So Many Loyalty Cards, So Little Loyalty

What retailers can do to rethink the topic

October 28 2020

Blog

Thank you! Your copy of the report opened in a new tab. If you have trouble viewing it,click here.

Thank you! Your copy of Webinar is opened in new tab, If you have trouble viewing it,click here.

What retailers can do to rethink the topic

Most companies attempting to drive customer loyalty fail miserably—and few so-called customer-centric companies generate sustainable customer loyalty that drives measurable business results. Why? Because they get three key principles completely wrong, right from the start:

We start to act loyally to customers when we understand them to a level of detail that ensures that we remain responsive to changes in their behavior, relevant to ever-changing customer needs and rewarding in the way we treat customers.

Acting loyally is about adopting a loyalty mind set of managing customer segments as strategic business units (aligning with how we think about a category management strategy as managing categories as strategic business units). This context demands change that is both incremental and transformational—evolution, but with a bit of manageable revolution.

What customer loyalty is, and is not:

We demonstrate loyalty to our customers by taking a loyalty approach wherein we commit to rewarding and delighting our customers with products and experiences that meet their wants and needs.

The loyalty program is an important element within a loyalty approach, as the key source of the data that enables customer intelligence, and as the channel that enables us to talk to our customers personally. I call the loyalty program the "little l" in loyalty, with the loyalty approach as the "big L."

But a loyalty program is not required to act in a loyal way to customers. Here's how to think of "big L" loyalty:

A loyalty approach, simply put, embeds customer insight throughout the retail organization to enable better, faster decisions and thereby increase sales and profit sustainably. Best-in-class practitioners have seen an incremental sales uplift in the early stages of a loyalty approach of between 1% and 2% and later stages between 3% and 4%, quarter over quarter and year over year.

As I used to say to my retail colleagues, "If the store is lousy but we deliver brilliant targeted CRM, the store will still be lousy."

Even if the personalized CRM is perfect, customers need to perceive that tangible changes have been made in the store itself before they will respond by giving more of their custom. We must put customer insights into action within the "hardwiring" of retail practices—pricing, promotion, assortment, adjacencies, new products, the checkout experience and so on.

In a previous article, I shared several examples of being loyal to customers in store by simply making the shopping experience easier—setting the yogurt section by customer need rather than by brand blocks, for example, and by setting product adjacencies according to how customers shop, rather than by how items are sourced in the supply chain.

3 Ways to Activate a True Loyalty Approach

David Ciancio is Global Customer Strategist for Dunnhumby, a pioneer in customer data science, serving the world's most customer-centric brands in a number of industries, including retail. David has 48 years' experience in retail, 25 of which were in store management. He can be reached at David.Ciancio@dunnhumby.com

labeled box lot

Article originally appeared on Forbes.

My company recently produced a report on the state of the food retail industry, and in studying that sector, we discovered something that we hope will make food retailers stand up and listen. We learned that the nation's top grocery chains have found a way to focus on both short-term financial performance and investment in long-term consumer engagement. The latter is considered an insurance policy for the future — a sobering thought in the new year.

Insurance for the future may be one of the most difficult things to buy if you are overly concerned about present-day financial performance. As a consultant and provider of technology services to food retailers all over the world, I understand why they are concerned. Despite positive projections for the industry in 2019, there are signs that the economy is slowing, and that could very well soften consumer spending.

There's also the continuing threat from digital disruptors like Amazon that might coerce retailers into taking actions, such as blindly lowering prices, that further erode margins that are already razor thin. Another threat, well known to the industry but perhaps less so to the general public, is the new generation of discount chains that have figured out the magic of balancing short and long-term strategy and planning.

But here's the biggest challenge facing food retailers: falling prey to fear itself. I'll admit that fear can sometimes be a helpful motivator to monitor and manage your business. A recent article reported the one photo that the CEO of Walmart keeps on his phone. It lists the top 10 retailers per decade over more than sixty years, and it serves as a reminder for how many companies come and go. But McMillon is managing fear, not falling prey to it. Retailers can manage their fear, rather than fall prey to it, by leaning on three tools that can alter their standing in the industry.

Recent years have brought with them the dawning realization that retailers possess abundant consumer data. Gathered and culled from direct interactions between stores and their customers, data of this quality helps retailers price and promote their products more intelligently. It helps them with product assortment, store design and managing the new kinds of services they offer. This can include things like in-store pickup and options for self-service, depending on what makes sense for their customers. More profoundly, data can help retailers think about how they can monetize that data to help their vendors connect more meaningfully with customers. The reality is that all grocery retailers potentially are media companies, with access to online and offline media properties. It's a lesson learned from Amazon, but a small number of retailers around the world are helping to raise their profit margins by taking a page from the playbook. The place to start is with first-party customer data, which is what retailers uniquely possess.

For food retailers especially, we learned that there is an enormous number of inefficiencies with how food retailers engage with vendors, beginning with how they collaborate on pricing and promotions. Some retailers are struggling to move beyond spreadsheets to other systems that help automate exceedingly detailed work. We are living in a time where inefficiencies can make or break a business. But still, many food retailers are ready to concede that times have changed. Beyond providing technology that moves beyond spreadsheets, retailers would benefit from interviewing their vendors to discover what would make life easier for them in this highly competitive industry.

Change may be painful, but inertia will be lethal.

As the celebrated business scholar Clay Christensen has written, it is very difficult for any business to change course on a strategy that had made it successful in the past. He calls this the innovator's dilemma because, at almost any time in the evolution of any industry, leaders must understand that a decision regarding the future must be made.

To that end, the future is not served by signing a partnership with a third-party fulfillment provider to launch an e-commerce service. It's about making better decisions that impact the core of your business and operating more efficiently to better serve your customers across all of your channels.

But here's where food retailers have a unique opportunity, at the beginning of 2019, to ignore fear and take a small leap into becoming more viable by making decisions based on what they know about their customers. There is no business that knows more about people than retail, because they actually meet and greet them every day.

Take heart, and fear not. This is only the beginning of a story that's mostly yet untold.

These are unprecedented times of rapid and deep changes for customers and society, driven primarily by technology, economic volatility, and political uncertainty (e.g. Brexit, US elections).

For Retailers and Brands, these are dangerous times of disruption and of tectonic shifts in structures, formats, and channels. A new epoch of retail has arrived, wherein, once again, only those most agile and adaptable to change will survive.

Amongst the new realities keeping retailers up at night and dragging down already thin margins:

Arguably, in today's multichannel world, retailers face a binary decision (relative to competition) to either be cheaper or more relevant (as any middle position is short lived and profit starved). Being cheaper means beating Walmart, Rakuten, Amazon and others at their own disruptive model game, which is highly improbable. Being more relevant means understanding customers better than others do, and from this, delivering an experience that customers personally value.

On the other hand, the opportunities for business growth arising from these challenges are immense. Seeing a tremendously fertile (and frightening) environment for change, even the hard-nosed, raised-in-the-business retail leaders are realizing that they must become more science-driven and more customer-aware if they want to even survive, let alone seize upon any opportunities for growth.

Agility is exactly the capability that retailers need, driven optimally by using data and science to delight customers. Retailers and brands must embody a cultural and mind shift to putting customers first; this is how they become empowered to seize on the opportunities now presented, and how they enable themselves to thrive therefrom. To change best and with purpose, it must be via Customer First – to deeply understand customers, to strategically invest in what matters most to them, to improve the shopping experience, and to personalize conversations with the most precious assets of the business – its customers.

Delighting customers using a loyalty approach – what I call Customer First – is not just some warm, fuzzy, altruistic thing (although a Customer First organization will feel better to its employees as a place to work and customers will enjoy better experiences), but is, rather, a growth-driving, growth-sustaining machine proven to generate profit when executed optimally.

Customer First delivers profit and margin growth by focusing on growing top line sales first. Sales growth, as every good retailer knows, covers many sins: it improves the percentages on the measures retailers care about most (e.g., store labor percentage, OG&A expense percentage). Greater sales directly translate into greater purchasing leverage on suppliers. Simply, growing sales via Customer First grows greater shareholder value.

More importantly, beyond projecting well-being for customers, Customer First protects jobs and well-being for employees of the business. In this protective role, Customer First becomes a moral obligation for the business and a moral responsibility for its leaders – and this is the highest purpose.

The new reality is that change is here to stay, perhaps more fiercely than ever. Those of us who understand this reality, who accept it and adapt quickly, will emerge profoundly the better for it. Better in terms of market value and employability as a business and as individuals. Better because we don't squander precious time and energy resisting the inevitable. And certainly, better when it comes to the health, happiness, and well-being of our customers and ourselves.

This is the seventh in a series of LinkedIn articles from David Ciancio, advocating the voice of the customer in the highly competitive food-retail industry.

The traditional, regional U.S. grocery store—it's the institution that has fed communities for decades and families for generations. It offers that connection to a simpler time, a time when the guy behind the meat counter would know Customers by name, a time when a dad pushed his child around in a shopping cart while they "helped" him shop and a time before mobile phones invaded our lives and sped up the pace of life…

That place—the traditional grocery store—has history. Customers and the people who work there are part of a family. That kind of emotional connection is priceless.

If this is true, then why does Aldi—which borrows a quarter per shopping cart and operates with a small crew that arranges shelves while taking care of customers—have a stronger emotional connection with shoppers than 90% of its competitors?

Yes, that's right. Aldi, known for its cost cutting and low prices, has– an emotional connection that is stronger than nine out of 10 traditional grocery stores.

Traditional grocers may take for granted that they have an advantage over non-traditional channels in the strength of their emotional connection with shoppers, but that doesn't appear to be the case at all. So just how bad is it for traditional grocers?

The inconvenient truth is that the average traditional grocery store has a lower emotional connection with its shopper than the average store in any other major channel where groceries are sold. While traditional grocers have been focused on selling groceries to the same towns for decades, non-traditional grocers have been able to move into those towns and secure a stronger emotional connection in far less time.

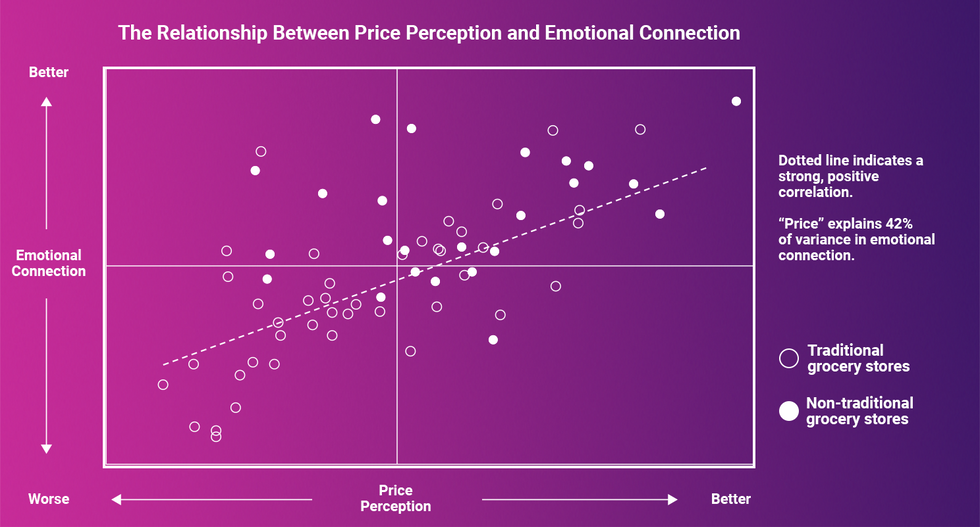

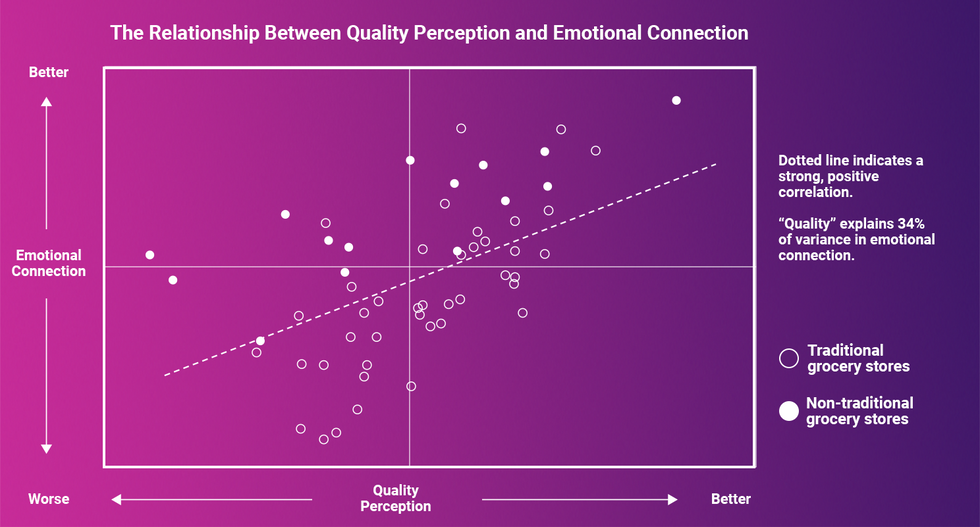

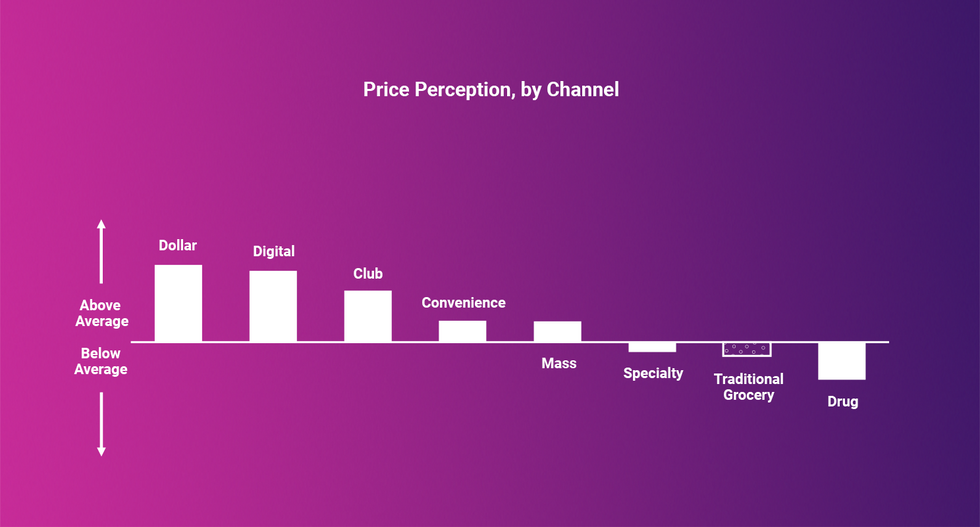

How? Well, it appears that emotional connection does have a price, after all. In fact, price perception is slightly more associated with emotional connection than perception of the quality of products and store experience:

And, whereas traditional grocers have managed to hold their own on quality perceptions, they lose on price perception.

So, where does the traditional grocer start if they want to win back the hearts of their local constituents? After all, there are many levers they can pull within pricing, assortment, and store experience to move perceptions. A close look at data from our 2019 Retailer Preference Index: Grocery Channel Edition offers some hints. Stores who have the strongest emotional connection separate themselves from the pack with the following:

Translated into language customers might use, that means:

Of the 56 retailers ranked by emotional connection, 24 of the bottom 25 are traditional retailers. And while Aldi, ranked 17th for emotional connection, has been used as a stark example to illustrate traditional grocers' emotional connection issue, many other non-traditional stores have a stronger emotional connection with their shoppers than Aldi does with theirs.

However, 3 traditional grocery stores buck the trend and join non-traditional retailers in the top 10: Market Basket (4th), H-E-B (5th) and Publix (6th). They each check more than one of the boxes on the core ingredients of emotional connection.

These retailers, more than any other traditional, regional grocer, have established with their emotional connection an insurance policy for an uncertain grocery industry future. And the prevalence of non-traditional grocers with superior emotional connection proves the point that this insurance policy is more a product of "what have you done for me lately" than a product of consumer nostalgia. Non-traditional grocers are buying emotional connection with better prices while delivering on some combination of a superior private label, offering the best natural and organic prices and having staff who show they value customers.

A new format in grocery retail is emerging: the 50,000 square foot convenience store. Its value proposition to customers is simple: higher quality perishables and ready-to-eat items than your typical grocery store. Thousands of the same center-store products you can also find at Walmart, Target, Amazon, Costco and Sam's Club. Everything at higher prices. Added bonus: since the store is 10x to 20x bigger than your typical c-store, you can get your steps in and burn calories at the same time.

Wait, what?

The reality is that this is not a new format—rather the customer-led repurposing of a familiar one: the traditional, regional grocery store. This finding comes from a follow-up analysis of data collected for the recent 2019 Grocery Retailer Preference Index report, a report which identified winners and losers among the 56 largest retailers in the U.S. Grocery Retail Industry. In this follow-up analysis, we examined the types of trips people took (e.g. bigger vs. smaller) to each retailer, as well as the categories they bought (e.g. produce, ready-to-eat or paper products). The findings cast further light on the problems faced by traditional grocers in an evolving grocery landscape that has seen national mass, club, drug, dollar, convenience and digital players invest more in the grocery game the past few decades.

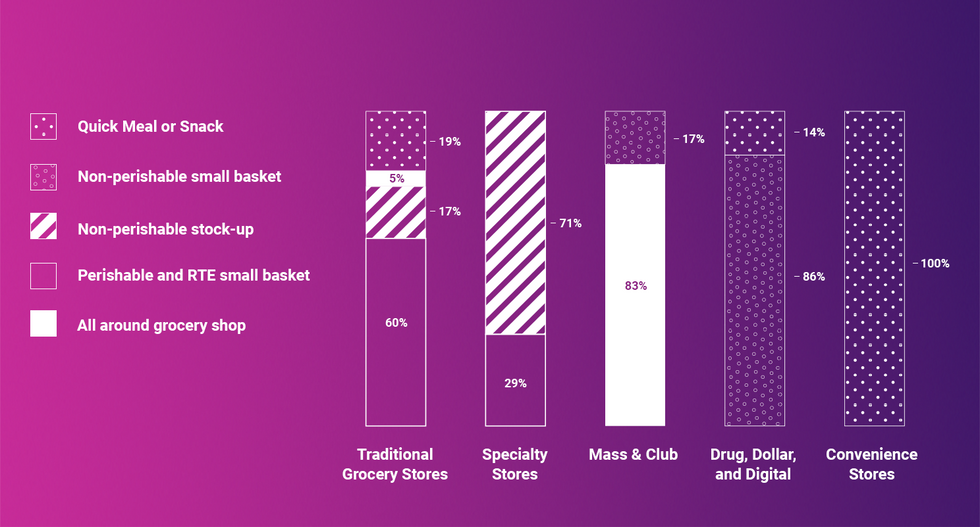

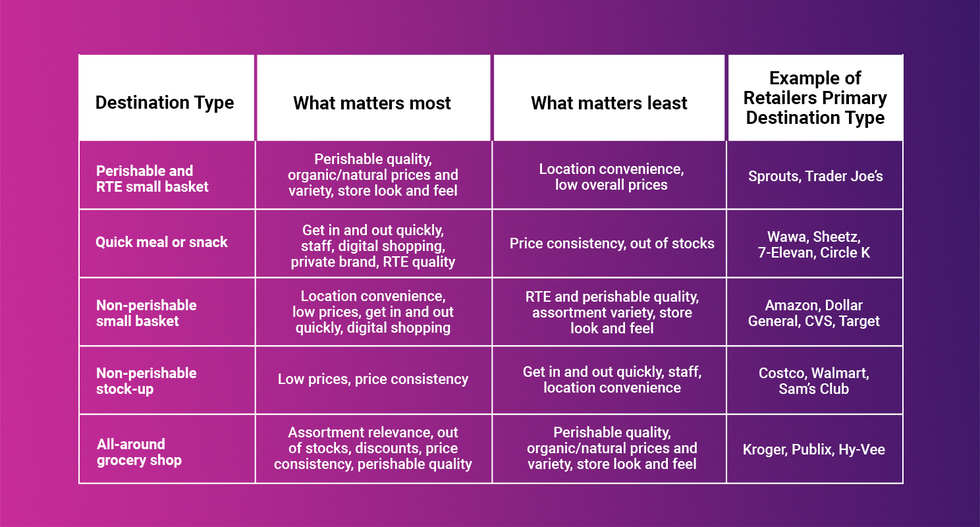

Certain channels lend themselves to certain destination types. Specialty grocers like Trader Joe's or Sprouts, with fewer SKUs and smaller formats than the traditional grocer, tend to fall in the "Perishable and ready-to-eat small basket" destination type. Club and mass are non-perishable stock-up destination. Drug, dollar and digital in non-perishable small basket. C-stores in quick and convenient meals. However, many traditional grocers have an identity crisis. Only 6 in ten are seen primarily as "all around grocery shop" destinations, despite all of them carrying the full complement of SKUs.

In other words, almost half of traditional grocery stores are shopped more like a convenience and specialty store than like a store with 10-20x more products than that. At best, categories beyond perishable and RTE food are typically an afterthought and only shopped in a pinch. At worst, those categories are bypassed completely by shoppers, who instead buy the same products for cheaper at widely available mass, club, digital, dollar or drug channels.

The result of being treated as a perishable c-store is a lower share of customer wallet. Traditional grocers who are all-around grocery destinations win 33% of their customer's share of wallet, versus only 20% for traditional grocers shopped like a perishable c-store.

So, what can traditional grocers who are not being viewed as an all-around grocery shop do about it?

According to an analysis of customer needs gathered from a survey sent to 7,000 shoppers in the U.S., if traditional grocers want to ensure they'll be an all-around grocery shop, they need to ensure some key ingredients are in place:

For now, traditional retailers aiming to be all-around grocery shops can trade-off on having the best digital offering and the best ability to get customers in and out quickly. These things are less important to customers when picking an all-around grocery destination.

While some traditional grocers are struggling to win the title of all-around grocery shop, one non-traditional store isn't: Aldi. Aldi's consistently industry-leading prices and their ability to manage out of stocks and store cleanliness just as well as your average traditional grocery store, has made them a stock-up destination for perimeter categories, like produce and dairy, as well as center store packaged food items. As a result, despite having stores which carry less than 2,000 SKUs, Aldi's share of customer wallet is in line with that of the average traditional grocery store, which often carry more than 40,000 SKUs.

Of course, the reality is that no single non-traditional competitor is eating away at traditional grocers' hold on the all-around grocery shop. Rather, a host of non-traditional competition, each with unique value propositions, are all taking small bites, which add up. The data suggests that this is because traditional grocers took their eye off the retail basics, perhaps because they grew complacent after decades of dominance and relatively little industry disruption from non-traditional substitutes.

So, the call to action is clear: before overinvesting on any shiny new toys, like eCommerce or technology to speed up checkout, get back to your roots and make sure you're offering the right prices on the right products.

people collaborating about smarter retail investments

Grocery retailers can employ a countless number of tactics to compete in today's dynamic market. The issue is not the ability to do many different things at once, which retailers are often good at, but resources are finite. It's important to determine the right strategies to prioritize investments and which tactics they should stop entirely.

Many organizations, not just in retail, struggle to focus resources and attention on the areas that are most important to the health of the business. This often results in organizations chasing too many priorities, with few areas receiving the attention required to make meaningful improvements. Retailers that cannot markedly improve the business in areas that drive value perceptions and visits will find it difficult to navigate an increasingly fragmented and competitive market. The issue is further exacerbated by thin profit margins and scarce resources that require an even more thoughtful and strategic allocation of resources.

At the root of the problem is the inability to systematically assess and diagnose key issues across the business. Without the right data, systems, and processes, coupled with silos and day-to-day demands, diagnosing key macro issues is quite difficult. As a result, few organizations spend the resources or time needed to carefully align their strengths and weaknesses with the demands of Customers, competitors, and technology.

Artwork courtesy of Roger Penwill

The inability to confidently diagnose also leads to a largely internal focus and a planning process that centers on marginally adjusting next year's spend, hoping next year will be better.

Over time, this internal focus can result in a disconnect with Customers and too much influence from external organizations with conflicted priorities. This Customer disconnect causes a misalignment between the evolving Customer needs and the retailer's value proposition, which opens the door for competitors and new market entrants. This was the case with Walmart, Trader Joe's, and Costco who have all significantly expanded their market share over the last 20 years at the expense of traditional supermarkets. Ironically, this also happened with discounters in the U.K, who now control over 12% of the grocery market.

If a retailer can confidently diagnose key issues and identify opportunities, knowing that performance will improve, they would be more confident reallocating available resources. More importantly, they will have the knowledge and information to scale back in areas less important to the health of the business.

"The essence of strategy is choosing what not to do." Michael Porter – What is Strategy, HBR 1996

However, reducing or reallocating resources is difficult for most organizations. Relationships, culture, and legacy are baked into many systems, processes, and activities that are simply disconnected from the Customer and the overall performance of the business.

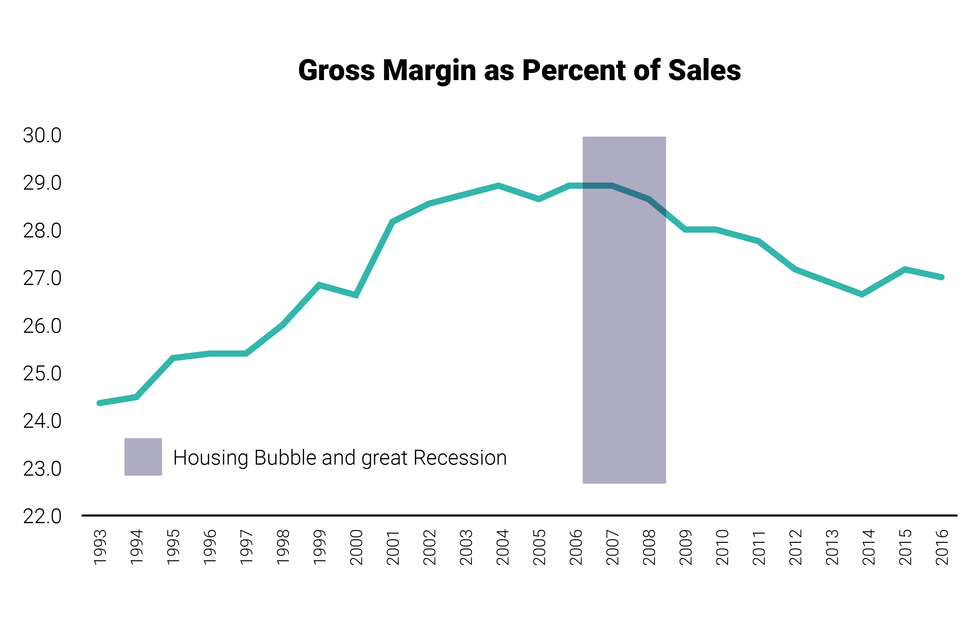

For example, many inwardly-focused traditional grocers failed to recognize the shift in the consumer and the market in the post-recession period. Looking at gross margins in the post-recession period, industry-wide gross margin as a percent of sales fell from 28.9% in 2007 to 26.7% in 2014.

U.S. Grocery Margin as Percent of Sales

Yet, other traditional retailers continued to incrementally increase their gross margins as they did in the pre-recession period, which may have helped them hit their short-term financial goals but damaged their long-term value perception. By 2006, Costco, Walmart and Trader Joe's had expanded into many markets and leveraged their strong value proposition in the post-recession period to steal significant share from supermarkets.

If traditional grocers diligently monitored the external market, changing Customer needs and diagnosed key issues, they might have responded by aggressively cutting back on expenses and investments. Consequently, they might have better managed the price perception gap and share loss over the long-term, rather than having to close stores today.

For example, a major retailer had a 2-percentage point gap in gross margin during the pre-recession market period and today it is over 5-percentage points. The premium price gap begins to reach a point where some retailers are simply no longer price competitive. Our research has shown that this lack of price competitiveness erodes not only financials, but also the emotional connection which used to be a strength for many regional grocers. Once the emotional connection starts to fade, it becomes increasingly difficult to win Customers and their wallets back.

So, how can retailers improve the ability to consistently identify key issues and take advantage of opportunities? It starts with a combination of people, process and data analysis to build the evidence-backed business case that can be used to develop a consensus across departments and alignment throughout the company. Depending on internal resources, this can include enlisting a partner like dunnhumby to help connect all available data sources, like Customer information from transactional data, market research, and online sources. In our upcoming Strategy posts, we'll look at strategic frameworks and other requirements to isolate key business issues and identify new and important opportunities.

gray and blue Open signage

At a recent customer conference — a gathering of dozens of executives of the nation's top food retailers — I opened my keynote by paraphrasing the opening line of "A Tale Of Two Cities": "It's the best of times, it's the worst of times."

I was talking, of course, not about the French Revolution, but the revolution that's afoot in my industry. And unlike Dickens, I was looking at what's happening not in the past but in the present.

I do not subscribe to the view that we are in the middle of a retail apocalypse; rather, I believe this is a retail revolution where the winners and the losers are yet to be determined. While the headlines continue to spook retailers inside and outside the food sector (Sears filed for Chapter 11, while Toys R Us is plotting a comeback), it seems like we are only focused on the worst-of-times/doomsday scenario. The truth: success stories have been obscured in the toss and tumult, and a rulebook for success is emerging. In a nod to another writer about revolutions — Saul Alinsky, author of the infamous Rules For Radicals — I offer seven principles that the best and the brightest retailers are following to weather the storm.

In my first column for Forbes, I made the point that "putting the customer first" — what seems like a timeworn cliché — is good for business. In the food retail sector, the main theater of battle in the retail revolution, the virtue of being customer-first is most apparent. This is a revolution where the customer is the victor, and the pressure is on retailers to compete for her. According to our research, she shops on average at four grocery stores each month and regularly buys groceries from at least three other channels. Most important: She has clear opinions about what each store represents in terms of value. Ignore what she thinks and wants at your peril. If you are a food retailer today, you need to start with a data-driven customer strategy.

All great revolutions result in the destruction not just of institutions but old credos as well. Here's one: E-commerce will lead to an inevitable race to the bottom for retailers because they need to compete more and more on price. We recently unveiled research that shows customers are more driven to make decisions as to where they shop based on perceived value, not price, per se. We have a formula: divide quality by price, and that gives you a better idea of what your customer wants, and how to put the customer first. For example, customers happily exchange the time it takes to shop at Costco and Walmart for lower prices — a choice driven by a subconscious cost/benefit analysis of each retailer's value proposition. A recent report by Forrester concludes that price, convenience, assortment and experience are all important to the modern consumer.

Which is not to say that you cannot differentiate more around quality or price to win customer preference. Retailers that are focused more on "fresh" or "organic" might focus more on quality, while big box brands might focus more on price. It's important to note that a study by Business Insider found that discount stores are surging. But the battle for shoppers today mandates you think about both price and quality. By analyzing first customer data — which retailers have access to — retailers can get a better sense of what matters to their customers.

In another study, we found that brands with a more homogenous customer and store footprint perform better. Why? Because they deliver a value proposition that is more consistent with their customer's expectations. They opened the most stores in the last 30 years, and as a such, their customers are more homogenous, and they understand their customers — their habits, their biases, and, ultimately, their preferences — better. Again, the best place to start is with tools for analyzing customer data.

A growing corpus of research shows that food retailers with their own private label product lines are benefitting not just from brand lift but margins as well. An intelligent private label strategy can significantly improve overall margins. But there should be an emphasis on "intelligent." To make this happen requires more than strategy; it takes a little something called customer data science.

By that, I mean the data, tools and practitioners that are now available not just to the Amazons of the world but to practically every retailer on the planet. Along with the revolution that is empowering consumers to shop more intelligently, there's the democratization of the science that was limited to just a few businesses visible at the start of the revolution. But to enter the battle you need to equip.

As I said at the start, this is not just the worst of times but the best of times as well. In addition to the democratization of best practices and tools, the relative strength of the economy plays in the favor of large incumbents and new market entrants poised to enter the fray. They may have more cash and other resources to commit today than when the inevitable dip in the economy makes competition for the choice-rich shopper even tougher.

When that time comes, we may actually have a tale of two retailers, not cities: the one that planned for the revolution and the other that did not.

Article originally appeared on Forbes.

Are retailers confusing innovation and disruption?

In a very good book by Thales S. Teixeira, Unlocking the Customer Value Chain, he lays out the argument that many assume innovation and disruption are highly correlated. As Teixeira points out, it is a reasonable argument to defend one's position through innovation and technology if you are being disrupted by innovative competitors. And that also helps to explain why most traditional grocery retailers are rapidly building up their digital and e-commerce capabilities.

In dozens of markets such as music, books and apparel, we have seen e-commerce and digital technologies lay waste to many retailers. In grocery, we have seen Walmart buy Jet.com and the emergence of Ocado, which is a pure play online grocery retailer. There have been more than a few articles written about the retail apocalypse and the demise of brick-and-mortar retailers. No doubt there has been disruption in this space, and much of it centers on technology.

But I will attempt to show that while there has been disruption in the grocery market, it has not been driven primarily by technology. There is a bigger, more fundamental driver.

It's called value.

There have been many waves of disruption in the grocery market, and the A&P was the first to innovate on a grand scale. It used branding along with innovations in food-processing, products and packaging to disrupt the local general store. The second wave saw King Kullen use refrigeration and abandoned warehouses to build the first self-serve modern supermarket. Walmart then used warehousing, logistics and analytics to create a lower cost structure and then used scale to squeeze suppliers. In the 1990s, Costco and Trader Joe's brought a new business model and a new value proposition to the market.

By the early 2000s, Walmart, Costco and Trader Joe's began to accelerate their growth and expansion. Each of these three retailers provided a combination of price and quality that was superior to most traditional grocery retailers, which, like many general store owners, hoped their customer relationships would be enough to keep their customers from straying.

With an already rapidly growing store base, the three disruptors became even more relevant to shoppers with the popping of the housing bubble and the Great Recession. Price and value became even more important to many shoppers who began to try these less expensive, less traditional retailers. Two of the three maximized their value perceptions through their own private brands, which were unique and offered quality items at very competitive prices.

With the Great Recession, the gross margin rate dropped from a high of 28.9% in 2007 to 26.7% in 2014, according to the 2016 U.S. Census Annual Retail Trade Survey. However, many traditional grocery banners missed this sizeable drop in gross margin because of their internal focus. Consequently, they just continued to grow their gross margin rates and their corresponding prices at historical levels rather than adjusting to a fundamental shift in the market. Consequently, the gap to these new disruptive retailers grew from a manageable difference to a game-changing shift in value perceptions.

In our recent Retailer Preference Index (RPI) report, we highlight the connection between value perceptions and financial/emotional performance. I believe it is this shift in value perception, which is the combination of price and quality perceptions, that is the key disruptor of the grocery market.

It happened when the A&P overwhelmed the corner store. It happened when King Kullen overtook the dry goods grocery store, and it has happened over the last 15 years as Walmart, Costco and Trader Joe's brought a unique combination of price and quality to the market. Keep your seat belts on because Aldi, Lidl and Amazon are the next wave of disruption, and their robust value perceptions will continue to disrupt the grocery market, particularly for traditional grocery retailers.

We have seen retailers invest heavily in technology and e-commerce because they have likely seen the impact on other industries, and I believe they are misattributing their current poor performance to technology and e-commerce. They logically think they can defend against e-commerce by developing their own e-commerce solutions, but this is not the core of their current performance issues. It is the gap in value perception that needs to be addressed and not an e-commerce offering.

Moreover, the investment in technology is likely raising the costs for many smaller retailers that are then going to pass them onto customers in the form of higher prices, which will exacerbate their value perception issue. Even if a retailer has the best e-commerce solution, the best website and the best phone app, it will not drive incremental value unless their price perceptions are in line with the industry and consumer expectations.

Amazon's recent move into brick-and-mortar outlets suggests that technology and e-commerce may not be disrupting fast enough. E-commerce is still less than 5% of grocery sales, and it has been around in earnest for over 15 years. Peapod was founded 30 years ago, and a 2016 Wall Street Journal article stated that the company was only profitable in three of its 20-plus markets. In a more recent 2018 Crain's article, Peapod's CMO stated the company was profitable in established markets but did not say it was profitable overall.

It is essential that retailers carefully align their own unique abilities with opportunities in the market before embarking on an expensive and risky technology spending spree. Walmart, Costco and Amazon versus traditional regional grocers is a modern-day David and Goliath story. And as David chose not to use the same weapon nor the same heavy armor as Goliath, it is important that regional grocers carefully consider how they can leverage their strengths to compete and coexist with the Goliaths of today.

Smarter operations and sustainable growth, powered by Customer Data Science.

Better understand and activate your Shoppers to grow sales.

The Great Recession programmed lasting value-consciousness into the minds of consumers. How might COVID-19 rewire us again?

The fourth annual dunnhumby Retailer Preference Index for U.S. Grocery (RPI) sheds light on what makes a retail winner, and how the pandemic has impacted consumer shopping behaviors. Known as retail's equivalent of the Gartner Magic Quadrant, the RPI surveyed about 10,000 consumers to understand what's driving customer preference and rank the top 57 grocery retailers in the United States.

Join dunnhumby CEO Guillaume Bacuvier as he dives into the latest study, revealing the levers for success, and which retailers are winning the hearts, and wallets, of shoppers today.

The 2021 Retailer Preference Index: Who's winning and why. David Ciancio, Global Head of Grocery discusses the 2021 U.S Retailer Preference Index (RPI): Grocery Edition with the lead author of the RPI, Erich Kahner. They unveil key insights and discuss who is winning and who is best positioned for the future.

The Prophets of Aisle Six is the first online reality series focusing on innovation in the food retail industry. In this episode, Jose Gomes, dunnhumby's North America Managing Director, travels to the downtown Cleveland store of Heinen's Fine Foods. Jose meets with Tom and Jeff Heinen, co-owners and brothers, and learns how they are evolving their grandfather's mission of delivering excellent customer service. With 23 stores in Northeast Ohio and the greater Chicago area, and a 90-year legacy, Heinen's is proving that being a small retailer can be an advantage when it comes to data.

In this series, dunnhumby tours the globe and speaks with some of the world's greatest brands, exploring their biggest challenges and how they are using customer data science to meet those challenges.