates true consensus and inclusive action.

In summary, “In God We Trust” ... all others must bring data.

David Ciancio is global customer strategist for Dunnhumby, a pioneer in customer data science, serving the world's most customer-centric brands in a number of industries, including retail. David has 48 years' experience in retail, 25 of which were in store management. He can be reached at david.ciancio@dunnhumby.com